5 Estate Planning Steps Literally Everyone Needs To Take

February 05, 2025You may be thinking that you do not have the need for an estate plan or at least there is no harm in delaying getting started with estate planning. The truth is that anyone with savings, debt, a spouse, children, a home, or a retirement plan needs to at least have the basics in place.

Hopefully, it’s true that you won’t need it for decades to come, but should something happen and you don’t have a plan, it could make a HUGE difference, sometimes even while you’re still alive.

Here are the 5 critical steps – make a plan to check these off the list today.

Step 1: Create or review your will

If you have a current will, congratulations! You have already taken an important step in the estate planning process. Your will controls the distribution of everything you own that doesn’t have a beneficiary designation and can also name a guardian for any minor children. Things that you pass via will include:

- Tangible personal property like your home, your car, and all your stuff

- Individually held financial accounts such as savings, checking, stocks, bonds, and mutual funds held outside retirement accounts which do not have a beneficiary designation.

Don’t have a will? If you die without a will, your state has laws that determine who gets your money called laws of intestacy. These laws vary from state to state but generally give first priority to your spouse and children. If you have neither, then blood relatives including parents, siblings, and others are your default heirs, under a specified order of priority. If no blood relatives can be found, your money goes to the state Treasury.

Protect your children! Should your minor children lose both parents, your will determines who will raise them and manage your money on their behalf until they reach the age of majority. If you die without a will, the state will name a guardian to take the children – and it may not be who you think is the most appropriate person!

In your will, you can designate a guardian for your children, as well as one or more alternates in the event your first choice is not available. You can name the same person, or a different one, to manage any money left to your children as well.

Step 2: Review your assets and update beneficiary designations

Many people think that once they have made a will, all of their assets will pass according to that document. Actually, a large number of your most valuable assets are not subject to probate, meaning they may NOT pass by will. Use this checklist to keep track of specific exceptions to your will.

Do you…

- Own any bank accounts, mutual funds, or brokerage accounts in joint name with someone else?

-If yes, the joint account owner will automatically own the assets upon your death (in most cases). Also, in most states, you can designate an individual account to be “Payable On Death” (POD) or “Transfer On Death”(TOD) to a named beneficiary for the same result and the account will “skip” your will (and probate).

- Own real estate with another person?

-If yes, real estate owned as joint ownership with rights of survivorship also does not pass by your will but goes directly to the other joint owner automatically.

- Have insurance policies, annuity contracts, employer retirement plans and/or IRA’s?

-If yes, keep your beneficiaries updated. All of these account types require you to name who will receive the account or policy value upon your death. If you fail to name a beneficiary or all beneficiaries have died before you, the account will be payable to your estate.

- Have a trust?

-If yes, your trust will determine how the trust property is distributed to beneficiaries, but only if you take the necessary steps to re-title accounts and other assets to the trust. Failure to change the title to the name of your trust will cause them to pass by other means, regardless of what the trust says.

All of these exceptions pass directly to the person named, and not by your will. It is extremely important to keep your beneficiary designations up to date – it is not uncommon for older life insurance policies and previous employer retirement plans to be paid out to ex-spouses or other unintentional parties. Updating your will does not fix these accounts, since they are not subject to your will.

Step 3: Evaluate your insurance coverage

Whether your income stops due to death or disability, the effect on your family is the same. Where will the money come from to replace your paycheck? Insurance may be your best option. Without it, your family may need to sell assets, move to a less expensive home and/or disrupt college and retirement plans.

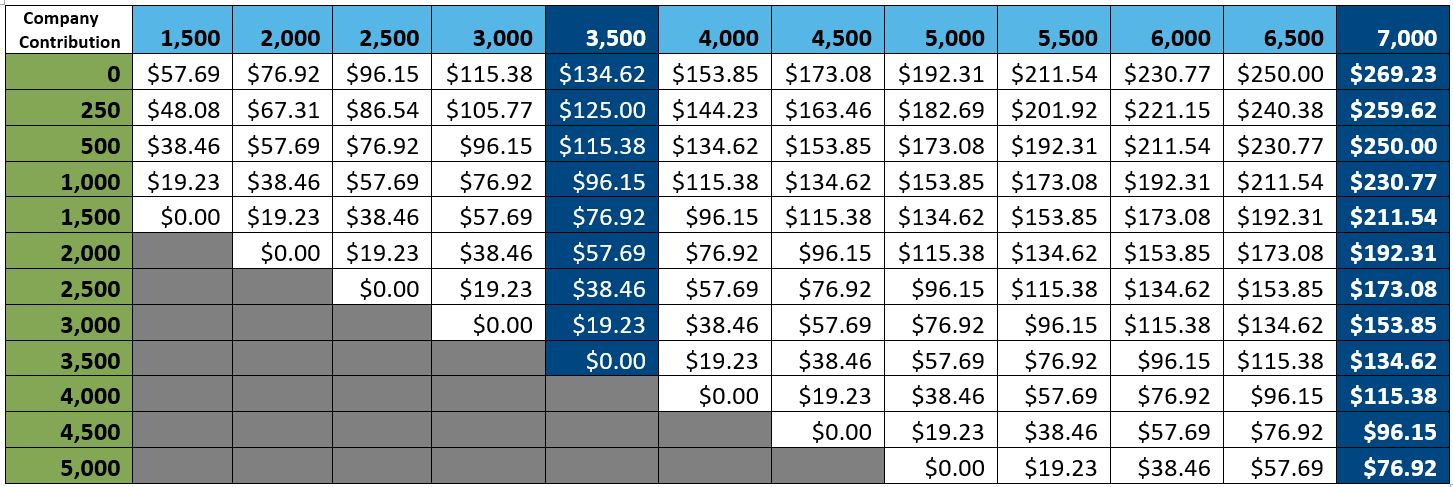

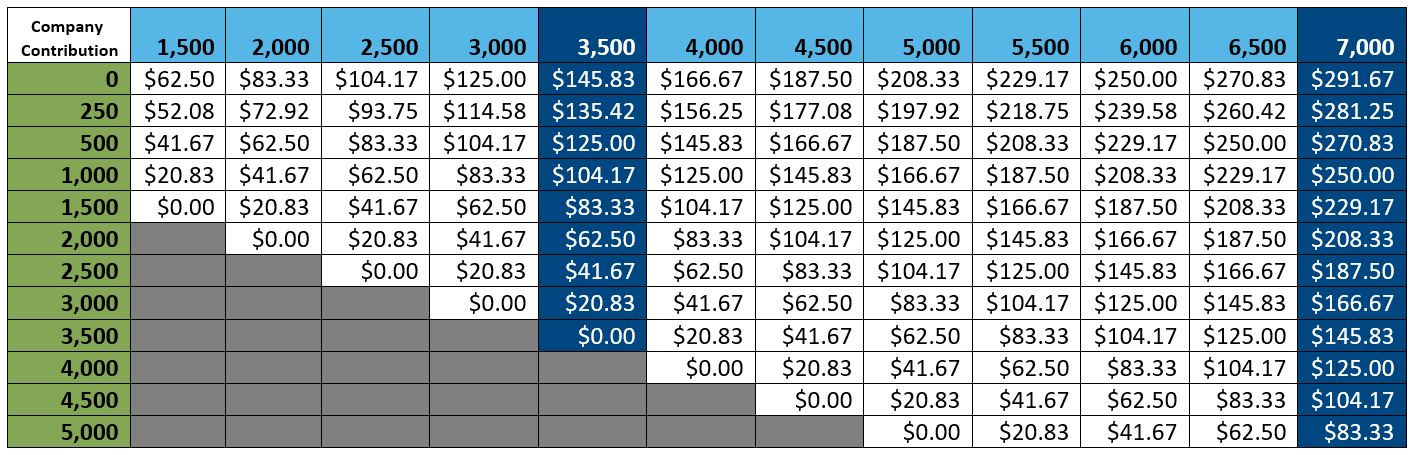

- Life insurance. Use this calculator to get an idea of how much insurance you need to have in place. Once you decide on the right amount for you, be sure to find out what benefits you have through work first. Sometimes, you can get all of the life insurance you need there at the most affordable rates, but if you can’t, look into supplementing with a personal policy.

- Disability insurance. This is your paycheck insurance – should something happen that keeps you from being able to work, this insurance kicks in to replace some of that until you’re able to work again. Statistically speaking, this is the insurance you’re more likely to use during your working years. First, confirm any coverage you have through work and find out if you can add to it, if necessary — most group plans are broken into Short-Term and Long-Term and often have lower premiums than individual policies. It’s important to know that most policies only provide 60 – 70% replacement income, so should you become disabled, you’ll still have a drop in income. Use this calculator to see if you need to purchase coverage beyond what you have through work.

Step 4: Check your powers of attorney

Remember that your will doesn’t take effect until you actually pass away, but what happens if you have an accident or are otherwise unable to make financial or healthcare decisions for yourself? You can designate someone else to make these decisions for you using the following important documents:

Advanced Directives – There are two types of documents, called advance directives, that can be prepared as part of your estate planning for future medical decisions.

- Living Wills – If you have strong feelings about what type of medical care you want (or don’t want!) and you are unable to communicate, a living will can do it for you. This is a document that you can use to state under what circumstances you wish to be kept alive by artificial means. If you do not express your views in writing, all available means of treatment to maintain your life are usually provided, even if family members object. Therefore, if there are conditions where you would not want treatment, it is important that you state your wishes while you are able to do so.

- Medical Power of Attorney – While the title and wording of this document may vary from state to state, most states permit a document that enables you to select someone to make medical decisions on your behalf. This power can only be exercised when you are unable to communicate but is not limited to situations where you are terminally ill.

Durable Power of Attorney – There can be a number of situations where you may need someone else to make financial transactions on your behalf. Whether you’re traveling overseas, in a coma, or sequestered in a jury, a document called a durable power of attorney permits the person named as your agent to sign documents, trade securities, and sell property. You do not have to be unable to act for yourself in order for your agent to act on your behalf.

The agent does have to act in good faith, and may not abuse the power of attorney for his/her own advantage. If you sign a power of attorney that is not specifically durable, the power is revoked upon your disability or inability to communicate. With a durable power of attorney, your agent can make the necessary transactions in order to pay your medical bills or make sure your family has the money they need.

Living Trust – Another method is to place your assets in a living trust. Don’t confuse this with the living will described above. Although they sound similar, they are very different. A trust is simply an arrangement that provides for a third party to manage your assets for a beneficiary, upon your death. A living trust allows you to start a similar arrangement while you are still alive. You can be your own trustee, and simply name a successor trustee to take over upon your death or disability. A living trust is a more expensive estate planning tool than a durable power of attorney, but it can also be customized to your specific needs. It is particularly useful for more complicated situations such as second families or people who own property in multiple states.

Step 5: Monitor your estate plan

Things change. That’s why you should review your estate plan whenever a life event occurs for you and your family. Even if it seems like nothing’s changed, you should review your estate plan every few years at a minimum. A good rule of thumb is that you should update your will any time someone enters or leaves your life (aka birth, marriage, divorce, death)

Documents to review

- Your will and any trusts

- Powers of attorney

- Beneficiary designations on employer-sponsored retirement plans (401(k), 403(b), 457, etc), IRAs, life insurance policies, annuities, HSAs

An estate plan, like a financial plan, is always evolving as your life changes. It can be easy to delay making an estate plan because there are several important decisions you must make, but don’t fall victim to analysis paralysis. You can always change your documents as long as you’re still of sound mind, so choose what works for your life today, and then make updates as things change. Also, be sure to check with legal benefits offered by your employer to help with the estate planning process.