How Much Should You Contribute To Your HSA This Year?

January 09, 2019How much should you contribute to your Health Savings Account in 2019? If you’re enrolled in a high deductible health plan for this year, take a look right now so that you can make any adjustments you decide to make ASAP (yes, unlike the FSA, most plans allow you to change your payroll contributions throughout the year).

What’s so great about HSAs and High Deductible Health Care plans?

What if I told you that you could reduce your current income taxes, invest your money so it could grow tax free and take future withdrawals pay for medical expenses – also completely tax free? Would you do it? Probably. That’s why Health Savings Accounts are such a great deal. However, there are some common misunderstandings about how they work in conjunction with an insurance plan.

The biggest risk with HSAs

Generally, with a high deductible health plan, in return for a less expensive premium, you will pay for more of your medical expenses yourself before your insurance begins to pay. (See this video on how a deductible works.) If you’re used to a more traditional insurance plan with a lower deductible which starts paying sooner, you may not realize that if you don’t contribute enough to your HSA, you could find yourself financially unprepared for thousands of dollars in medical bills.

Let’s take a simple example: You break your arm in a sports injury and have $3,000 worth of medical bills from urgent care, the X-Ray, your cast and follow up visits. Because you chose your company’s high deductible plan for its low premium, your insurance deductible is $3,500. That means that the FULL cost of your injury is yours to pay. You didn’t contribute much to your HSA, so you find yourself scrambling to pay for the bills with your credit cards and are considering taking a 401(k) loan for the remainder.

The minimum – cover your insurance deductible

If you had contributed enough to your HSA to cover your deductible you wouldn’t be in this situation. Many employers who offer high deductible plans also make HSA contributions on behalf of their employees, but it’s often not enough to cover the full in-network deductible. At a minimum, you should contribute enough to your HSA annually to cover the portion of your in-network deductible your company contribution doesn’t.

The maximum – contribute up to the IRS limits

Someone with individual coverage can contribute up to $3,500 to an HSA in 2019. Those with family coverage can contribute up to $7,000. Those who are 55 or older by the end of the year can contribute up to an additional $1,000 in catch up contributions. If you’re making catch up contributions, you’ll both need your own HSA. Note that if you and your spouse are both covered individually by your employers and file taxes jointly, your combined HSA contributions cannot exceed the family maximum. Need more details? See IRS Publication 969.

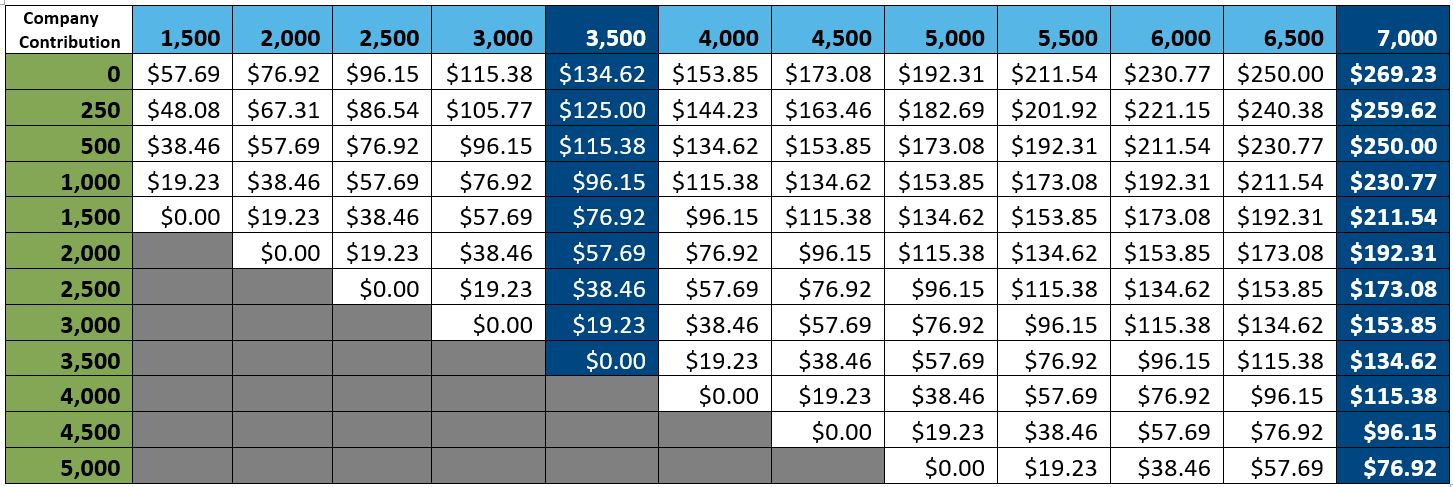

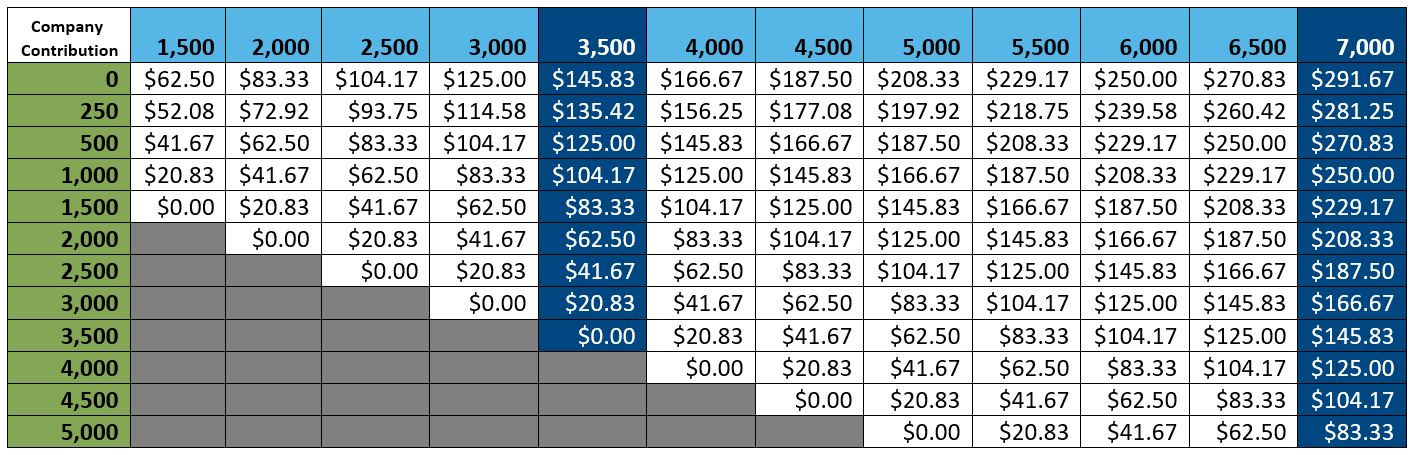

Use these charts to figure out how much you’d need to contribute each pay period.

Paid Every Two Weeks (26 times per year)

Paid Twice Per Month (24 times per year)

What if I don’t think I’ll need to spend all my contributions? Should I still make them?

Yes! In fact, that’s the whole idea behind HSAs. Many financial planners recommend maxing out your HSA before your 401(k). If you don’t spend all your contributions in the year you make them, you can roll them forward indefinitely without penalty. You can invest surplus funds to grow. Most HSA accounts have mutual fund investment options with long term growth potential, such as stock or balanced funds.

The growth of your investments in your HSA is tax-free, if you take future withdrawals for medical expenses. To give you a simple example, if your $1,000 surplus in your HSA grows to $10,000 in the future, you’d be able to reimburse yourself for future medical expenses for the entire $10,000 without taxes. This is such a powerful income-planning tool that folks are actually paying for their insurance deductibles using other funds now, so they can leave as much as possible in their HSAs to grow for the future. See The Health Savings Strategy That Not Enough People Are Talking About.

How much of my HSA should I invest, then?

A best practice is to keep the amount of your insurance deductible in cash. When you’ve got surplus more than the deductible amount, consider investing that in a longer-term option. If you leave your job, don’t worry – just like your retirement account you can leave the HSA with the provider or you can roll it to a new employer or the financial services firm of your choice (see this post.)

What if I can only change my payroll deductions annually but I want to save more?

If your company only allows you to choose how much you have deducted from your paycheck once per year during open enrollment, you can still write a check or set up a deposit from your personal checking account into your HSA. Contact your HSA provider for instructions.

The bottom line

Contribute enough to cover your insurance deductible, and more if you can swing it.