What’s Your Plan For a Financial Independence Day?

May 10, 2023Continue reading “What’s Your Plan For a Financial Independence Day?”

Continue reading “What’s Your Plan For a Financial Independence Day?”

A recent article in the Wall Street Journal asked a question that has led to one of my favorite conversation starters, both with clients and over beverages at my local watering hole: “Would you rather have $1 million or $5,000 per month in retirement?” To me, the way a person answers that question tells me a lot about how their mind works around money. So far, the answers I get are split about 50/50. Here’s what I’ve learned:

I’ll take it all right now, please.

Those people who choose the lump sum tend to have a strong belief in their ability to be fiscally sound. When asked what they’d do with the money, they typically say that they would pay down every penny of debt, make a luxury purchase or two, then live fairly frugally to preserve the remaining money, while investing it to get some growth. Their hope is to be able to grow that initial lump sum well beyond the starting amount and also do some good in the world.

I’d rather keep a steady paycheck.

On the other hand, the people who say they’d rather have the monthly income tend to be wary of becoming one of those tragic stories about people who “had it all” and then blew it. They feel like they can live on the monthly income with ease and save a portion of it for future generations or charitable work. The WSJ goes into the psychology of this choice, which is something called “the illusion of wealth” versus “the illusion of poverty,” but you’re better off just reading the article to understand that one better.

Are you focusing on the right number?

Why do I mention this debate? So many people that I have talked to regarding retirement are completely fixated on getting to some “magic number” in their 401(k) before they’ll feel safe to retire. When I meet people who are locked in on needing X number of dollars in order to retire, they are almost always already in excellent shape for retirement. Why? I find that they’ve been so laser focused on the dollar value of their accounts that they haven’t really thought about the monthly income that the portfolio could generate.

In many cases they’ve saved enough that they can afford to have a higher monthly income than their current income! I can’t count the number of times I’ve told someone that they can walk back to their desk because they are choosing to, not because they need the paycheck.

The number that counts.

When we prepare retirement projections, the most important number – in my opinion – is the monthly income that a person will have from all sources (Social Security, pension, investment accounts, retirement accounts, etc.) during retirement. After all, most people have a lifestyle that requires a rather consistent monthly income. If that income, plus some, can be replaced today – work truly becomes an option, not a requirement.

Find your number.

What can you do? Run retirement projections at least annually. This is probably the most important thing anyone can do to track their progress toward financial security. After a few years, your projections should show a trend. If you’re doing things right, you’ll see that trend improve with each year. When it doesn’t, you can decide what actions to take in order to get the trend line back to being a positive. Regardless of your stance on the question of a big lump sum vs. a steady monthly income, running a projection to see how much income you can expect to have in retirement will help you determine a lot of financial decisions between now & then. To steal a line from Nike: when it comes to running retirement projections, JUST DO IT.

When it comes to choosing how to invest the money you deposit into your 401k and/or your IRA, it’s easy to get overwhelmed, but don’t let information overload stop you. It’s true that investing can get complicated and involved, but there are also things out there that make it pretty easy.

First thing though, is knowing whether you are a conservative, moderate or aggressive investor. The younger you are, the more aggressive you MAY be, but just to be sure, take this quiz to find out. Once you know what your investing personality is, the best way to narrow your options is by declaring yourself either a hands-off or hands-on investor.

Typical things a hands-off investor might say:

“I wish someone would just do this for me.”

“Words like ‘allocation’ and ‘portfolio’ are foreign to me.”

“I want to set it and forget it.”

“I rarely review my account and prefer a pre-mixed solution.”

The good news is that the investing industry recognizes that there are plenty of people out there who want the benefits of investing but who don’t have the knowledge, interest or even just the time to do it well, so they have created solutions that can be really great. If that sounds like you, then you don’t need to worry about how to pick a stock or watch channels like CNBC or Bloomberg TV – that’s more for the hands-on folks.

If you’re a hands-off investor, look for Target Date Funds in your 401k or IRA – the easiest way to spot them is that they have a year, like 2050, in their name. Target Date Funds are great because they choose the mix of stocks and bonds for you, in a mix according to the year you choose, and they typically charge lower fees than more actively managed options. Moderate investors typically choose the fund with the year closest to when they turn 65, while conservative investors may look for a year that’s closer to today and aggressive people often choose the one closer to the year they’ll turn 70 or 75.

When Target Date Funds aren’t available, then hands-off investors may opt to hire an investment manager to help them pick or they use the suggested investment mixes that can be found on the last page of the Risk Tolerance Profile and Asset Allocation Worksheet to help them put together a mix of the funds available in their 401k.

Typical things a hands-on investor might say:

“I enjoy researching mutual funds and their objectives.”

“I love my Jim Cramer bobblehead.”

“I log into my account regularly to check in on things.”

“Investing is interesting and I enjoy learning about it.”

If you’re a hands-on investor, chances are you probably have a pretty good handle on what you want to do with your money, but here are a few resources to check out to keep your knowledge and skills top notch:

How to Invest in Your Employer’s Retirement Plan

Should You Care About a Mutual Fund’s Past Performance?

How Investing is Like Eating Pizza

I recently wrote about how to invest in a Roth IRA and in your employer’s retirement plan. But what about a plain old taxable account? Here are some options to consider:

Use it for short term goals. One of the advantages of a taxable account is that you don’t need to worry about any tax penalties on withdrawals. For that reason, it probably makes the most sense to use a taxable account for goals other than retirement and education like an emergency fund, a vacation, or a down payment on a car or home. In that case, you don’t want to take risk so cash is king. To maximize the interest you earn, you can search for high-yielding rewards checking accounts, online savings accounts, and CDs on sites like Deposit Accounts and Bankrate.

Keep it simple for retirement. Just like in a 401(k) or IRA, you can simplify your retirement investing as much as possible with a target date fund that’s fully diversified and automatically becomes more conservative as you get closer to the target retirement date. There are a couple of differences in a taxable account though. The bad news is that you’ll be paying taxes on it each year so you want a fund that doesn’t trade as often. The good news is that you’re not limited to the options in an employer’s plan so you can choose target date funds with low turnover (how often the fund trades and hence generates taxes) like ones composed of passive index funds.

Invest more conservatively for early retirement. If you plan to retire early, a taxable account can be used for income until you’re no longer subject to penalties in your other retirement accounts or to generate less taxable income so you can qualify for bigger subsidies if you plan to purchase health insurance through the Affordable Care Act before qualifying for Medicare at age 65. In either case, you’ll want to invest more conservatively than with your other investments since this money will be used first and possibly depleted over a relatively short period of time. Consider a conservative balanced fund or make your own conservative mix using US savings bonds (which are tax-deferred and don’t fluctuate in value like other bonds do) or tax-free municipal bonds instead of taxable bonds if you’re in a high tax bracket.

Make your overall retirement portfolio more tax-efficient. You can also use a taxable account to complement your other retirement accounts by holding those investments that are most tax-efficient, meaning they lose the least percentage of earnings to taxes. Your best bets here are stocks and stock funds since the dividends and gains are taxed at a capital gains rate that’s lower than your ordinary income tax rate as long as you hold them for more than a year. In addition, the volatility of stocks can also be your friend since you can use losses to offset other taxes (as long as you don’t repurchase the same or an identical investment 30 days before or after you sell it). When you pass away, there’s also no tax on the stocks’ gain over your lifetime when your heirs sell them.

In particular, consider individual stocks (which give you the most control over taxes) and stock funds with low turnover like index funds and tax-managed funds. Foreign stocks and funds in taxable accounts are also eligible for a foreign tax credit for any taxes paid to foreign governments. That’s not available when they’re in tax-sheltered accounts so you may want to prioritize them in taxable accounts over US stocks.

For retirement, you’ll probably want to max out any tax-advantaged accounts you’re eligible for first. But if you’re fortunate enough to still have extra savings, there are ways to make the best use of a taxable account. Like all financial decisions, it all depends on your individual situation and goals.

It might sound cliché but as with any planning exercise, the first step is to just set a goal. After all, how will you know when you’ve gotten there if you don’t know where you’re going? How you’ll go about defining your goal depends a lot on how close you are to actually thinking about retiring as well as how you personally define the concept of “retirement.”

One of the challenges of setting a retirement goal is that it’s less of a set number and more of a moving target. How much you’ll need to have in order to stop worrying about how much is coming in from working depends heavily on how closely you want to mirror your working standard of living. Someone who will have their mortgage and other debt paid off and no dependents to care for can retire on much less than someone who will still have housing expenses or kids in college. If you’re looking at the more traditional definition of retirement by simply stopping work one day and living off of social security and savings, setting that goal can be as simple as running a retirement calculator and seeing if the age you’re hoping to retire is feasible considering your current savings amount and rate of saving. If you’re not on track to retire by the age you are hoping, then you’ll either need to push back your date, increase your savings, or decrease the expenses you’ll have to cover in retirement.

The closer you are to actually retiring, the more specific you can be with your planning. The Financial Finesse calculator gauges your goal based on whether you’re on track to replace a percentage of your income, but often people who are planning a significant reduction in living expenses and/or folks who are plowing tons of money away into savings during their later working years can get away with savings that only replace a fraction of current income. If you’re the type who thinks of retirement as more of a “financial freedom” day where you can pursue activities without concern for earning, then there are a few more variables. For example, if you’re thinking that you want to spend your second chapter starting a business, then your goal may be more of a dollar amount that will sustain you for a year while you build your business up to provide ongoing income.

If you’re a couple decades or more away from retiring, then the best way to set your goal is to aim for being on track to replace 80% of your current income. The closer you can remain to that target, the more choices you’ll have as the years go by. And if you’re getting a late start or the thought of quitting working feels more like an imminent reality and less like some hazy future that may or may not happen, then you’re better off using the “Equivalent Pay (Today’s Dollars)” amount in the Goal Calculation tab of the calculator to measure whether you’re close to your goal or not. If the equivalent pay amount doesn’t meet or exceed your anticipated annual budget in retirement, then you need to plan to work longer, save more or cut some expenses.

| Retirement factor | Need less savings | Need more savings |

| My mortgage will be paid off | X | |

| I want to start a lucrative business | X | |

| I want to pursue a lower-paying passion project | X | |

| I want to travel in style | X | |

| I want to move to a lower cost region | X | |

| I have a long life expectancy | X | |

| I have health issues | X | |

| I have family to help support me | X | |

| I plan to work part-time | X | |

| I plan to be a missionary in a third-world country | X | |

| I expect to have a lot of expenses | X | |

| I expect life to be pretty simple and cheap | X |

Last week, I wrote about how to invest in a Roth IRA but how about your employer’s retirement plan like a 401(k) or 403(b)? After all, that’s where most people have the bulk of their retirement savings. Here are some options:

Keep it simple…real simple. If you have a target date retirement fund in your plan, this is the simplest option. In fact, it’s probably the default so you may not need to do anything at all.

The idea is to pick the fund with the target date closes to when you think you’ll retire. Each fund is fully-diversified to be a one-stop shop that automatically becomes more conservative as you get closer to retirement so you can set it and forget it. It doesn’t get much easier than that.

There are a couple of downsides though. First, you may not even have this option in your plan. Second, your plan’s target date funds may have high fees. Finally, you don’t have the ability to customize the mix of investments to match your particular risk tolerance (although you can pick an earlier date if you want to be more conservative or a later date if you want to be more aggressive) or to complement any outside investments you may have.

Target a particular risk level. If you don’t have a target date fund or want something more tailored to your particular risk tolerance, see if your plan has a target risk fund or an advice program. A target risk fund is fully diversified to be a one-stop shop, but it stays at a particular risk level so you may want to switch to something more conservative as you get closer to retirement.

An online advice program can recommend a particular mix of investments based on your risk tolerance. Many programs will even use the lowest cost options in your plan and/or factor in any outside assets you may have. For example, if you have a lot of stocks in a Roth IRA, the program may reduce your stock holdings in your plan accordingly. However, it will need to be periodically updated as your situation changes and some programs charge additional fees.

Create your own mix. If the above options aren’t available to you or if you prefer to have more control, you may have to create your own mix of investments. You can take a risk tolerance quiz like this one and use the suggested allocations as guidelines.

Just be sure to look for low cost fund options to implement your portfolio. You may want to use your plan for those assets in which you have low cost fund options and use outside accounts for the rest. (That’s why I invest mine all in a low cost S&P 500 index fund.) Don’t forget that taxes are another cost. If you have investments in taxable accounts, you may want to prioritize the most tax-inefficient investments like taxable bonds, commodities, real estate investment trusts, and funds with high dividends and turnover for your tax-sheltered retirement account since more of their earnings will otherwise be lost to Uncle Sam.

Consider a small amount in company stock. If company stock is an option, you might want to keep a small amount there to benefit from potentially lower taxes on the gains when you eventually withdraw it from the plan. Just don’t have more than 10-15% there because having too much in any one stock is too risky, no matter how great the company is. This is especially true with employer stock because if something happens to your company, you could be out of a job at the same time as your portfolio is decimated.

Not sure what to do? Don’t let analysis paralysis prevent you from investing at all. You can start with a simple option like a target date or target risk fund for now and adjust later. You don’t want to make the perfect investment plan the enemy of the good.

If you’re like many people I’ve talked to recently, you may have decided to contribute to a Roth IRA before the deadline on Tue. However, it’s not enough to open an account and fund it. After all, a Roth IRA is simply a tax-sheltered account, not an investment. You still have to decide how to invest the money. Here are some options to consider:

Use it as an emergency fund. If you don’t have enough emergency savings somewhere else, you can use a Roth IRA as part or all of your emergency fund since you can withdraw your contributions tax and penalty-free at any time and for any purpose. (Earnings are subject to taxes and a 10% early withdrawal penalty before 5 years and age 59 ½ but the contributions all come out first.) In this case, you’ll want to keep it someplace safe and accessible like a savings account or money market fund. Once you accumulate enough emergency savings elsewhere, you can invest it more aggressively for retirement.

Save for a short term goal. A Roth IRA can also be used penalty-free for a first-time home purchase (up to $10k) or education expenses. If you intend to use your Roth IRA for either goal in the next few years, you’ll probably want to keep it in savings.

Choose investments that complement your other retirement accounts. For example, you may want to use your Roth IRA for investments that may not be available in your employer’s plan like real estate, gold, commodities, emerging markets, international bonds, and microcap stocks. They can help diversify a more traditional mix of bonds and large and small cap US and international stocks.

Choose a more conservative mix for early retirement. If you’re planning to retire before becoming eligible for Medicare at age 65 and are planning to purchase health insurance through the Affordable Care Act (assuming it hasn’t been repealed and replaced), a tax-free Roth IRA can help reduce your insurance costs because the insurance subsidies are based on your taxable income. Since a large percentage of the account may be coming out over a relatively short period of time, you may want to invest it more conservatively than your other retirement investments.

Choose more aggressive investments for long term tax-free growth. If you’re not planning to withdraw your Roth IRA early, you may want to take the opposite approach and use it for the most aggressive parts of your portfolio. That’s because the account is growing tax-free and may be the last to be touched. (It helps that Roth IRAs aren’t subject to required minimum distributions.) Some examples of more aggressive investments would be emerging market and small and micro cap stocks.

Keep it simple. If this all sounds confusing and you want to just keep your investing as simple as possible, you can look at each account separately. For example, you might choose a target date retirement fund for your Roth IRA since it’s a fully diversified one stop shop that automatically becomes more conservative as you get closer to the retirement date. All you need to do is pick the one with the date closest to when you think you’ll retire and set it and forget it. If you want something more customized, you can also use a robo-advisor or design your own portfolio based on your particular risk tolerance.

Like all financial decisions, your choice begins with your goal. Are you trying to save for emergencies? Do you plan to use the account early or late in your retirement? Or do you just want to keep things as simple as possible?

Should you consider investing in an annuity linked to stock market returns but with less risk than the stock market? I recently had a coaching session with an employee who had invested a lump sum distribution from a retirement account into an equity-indexed annuity. Did she make the right decision, she wondered, and should she add more to the annuity or diversify into something else?

Remind Me What an Annuity Is, Please!

An annuity is a contract between you and an insurance company in which the insurance company agrees to make periodic payments to you, starting immediately or at some future time, in return for payment from you, either in a lump sum now or over flexible installments over time. With a “fixed annuity,” the insurance company agrees to a fixed return and a fixed payment. With a “variable annuity,” the rate of return and the payment vary depending on the investment choices within the contract.

So What is an Equity-Indexed Annuity?

An equity indexed annuity is the lovechild of a fixed and a variable annuity. With an equity-indexed annuity (EIA), the insurance company will pay an interest rate linked to a stock market index if the market index is up, with a guaranteed minimum rate if the market is down. In the case of the employee I spoke with, she would earn an annual rate of return linked to the performance of the S&P 500 during the accumulation phase of the annuity, capped at 6%. If the S&P 500 index went down, her return would be 0% for that year.

Who is a Good Candidate for an Equity-Indexed Annuity?

The primary financial planning purpose of an annuity is to turn a sum of money into a stream of income you cannot outlive. An equity-indexed annuity makes the most sense for an investor who is a) looking to create a future fixed income in retirement and b) who is not comfortable with direct stock market risk but would like to participate partially in potential stock market returns. In the case of this employee, she was willing to accept a cap on returns of 6% in return for no loss of her investment if the market declined.

She was also within 10 years of retirement and much more concerned about maintaining the value of her savings than she was in generating out-sized returns. It’s important to have both fixed and flexible sources of income in retirement so ideally an investor would refrain from putting all their retirement savings into an annuity. I encouraged this employee to keep some of her retirement funds in her 401(k) and IRA so she would have a source of income to meet flexible expenses in retirement such as a big vacation, dental work or an unexpected home repair.

Who is Not a Good Candidate for an Equity-Indexed Annuity?

A more aggressive investor would not be comfortable capping returns at 6% – especially in a year when the S&P 500 index went up 20%. Plus annuities generally have high fees which can eat into investment performance. EIAs typically have high surrender charges during the first 8-10 years of the contract so once purchased, you’ve got a strong incentive to stay put.

The moderately aggressive to aggressive investor could consider accumulating savings in a diversified portfolio of low fee index funds. That investor could potentially build a larger nest egg and then purchase an immediate annuity at retirement with some of those savings if interested in turning them into a stream of income. Because of the higher fees, younger investors are also generally not good candidates for equity indexed annuities. Finally, an investor who doesn’t ever plan to turn their savings into retirement income is not a good candidate for an annuity.

Was it a Fit for Her?

Was an equity-indexed annuity a good fit for this employee? After weighing the pros and cons, her conclusion was “yes.” She was willing to trade upside potential in order to eliminate the risk of losing money.

She was planning to annuitize within ten years – turning her annuity into a stream of payments in retirement. Moreover, she had chosen a reputable insurance company with an A+ rating from A.M.Best. Although she was excited about the annuity return/risk profile, she decided it would be best to continue to keep some of her retirement money in her employer plan so she’d have some flexible sources of income to meet unexpected retirement expenses.

Do Your Homework

Annuities are very complex investments. Before signing on the dotted line, make sure you’ve read and understand all the provisions in the contract. If you are considering an equity-indexed annuity, start with this fact sheet from FINRA. Check out the financial strength of the issuing insurance company and make sure it has a high rating for its financial position. If possible, get an unbiased second opinion from a financial planner in your workplace financial wellness program or a fee-only CFP® professional.

Do you have a question you’d like answered on the blog? Please email me at [email protected]. You can follow me on the blog by signing up here and on Twitter @cynthiameyer_FF.

Today is Employee Benefits Day. How will you celebrate? Don’t worry. Celebrating Employee Benefits Day does not require you to make a special trip to the party store or spend a single dollar.

In fact, the best way to celebrate it is to recognize and appreciate the value of your employee benefits and to maximize them for your personal financial situation. Don’t know where to start? Take this quick quiz to test your benefits knowledge.

1) You have decided it’s time to prepare a will. Where might you most likely find links to basic estate planning tools?

a. The public library

b. Your employee assistance program (EAP)

c. Your retirement plan provider

d. The HR department

2) Next year you plan to get laser eye surgery to correct your vision. Where is the best place to save extra money pre-tax to pay for it?

a. A health savings account (HSA)

b. An employee stock purchase plan (ESPP)

c. A flexible spending account (FSA)

d. A deferred compensation plan

3) Where you can save and invest for retirement so that the income after age 59 ½ will be tax-free?

a. Non-qualified stock options (NSOs)

b. Nowhere – there’s no such thing as tax-free retirement income

c. A cafeteria plan

d. A Roth 401(k)

4) During this year’s open enrollment, you choose a high deductible health plan (HDHP) because of the lower premiums. You have the option to save money pre-tax in an HSA to cover the deductible and a portion of out-of-pocket expenses. You should:

a. Skip the HSA. The point of choosing your health insurance was to save money.

b. Contribute no more than $1,000.

c. Contribute the maximum ($3,400 for an individual and $6,750 for a family in 2017). If you don’t need to use the money, you can roll it forward to future years.

d. Contribute no more than $1,500.

5) Taylor takes the train to work every day, Max drives and parks in the public garage and Jenna rides her bike. Who can use a pre-tax commuter benefits account offered by their employer?

a. Only Taylor. The point of pre-tax commuter benefits is to encourage employees to take public transportation.

b. Taylor and Max can contribute up to $255 per month in 2017, but not Jenna. There are no employer-sponsored bicycle benefits.

c. Everyone but contributions are from the employer only.

d. Taylor and Max can contribute up to $255 per month in 2017. Jenna can’t contribute pre-tax, but she can participate in her employer’s bicycle reimbursement program, for up to $20 per month in eligible expenses.

6) According to our recent financial wellness research, the single most important tool an employer can offer to boost employee retirement preparedness is:

a. A “bank at work” program

b. A retirement calculator

c. Incentive stock options (ISOs)

d. A target date fund

7) Which benefit replaces your income if you have an injury or illness which is not work-related?

a. Disability insurance

b. Long term care insurance

c. Workers compensation

d. Unemployment insurance

8) According to the 2016 Milliman Medical Index, what is the typical total cost for family coverage in an average employer-sponsored group health plan?

a. $25,826 for a preferred provider organization (PPO) plan

b. $6,742 for a health maintenance organization

c. $43,350 for a high deductible health plan (HDHP)

d. $15,003 for preferred provider organization (PPO)

9) Your employer will reimburse you up to $3,000 for an undergraduate course, a graduate course or a professional certification. How will the reimbursement be taxed?

a. Reimbursement for a professional certification will be taxed but not reimbursement for college/university courses

b. Reimbursement for college/university courses will be taxed but not reimbursement for professional certification

c. Tuition reimbursements are generally included in the employee’s taxable income

d. Tuition reimbursements of less than $5,250 are generally not included in the employee’s taxable income

10) What type of pre-tax benefit can you use to pay for after-school care expenses for your children?

a. Health savings account

b. None – after school care is not eligible for reimbursement

c. Education savings account

d. Dependent care flexible spending account

See the answers in italics below. How did you do? If you scored a 9 or higher, congratulations! Chances are that you see your employee benefits as an integral part of your overall compensation.

If you scored an 8 or lower, you may be leaving money on the table by not taking full advantage of everything your employer offers. If you have access to financial coaching via your workplace financial wellness program, consider setting up a time to talk to a planner about how you can fully maximize the value of your employee benefits. In addition, check out the blog posts for the rest of this week, which will focus on various aspects of your benefits.

Answers: 1 – b, 2 – c, 3 – d, 4 – c, 5 – d , 6 – b, 7 – a, 8 – a, 9 – d, 10 – d

Do you have a question you’d like answered on the blog? Please email me at [email protected]. You can follow me on the blog by signing up here, and on Twitter @cynthiameyer_FF.

Spouses who lose a partner are faced with a myriad of financial decisions at a time when they feel least equipped to deal with them. What resources are available to you as a surviving spouse? For most Americans, available resources include Social Security.

If you are a worker’s widow or widower, you — and your minor children if you have them — may be eligible for Social Security Survivor benefits. According to the Social Security Administration’s guide to How Social Security Can Help You When a Family Member Dies, the first and most important step is to contact the SSA to make sure your family gets all the benefits for which you are eligible. Benefits are based on what the late worker paid into Social Security and for how long. You cannot file online for survivor benefits. The best way to get a specific benefit information is to contact your local Social Security office or call 1-800-772-1213.

If you are the surviving spouse

You may be eligible to receive monthly Social Security survivor benefits if you are:

If your late spouse had not yet filed for Social Security retirement benefits, your survivor payment will be based on what your late spouse would have received at full retirement age (FRA), adjusted for various factors, such as your age when you file. The survivor benefit is based on what your late spouse paid into the Social Security system as well as their age at death. The more they paid into Social Security, the higher your monthly benefit would be. See If You Are The Worker’s Widow Or Widower.

Retirement claiming strategies for survivors

When you retire, you are able to receive surviving spousal benefits or your own benefits (whichever is greater). You may only receive one benefit at a time, but there are strategies for maximizing what you receive. You may be able to claim survivor benefits at age 60, then switch to claiming based on your own work record at your full retirement age or later, up to age 70. If your benefit at full retirement age or later is greater than your survivor benefit, you would maximize your overall Social Security benefits by claiming survivor benefits early and deferring your own benefit until full retirement age.

However, if your spouse was a much higher earner than you, the reverse would make sense: claim Social Security retirement benefits at 62 based on your own earnings record and then claim survivor benefits later on when the benefit equals your late spouse’s FRA. If you are still working, you can claim survivor benefits but your earnings may reduce your total benefit amount. See this article for a more detailed description of claiming strategies.

Benefits for minor or disabled children

Unmarried, minor children of a worker may be eligible to receive Social Security survivors benefits:

Surviving dependents of the deceased spouse may receive a monthly benefit of 75 percent of the deceased worker’s benefit amount. (See If You’re The Worker’s Minor Or Disabled Child.) There’s a cap on how much a family can receive in total between surviving spouse and children, generally 150 to 180 percent of the deceased spouse’s benefit amount.

If you are a surviving divorced spouse

If you were married to your ex-spouse for at least 10 years but are now divorced and have not remarried, your surviving spousal benefits are not affected by your divorce. If you are caring for your ex-spouse’s minor (under 16) or disabled child, you do not have to meet the “length of marriage” test. See If You’re The Worker’s Surviving Divorced Spouse for more information.

What if you remarry?

If you remarry after age 60 (age 50 if disabled) your remarriage will not affect your eligibility for Social Security survivors benefits. This also applies to surviving ex-spouses.

How to calculate your benefits

Use the benefit calculators on SSA.gov to estimate your Social Security benefits. See also Social Security Survivors Benefits Planner.

Do you have a question you’d like answered on the blog? Please email me at [email protected]. You can follow me on the blog by signing up here, and on Twitter @cynthiameyer_FF.

For most American workers who retire at age 65 or later, managing the costs of medical care becomes a bit more complicated. There may be more paperwork to juggle as reimbursements for costs could come from different sources. Here’s a breakdown of what’s typical:

Medicare

Most American workers and small business owners will be eligible for Medicare, the federal health insurance program for people age 65 and older. Medicare has four parts: Part A is Hospital Insurance, Part B is Medical Insurance, Part C includes Medicare Advantage Plans (HMO/PPO type plans which provide hospital and medical insurance together) and Part D is Prescription Drug coverage. See this article on understanding how Medicare works. Things to keep in mind include:

Medigap

A Medical Supplemental Insurance (Medigap) policy helps pay some of the health care costs not covered by original Medicare, such as co-pays, deductibles and co-insurance. Medigap policies are sold by private companies. Keep in mind:

Retiree Health Plan

Employers are not required to provide health coverage to retired employees, and most don’t. If you are lucky enough to be one of the 16–25 percent of Americans who receive retiree health benefits from a former employer or union or receive military or other veterans’ benefits, how your coverage works in conjunction with Medicare depends on your company or organization’s plan. Generally, if you are retired and have coverage from both Medicare and a retiree health plan, Medicare pays first for your medical bills and your group health plan is the secondary payer. Keep in mind:

Health Savings Accounts

For those employees who have balances at retirement in their health savings accounts (HSA), they are a highly tax-advantaged source of funds to pay health care expenses in retirement that are not reimbursed by Medicare or other insurance. HSA funds are triple tax-free if used for qualifying medical expenses: they are contributed pre-tax, grow tax-free and are withdrawn tax-free. During your savings years, there are good reasons to consider maxing out your HSA before other retirement accounts. Keep in mind:

Deducting Medical Expenses

Those taxpayers who face significant unreimbursed medical expenses can deduct some of those expenses. The IRS allows taxpayers to deduct qualified medical expenses which exceed 10 percent of your adjusted gross income for the tax year. For example, if you have a household income of $50,000, you would be able to deduct medical expenses in excess of $5,000. Keep in mind:

Long Term Care Insurance

LongTermCare.gov defines long-term care insurance as insurance which covers “long-term services and supports, including personal and custodial care in a variety of settings such as your home, a community organization, or other facility.” Medicare does not cover long term care. Keep in mind:

Do you have a question you’d like answered in this column? Please email me at [email protected]. You can follow me on our Financial Finesse blog by signing up here, and on Twitter@cynthiameyer_FF.

Well, if you’re Johnny Depp, the answer appears to be a resounding…YES! In a case where Johnny Depp and his former agents are making claims against each other (I have no idea which side’s arguments have merit), there are unconfirmed reports that his spending habits are rather lavish, averaging about $2,000,000 per month. He reportedly paid $3,000,000 for a party that ended with firing the ashes of Hunter S. Thompson from a cannon. Sadly, I missed that party. His prior firm is now suing him for an unpaid loan and he’s suing them for mismanagement of his finances.

This will be an interesting case to watch, and if he needs to generate cash, we may see a lot of Johnny Depp in roles that he wouldn’t have previously taken..or he could sell some islands. For those of us who have never spent close to $2,000,000 in a month, the numbers here seem completely absurd. It’s easy for us to roll our eyes at yet another celebrity who spent money on a lifestyle that isn’t sustainable in the long term.

How many times have we seen this? (Answer: A LOT) How can they not know that this is how the story unfolds? (Answer: It’s THEIR first time handling this much money.)

The interesting thing, at least interesting to me, is that I see this same thing happening on a daily basis, just with much smaller numbers, all over America. Here’s a story of someone I’ve had the pleasure to get to know over the last few years. He works for a big company that is one of our clients and is now, at age 50, ready to make progress in his financial life. He has a great job, a great family, great friends…and about $30,000 in credit card debt that is killing him! He is now struggling to make just the minimum payments on all of his cards.

During a conversation recently, we laughed at how we each made less than $20,000 per year in our first jobs out of college and at that time, we felt like we had more than enough money to live a great lifestyle! Fast forward a couple decades and now he’s earning just over $100,000 and feels like he has less discretionary income than when he was 22 and new to the workforce. As his income went up, so did his lifestyle and spending level.

It’s not quite the reported Johnny Depp level of spending, but it’s not tough to see how that happens. We somehow spend as much as we make, no matter how large the income gets. When that income stops, which we see in sports and entertainment, or slows down – that’s when we see headlines about famous people being broke.

It just happens more slowly and without the press when you aren’t famous. While Mr. Depp owes millions, a normal everyday guy owes $30,000 in credit card debt and it’s incredibly burdensome. Some of it was for vacations, some for car or home repairs, and some was books for college for his son, but it all has added up and become close to unmanageable.

We developed a plan to get him out of debt, which involved cutting back on some spending while increasing income for a 6-9 month window. He and his wife have ideas on how to generate some income thru “gig work” and will use every dollar to pay down credit card debt. Between Uber, Lyft, some handyman work and some graphic design, they will laser focus and work themselves hard for a fixed period of time. The reason I tell their story isn’t for the solution, but more for the parallel that I see between them and Johnny Depp. The numbers may be smaller, but the problem stems from the same behavioral pattern.

What can we learn? As your income goes up, pretend that it doesn’t! Rather than increasing your level of spending, how about increasing your savings rate FIRST!

Get to the IRS limit on your 401(k). Max out your health savings account. Contribute to an IRA. Build a serious emergency fund (a year’s worth of expenses). Once you are there, then allow yourself to increase your lifestyle to meet your income.

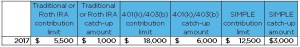

Turning age 50 is definitely a milestone – one that some people celebrate and some mourn while others remain ambivalent. No matter how you may feel about it, there’s at least one minor thing to celebrate from a financial planning perspective: 50 is the age when the annual contribution limits to retirement savings accounts is increased for savers via what’s called “catch-up contributions.” Here’s how they work.

Each type of retirement savings account has an annual limit that savers can contribute to each year. Catch-up contributions are intended to allow people who perhaps got a late start to “catch up” by giving them the ability to save above and beyond those annual limits:

So someone with a workplace retirement plan and a Roth IRA over the age of 50 could conceivably tuck $30,500 away after age 50 versus the lower $23,500 that younger workers are limited to. Even if you’re right on track with your retirement goal, the catch-up contributions can help to lower your taxable income and accelerate that financial independence day.

A strategy for 401(k) and 403(b) savers

For workers who are contributing to 401(k) or 403(b) accounts via payroll deductions at work, the catch-up contribution is typically a separate election that must be made in dollar amounts versus the regular contributions where you must elect a percentage of income. For workers whose pay varies due to hourly wages or commissions, it can be challenging to budget for these contributions or ensure that a certain amount is going in each pay period. The good news is that you don’t have to be maxing out your regular contributions in order to elect catch-up contributions.

So if you’re looking to bump your contributions up by a certain dollar amount and don’t feel like doing the math to figure out what percentage that is, you can just enter it as a catch-up amount. A small consolation for hitting that half-century mark? I think so.

Of course, I would always recommend trying to get the maximum amount into your retirement account each year, but that’s not always realistic for lower income workers or people with competing priorities like family needs or high interest debt. If you’re over 50 and thinking about making catch-up contributions, run a retirement estimate to see how they can help you get to your retirement goal sooner. Then start catching up today!

Receive the Tip of the Day in your inbox every week day! Just enter your email address on the Financial Finesse blog main page and select which categories you’d like to receive.

Have you ever borrowed from your employer’s retirement plan? When you need cash in a hurry, it can be tempting. After all, you don’t have to worry about a credit check and the interest just goes back into your own account.

However, there are a couple of reasons why this may not be the best idea. First, you lose any gains your money would have earned. Keep in mind that the stock market averages a 7-10% return per year, including many years with double digit returns so you could be losing out on real money.

Second, if you leave your job before paying off your loan, the outstanding balance could be considered a withdrawal and subject to taxes plus a possible 10% penalty if you’re under age 59 ½. These losses could end up jeopardizing your retirement. Here are some ways to avoid having to raid your retirement nest egg in the future:

Don’t think of your retirement account as a giant ATM. Even if your plan allows it for any reason, retirement plan loans should only be for dire emergencies and no, wanting the latest tech gadget or a vacation doesn’t qualify. Instead, calculate how much you need to save each month and have that amount automatically transferred to a separate savings account until you have enough to purchase what you want. Don’t have enough to save? Ask yourself what expenses you’re willing to cut back on to make your goal happen.

Have an emergency fund. Even if you do have an emergency, a retirement plan loan shouldn’t be your first resort. If your investments are down in value, you may not even have enough to borrow. Instead, build up enough savings to cover 3-6 months’ worth of necessary expenses and keep that money someplace safe like a savings account or money market fund. If you can’t stand the idea of all that cash just sitting there earning less than 1%, here are some ideas to put it to work harder for you.

Consider other options. For example, the average home equity interest rate is about 5%. Don’t forget that it’s tax-deductible too. If you’re in the 25% tax bracket, that loan may only cost you 3.75% after taxes, which is less than your investments will probably earn. Just be aware that your home is on the line if you can’t make the payments so this is probably not be a good idea if you’re facing severe financial hardship.

One final point is that people sometimes use a retirement plan loan to pay down credit card debt. Given how high credit card interest rates can be, this might be a smart move if it’s part of a larger plan to become free of high-interest debt. However, if you end up filing for bankruptcy, you’ll still have the retirement plan loan. In that case, you would have been better off using the bankruptcy to wipe out the credit card debt and leave your retirement account alone. (It’s generally a protected asset in bankruptcy.)

Retirement plan loans have a place, but be aware of the downsides. If you’re not sure what to do, consider consulting with a qualified financial planner. As with any financial decision, you want to make an informed one.

According to Fidelity’s annual study on New Year’s resolutions, the number of Americans considering a financial resolution for 2017 increased significantly over last year. If you are one of those who are hoping that 2017 will be the Year of Financial Security, I suggest a quick review of 2016 as a starting point. Ask yourself four questions to get started:

1. How much did you save? Before you start on a mission to save more money next year, take a look at how you did over the past year. Are you better off this year than last? Could you have saved more money? Were your expectations of how much you could save realistic?

Don’t let a small balance in your savings account discourage you from continuing your efforts. Make saving automatic by scheduling a recurring transfer on payday so you never miss the money. If you don’t yet have 6 months of your expenses tucked away in a savings account, that’s a good goal to start with.

2. How is your 401(k) or IRA doing? If you haven’t checked on your retirement account lately, this is a good time to log in and check your asset allocation. If nothing else, you should make sure you’re re-balancing your investments to account for changes in the stock market.

But you should also make changes to your allocation as you approach retirement. Someone who only has 5 years until retirement will have a lot more of their assets invested in fixed income funds versus someone with 30 years to go. It’s also a good time to run a retirement calculator to see if you’re on track to retire when you want to.

3. Did you reduce debt? Raise your hand if your financial resolution includes reducing or eliminating debt. Extenuating circumstances aside, if your total amount of debt increased or stayed the same in 2016, then it’s time to take a look at how you are going to make that number go down for the coming year. The first step in eliminating credit card debt is to stop using credit cards, so start thinking now about how you will shift your spending to cash only while you tackle your debt. Then make a plan and stick with it.

4. Has your financial outlook changed? Perhaps 2016 was a year of change for you. Perhaps you got married, got a raise, switched careers, etc. As you prepare your plans for 2017, cover these questions to set you up for financial success in the coming year:

Goal-setting for the New Year can be overwhelming. Make sure you give yourself some time and head space so that you are able to mindfully set goals that are realistic, achievable and motivational! Happy New Year!

Like what you’re reading? Sign up to receive my weekly blog posts directly to your email inbox. Go to the blog main page and enter your email address. You can subscribe to all posts or select your favorite topics and authors.

Last week, I wrote about how I’m investing in our company’s new 401(k) plan. That wasn’t the only decision I had to make though. Another choice was between making traditional pre-tax versus Roth contributions. Here are three reasons why I chose the former:

I expect my tax rate to be lower in retirement. The choice is basically between paying taxes now versus later. I’m currently in the 28% federal income tax bracket and the 6.65% NY state income tax bracket for a total marginal tax rate of 34.65%.

When I retire, my tax brackets are likely to be lower and I may end up living in a state with a lower state tax rate or even no state income tax at all. This is partly because I’ll need less income in retirement (especially since I won’t be saving for retirement anymore) and also because some of my retirement income will be coming from a tax-free Roth IRA. If I do end up being fortunate enough to retire in a higher tax bracket, I won’t mind paying the higher tax rate on my 401(k) as much since those additional dollars will be less valuable to me at that point.

I’d rather invest the tax savings outside my 401(k). With the pre-tax contributions, I get that 34.65% that would normally go to Uncle Sam if I made after-tax Roth contributions. I can then invest those tax savings in practically anything I want. Yes, I’ll have to pay taxes on the investment earnings, but I estimate that my higher expected returns in those outside investments will outweigh the taxes.

I can convert to a Roth later. One thing I love is keeping my options open. When I eventually leave the company, I can convert my 401(k) into a Roth IRA. (I’ll have to pay taxes on anything I convert so hopefully my tax bracket will be lower in at least that year.) However, if I choose the Roth option, there’s no way to go back and recover the benefit of lower taxable income.

Does this mean everyone should make pre-tax contributions? Absolutely not. If you expect your tax rate will be higher in retirement or if you’re maxing out your contributions and want to shield as much of it from taxes as possible, the Roth option would probably make more sense. As always, the best choice depends on your particular situation. Just remember that either choice is better than not contributing at all (or delaying due to analysis paralysis).

In many recent conversations, I’ve been asked “how much do I need to save for retirement?” The answer is always “It depends!” Do you want to plan to live until you’re 100 or are you going to project a short life expectancy because of serious health issues? Will you have no mortgage or debt and spend lots of time at the public library reading books or will you have a big mortgage and fly all over the world staying at luxurious hotels?

Your lifestyle choices matter A LOT. Given all the variables and uncertainty regarding how much someone needs saved/invested in order to retire comfortably, it makes sense to have some rules of thumb around that. So here are some varying thoughts on how much you might need to save for retirement:

Fidelity recommends that someone have 10x their annual salary saved by age 67. They also suggests a timeline to use in order to get to that magic number:

Aon Hewitt, a benefits consultant, suggests that you have 11x your final salary saved before you retire.

A long established rule of thumb in the financial services community is “The 4% Rule.” What that means is that you can take a 4% withdrawal from your final savings balance annually and increase the amount with inflation each year. If you have $500,000 in your accounts, you’d be able to spend $20,000 in the first year. So for every $1,000 per month you want to spend in retirement, you’d need $300,000 of investments.

Charles Farrell, financial author, recommends saving 12x your final income.

An article in The Street tells Millennials that they will need $2 million in order to retire.

These are just a few of the countless ways that people can calculate their “magic number.” Personally, I don’t believe in magic numbers. How much you need to save for retirement is very dependent upon the lifestyle you want to live.

Conventional wisdom says that you’ll need to replace 70-80% of your current income in retirement to live a lifestyle similar to today’s. I’ve met people who will be perfectly happy at 40-50% because they will have paid off their mortgage and have been aggressive savers who have lived far below their means for decades and won’t spend much money in retirement. I’ve met others who have plans to see the world post-retirement and they’ve saved their whole lives in order to splurge during retirement, so they’ll need >100% of today’s income.

What can you do with all of this potentially conflicting information? Start to think about your retirement picture. Take a look at your current expenses and see what will still be there during retirement and what won’t be. Consider the cost of healthcare and that you’ll need to account for that since you probably won’t have company benefits kicking in a portion of the cost.

Run some retirement calculators to see if you’re tracking well toward a secure retirement or not. Google “retirement calculator” and you’ll get thousands of options. You can also use our retirement estimator as another tool to help you get a gauge on your progress. The next time someone asks me “How much do I need to save for retirement?” I will email them a link to this blog post…

Sometimes I need to learn to not open my mouth and make smart alec comments. The other day, I was in a meeting with coworkers in which we were talking about retirement, and I joked that we needed to help people “Make Retirement Great Again.” As a result, I was given the challenge of writing a blog post with that title.

We are living in a world where pensions are being frozen or eliminated, Social Security is projecting a reduction in benefits in the next several decades and the burden of building a secure retirement is now falling on our shoulders – not the government or the employer. Today’s new graduates are a generation that is facing a mostly “build it yourself” retirement platform. So here is my absolutely non-partisan “6 step plan” for every person (from new graduates to grizzled workforce veterans) in this country to “Make Retirement Great Again”:

1. During your remaining work years, know exactly where your money goes. When you know this, you are in a position of power. You can say “I agree with where my money is going” or “I want to change this up a wee bit.” The key is that you then have the power to make informed choices. Whether it’s Mint.com, an Expense Tracker worksheet, a spending log or some other form of organized knowledge, find a tool that works for you so that you know exactly where every dollar goes.

2. Save an increasing amount each year. Many 401(k) plans have a “rate escalator” feature that allows you to increase your contribution percentage at pre-set intervals. For those who work for companies where annual pay increases are predictably timed, that is an amazing opportunity to increase your 401(k) contribution by 1% per year. Over the course of a career, this could mean hundreds of thousands or perhaps even more than a million dollars in extra retirement savings for those who are young enough. If you don’t have this feature, pick a day – either your annual increase date, your birthday, or on January 1st – to increase your contribution every year.

I promise that you won’t notice the difference in your net paycheck after 3 pay cycles. It will become your “new normal.” However, it may enable you to retire years earlier or move to a lower stress, lower paid job late in your career or position you well in the event of a downsizing.

3. Eliminate debt. In discussing early retirement packages with many dozens of employees recently, one of the key factors enabling those who accepted an early retirement package to walk into life beyond their long term corporate job was the absence of debt. Those who still had credit card debt or a big mortgage were far less confident in their ability to accept the early retirement offer. Most of them couldn’t accept the package even if they desperately wanted to.

If you aggressively pay down debt, including your mortgage, that is a tremendous way to position yourself to go into retirement feeling secure. A zero debt level allows you to have a very low embedded cost of living. It also allows your accumulated savings and investment dollars to last a whole lot longer since they aren’t being drawn down as rapidly.

4. Know your income streams. I’ve talked to so many people who “think they know” how much they’ll get from pensions and Social Security, only to be completely surprised (mostly on the happy surprise side but sometimes on the sad side) by the level of income they can expect from these sources. Knowing your numbers is a huge way to prepare yourself for a great retirement.

If you have a pension, run multiple estimates. Know your monthly payments at age 55, 60, 62, 65, 67 or or any other age that is relevant. See how the benefit changes can help you create your retirement vision.

Do the same thing for Social Security. Use this retirement estimator to see what you can expect from Social Security. Feel free to hit the “create new estimate” button at the end and use various ages.

5. Plan for medical expenses. Fidelity prepares a health care costs for couples in retirement report annually. For a couple retiring in 2016, the estimate is $260,000 in healthcare expenses from retirement through death. This is a pretty staggering level of expenses. How will you prepare for this?

A health savings account is a great tool to build a pool of funds for future healthcare expenses. If possible, max out your HSA annually between now and retirement and try to pay for medical expenses from your regular daily cash flow so that the HSA can build up and grow. Most HSA accounts have investment options as well, so those funds can be invested for growth. In the absence of that option, save even more aggressively in your 401(k) or bank savings account or some other form of savings/investments.

6. Be the opposite of Congress and try to reduce expenses or implement a spending freeze. This goes right back to step #1 and closes the loop. When you know what your expenses are, you then have the power to make changes.

Find small ways to reduce your spending. Even if it’s a couple dollars here and a couple dollars there, it all adds up. After a few months, you won’t miss the reduced spending.

When I’m ready to go into “expense reduction mode” or “spending freeze mode,” I have a cheesy way to keep focused. Every time I pull out my wallet (or log in to an online purchasing platform), I ask “Is this something that I really NEED, or do I just WANT this?” It sounds overly simplistic, but I can’t tell you how many times it’s made me pull out of the Starbucks parking lot before I get out of my car. Give it a whirl and see if it works for you. For every dollar you don’t spend, it’s a dollar that can be added to your emergency fund, paid on debt or invested.

I was recently at a conference talking to a group of women. The conversation was about everything from movies and books to kids and then it turned to marriage. What surprised me about the conversation was not how many women were divorced (we all know that the divorce rate is high in our country) but the age of the women who were recently divorced or facing a divorce. Almost every woman at my table of 20 who was recently divorced or about to be divorced was about 50.

Many were either stay-at-home wives or worked part-time jobs making little money. The reality of being divorced meant they now had to look for work that was not only satisfying but could meet their expenses, and in some cases, help them save for retirement. As these women found themselves job hunting after being out of the job market for decades, I offered the following suggestions on what to look for before accepting an offer:

1) A generous 401(k) match and/or a pension program: Get as much help as your employer can give you to save for retirement, especially if you feel you are behind in savings. Although most pension programs are going the way of the dodo bird, there are still organizations like the federal and state governments that pay a pension. The other is to look for companies with generous 401(k) matching programs. Consider using this article as a starting point to research potentially generous 401(k) plans and verify the information using Glassdoor, Vault or any other website that has employer information and/or employee comments about the company.

2) An extensive benefits package that you can take with you when you retire: Benefits like long term care, life and health insurance while you are working and after you retire (if offered) can be extremely valuable. In most cases (not all), long term care insurance is particularly cheaper when bought through an employer as opposed to an insurance salesperson. In some cases, you can even get it with a less extensive underwriting process.

3) A generous vacation schedule: Most people do not think about it, but you want time to recharge and see the world without having to fight your employer. Look for employers with generous vacation/time off schedules. As they say, time is money.

4) Good opportunities in your career: A company may have the best employment opportunity, but if it is not in the field you are in, you may not experience the full benefits. Consider the potential career opportunities in your field from your potential employer. Explore the job training and tuition reimbursement programs and how committed the company is to helping you develop professionally. Also consider that it may be better to temporarily take a lower paying job if it advances you in the long run.

There are lots of websites to help you on your search. Look at articles such as Forbes‘ “The Best Places to Work in 2016” or similar articles in your local newspaper. Employees are not shy talking about their companies, both good and bad. Go on websites like Glassdoor, Vault and Monster to get insider info about the company. You can even ask questions as many people are happy to reply.

Lastly, do not discount the power of personal connections. Talk to your friends and family about your job search and try to get insight about potential employers. The work you put in at the front end will go a long way to finding a satisfying career.

I got a phone call from my daughter (senior in college) not too long ago, relatively late at night, asking me if I could text her a photo of my HSA card. I figured she was heading to the pharmacy to pick up some antibiotics for a sinus infection. But when I heard Nick & Danny (two of her roomies) screaming in the background to get towels and try to stop the bleeding, I learned that her calm exterior was masking something bigger. It turns out that she eventually needed a whole bunch of staples and some glue to close up the large gash in her leg acquired when opening a box with a large knife when she couldn’t find her small scissors. She’s back to walking normally now so the crisis is over and she’s back to her normal daily activities.

It’s amazing to me how many different bills can come in from one injury. There were bills from the hospital (supplies, etc.), the ER department, the physicians group who treated her and a few others that I’m sure I’ve forgotten. The incoming mail probably hasn’t come to a complete halt just yet.

While I have an emergency fund set aside for emergencies (what else would it be for?), in the heat of the moment, I wasn’t thinking “let me pull money from my emergency fund so that she can get treated at the hospital.” I was thinking “Holy ****! My daughter’s roomies are screaming and she’s got the calm “something’s wrong” demeanor. I need to get the hospital paid right now so that they see her.” So I used my health savings account card to pay for the trip to the hospital.

I deviated from the logic and reason that I use in my normal budgeting process. In the heat of the moment, I “messed up.” But the good news is that I had my health savings account there as a backup. That wasn’t consistent with my long term plan, but I’m not going to look back with any regret.

My long term plan with my HSA is to build a pool of $100,000 or more before I retire. I plan to make the maximum contribution every year, pay for medical expenses from either my checking account or my emergency fund (if it’s a big one) and invest the balance for growth. Once I retire, the HSA will be there to pay for medical expenses for the rest of my life…or at least a good portion of the rest of my life.

What’s your plan to pay for medical expenses for the next 20, 30, 40 years or more? I have an outline of what I plan to do. I encourage you to come up with your own personal “lifetime medical expenses” plan. Here are some ways that people have told me that they plan to pay for medical care:

These are just a few of the many ways people have told me that they are planning to cover medical expenses over the rest of their lives. I’m sure there are others. What’s your plan?