Why The Traditional 401(k) Is Underrated

August 31, 2017Do you like paying “hefty tax bills?” According to this article titled, “If you like paying hefty tax bills, stick with your regular 401(k),” you’re likely to be better off contributing to a Roth 401(k) since required minimum distributions from a traditional 401(k) can keep you at the same or a higher tax bracket in retirement. That sounds pretty cut and dry but as with most universal financial recommendations, it’s a bit oversimplified.

Let’s take a look at some reasons why you might want to contribute to a traditional 401(k) even if you don’t like paying “hefty tax bills:”

1. Lowering your taxable income now can make you eligible for other tax breaks. One of the main differences between a traditional and Roth 401(k) is that the former lowers your taxable income now, while the latter can lower your taxable income in retirement. In other words, would you rather pay the tax now or later? One way to answer that is to compare your tax rate now with the one may pay in retirement.

However, there’s another factor to keep in mind. There are a number of tax breaks that phase-out based on your taxable income. Since almost all of them involve working, having children, saving or paying for education expenses, or saving for retirement, you’re much more likely to be eligible for them now than when you’re retired…assuming your taxable income doesn’t disqualify you. Before switching to a Roth 401(k), see if traditional 401(k) contributions can help you qualify for other tax breaks.

2. Your effective tax rate in retirement may be lower than you think. First, don’t forget that not all your income will be taxable in retirement. Even if you have no other tax breaks, you’ll still likely be eligible for at least the personal exemption and standard deduction and your Social Security will at most be partially taxable depending on your “combined income.” Any withdrawals from Roth accounts may be tax-free and only earnings on outside savings and investments are taxable (as opposed to any principal that you sell or withdraw).

More importantly, we need to examine what we mean by “tax rate.” For example, let’s say you currently earn a joint taxable income of $100,000. That would put you in the 25% tax bracket. If you contribute $18,000 pre-tax to your 401(k), all $18,000 would otherwise have been taxed at that 25% rate.

You then retire with the equivalent of $80,000 of taxable income (including RMDs) and are still in the 25% tax bracket. However, only the taxable income above $75,900 (in today’s dollars but the brackets are adjusted for inflation) or about 5% of your taxable income is taxed at that 25% rate. This means your average or effective tax rate is only 14.35%, despite still being in the 25% tax bracket. Would you rather pay a tax rate of 25% now or 14.35% later?

3. You can always convert to a Roth IRA later. If you make pre-tax contributions, you always have the option to later roll them into a traditional IRA and then convert them into a Roth IRA. You’ll have to pay taxes on the amount you convert, but if you plan to take time off from work to go back to school or take care of a child or elderly parent or even start a business that takes time to ramp up, you may be able to convert at that time and pay a lower tax rate. If your taxable income is low enough in retirement, you may even decide to convert then so your Roth account can grow tax-free for your heirs. However, if you make Roth contributions, you don’t have the same option to convert them to traditional.

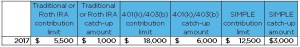

None of this is to say that the traditional 401(k) is better for everyone either. In fact, there are some very good reasons to make Roth contributions such as if you’re maxing out your 401(k) contributions, you want to have tax-free income in retirement to qualify for higher health insurance subsidies under the Affordable Care Act, or you expect your tax rate to be the same or higher in retirement. If you’re not sure what the best option for you is, consult a qualified and unbiased financial professional.

Don’t just rely on one article’s headline. If it sounds too simple to be true, it probably is.

This post was originally published on Forbes, July 26.