The No-Tracking Budget

April 21, 2023You don’t have to be a financial planner to know that one of the critical ingredients of financial security is having a budget, but knowing you need one and actually sticking to one are two different stories. We’re not here to lecture about why you should budget; let’s instead discuss a way to make it less painful. The purpose of a budget is threefold:

- First, to ensure you are not spending more than you earn.

- To figure out how much you can actually afford to save.

- If you are spending more than you make or you’d like to save more, then it helps to figure out where you might be able to cut back.

Finding a way to stick to your budget

Putting together a budget is one thing. Sticking to it is another. Putting together is relatively simple, and while there are many tools to help, sticking to it is where most people give up. So let’s talk about that part, assuming you already know how much you need to spend each month on needs versus wants.

Stop obsessing over categories when tracking.

Confession: I can’t tell you exactly how much I spent dining out last month. And I can’t tell you how much I plan to spend on it this month. That’s because that number isn’t as important to me as first ensuring I cover all my other financial goals.

I can tell you how much I’m saving toward several small but significant financial priorities so that whatever is left over is what I can spend on things I can go without, such as sushi night, shopping, spa services, or Target. (Yes, Target is a discretionary expense for me, and don’t tell me you also haven’t discovered their magnetic carts that just attract things.)

By prioritizing the things I know I need to make happen financially, I essentially back into what I can spend on wants without any tracking beyond setting up an alert to tell me if my account dips below $100.

Make it automatic

I do this through automatic transfers set to happen each payday. I have a series of savings accounts, one for each financial priority, through an online bank that lets me set up as many different savings accounts as I want. It’s the electronic version of the envelope system.

My checking account for spending money is at a “bricks and mortar” bank, and I have a checking account for bills that’s also housed at the online bank. Here are some other accounts that you might set up:

Accounts to set up for the no-tracking budget

Monthly bills

Separating your known monthly bills into a separate account and setting them on auto-pay might revolutionize your relationship with money. This account is for things with due dates and relatively set amounts like rent/mortgage, cable, cell phone, etc. You may need to estimate for things like electricity and gas. I use the highest amount from the past year, which ensures I’m well-funded.

What isn’t this account for? Things you can pick and choose how much and when to spend each month like groceries, personal care, and even your dog walker. Yes, this is money you need to spend, but it doesn’t have a due date or a set amount, which defeats the purpose. This fixed amount would only fluctuate if you made a drastic change like moving, canceling cable, etc.

Emergency fund

Getting this account funded with three months of expenses was my top priority, so before I even opened another account, I saved as much as I could. Now it’s just there, accruing interest. I can’t over-emphasize the peace of mind this gives me.

What isn’t this account for? Things I forgot to include in my “oh crap” account, like expenses to stand up at a wedding, Christmas gifts for family, or a plane ticket for a funeral. Those are all important things, but they are not an emergency.

Car stuff

This account is for car-related things such as insurance, new tires, repairs, registration, etc. Once it’s paid off, I’ll transfer my monthly payment into this account too, so I can save to buy my next car with cash.

What isn’t this account for? Gas money – that’s discretionary and comes out of my spending account.

Pet Medical

Pet insurance can run from $10-$90 per month, and Consumer Reports found that it’s not worth the money for the average healthy pet. Instead, pay yourself the premium so that if/when an expensive injury or illness pops up, you have some money saved. It’s worth noting that most pets’ major expenses come when they’re older, so if you do this throughout their life, you should have a sizable chunk built up by the time you need blood work and x-rays to figure out what old age ailment they have.

What isn’t this account for? Pet food (spending account), pet-sitting (spending or vacation account), and routine visits unless you’re accounting for that with the amount you’re setting aside into this account.

Kid activities

If you have kids, then you know that their extracurricular activities can add up pretty quickly. Try annualizing the costs and transferring one-twelfth each month to ease the burden of sign-up and gear-up season.

What isn’t this account for? Clothing, toys, everyday family expenses – try to isolate the “extra” stuff in this account, which can be a way for spouses who may disagree about how much to spend on this stuff to keep tabs on it in an agreeable way.

Depending on what’s important to you and what you want to better control your spending on, you may have other accounts. For example, my friend with a side gig has an account where she puts 20% of her income aside to have enough at tax time.

It takes some work to set up these accounts, but it’s worth it.

Real Results

I shared this system with a colleague of mine who is a busy mom of two young children, and her email to me says it all:

“I just wanted to say thank you. I’ve separated all my fixed bills through those accounts and set up a few savings accounts for shorter-term larger dollar items – Christmas, home improvements, and travel. That way, we don’t have to either put off those things or feel guilty about spending money on them.

Plus, I set up accounts for the girls for them to earn money and use on toys or whatever, and the transition of seeing the numbers is easier for them because they are still learning math and identifying the value of the paper/coin money. So, they earn it in cash, then we add it up and deposit it into our bank, and I transfer the money to their accounts.”

If you’re having trouble sticking to your budget, why not try it? What will your accounts be? Customize it to your life, and just make sure you’re also being deliberate with any “extra” money you find by trying this process!

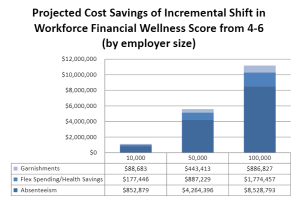

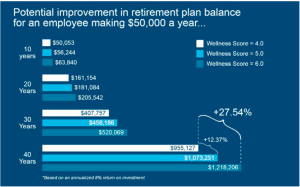

The national average financial wellness score is 5, based on Financial Finesse’s 0-10 financial wellness scale which benchmarks each employee’s financial wellness based on an online assessment. A Workforce Financial Wellness Assessment™ aggregates and analyzes this data on the company level. The chart to the left shows the projected costs savings of an incremental shift in the median workforce financial wellness score from 4-6, which has the potential to save a large employer of 50,000 employees approximately $5.6 million a year.

The national average financial wellness score is 5, based on Financial Finesse’s 0-10 financial wellness scale which benchmarks each employee’s financial wellness based on an online assessment. A Workforce Financial Wellness Assessment™ aggregates and analyzes this data on the company level. The chart to the left shows the projected costs savings of an incremental shift in the median workforce financial wellness score from 4-6, which has the potential to save a large employer of 50,000 employees approximately $5.6 million a year. $271.50 (net healthcare savings per employee)

$271.50 (net healthcare savings per employee)

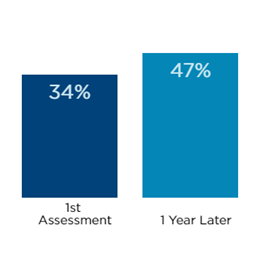

Our research also found that employees that engage repeatedly in their employer’s financial wellness program increase their likelihood of being on track for retirement—from 34 percent to 47 percent according to our findings*. For a 50,000-life employer, this 13-point improvement could equate to a $6.5 million annual cost reduction related to delayed retirement.

Our research also found that employees that engage repeatedly in their employer’s financial wellness program increase their likelihood of being on track for retirement—from 34 percent to 47 percent according to our findings*. For a 50,000-life employer, this 13-point improvement could equate to a $6.5 million annual cost reduction related to delayed retirement.