3 Clever Ways to Trick Yourself Into Saving Money

February 24, 2023I actually don’t think we have a financial literacy problem in America as much as we have a financial wellness problem. Everyone I talk to on our financial helpline knows what they’re supposed to do to be more financially stable. But while knowledge is power, putting that knowledge into action is where the real trouble is. It’s the same thing with eating well and exercising. We know what we’re supposed to do, but we don’t always do it.

That’s partially because these things take willpower and science has proven that willpower is finite, much like the gas in your gas tank. When you wake up in the morning, your willpower tank is full. But as you go through the day exercising willpower when you decide to go to work instead of stay in bed, hop on the bus instead of hailing a cab, order a salad over fries, etc., your tank becomes depleted. This is why you can often find me with a bowl of popcorn in front of the TV at night while I have no problem choosing a healthy breakfast every morning. My willpower is gone by the time we switch on Netflix.

You can overcome a lack of willpower by trying things like the “no-tracking budget” or using an auto-escalator to increase your 401(k) savings rate at regular intervals. But you also need to address your mindset around the financial behaviors that fly in the face of your stated goals. Here are a few tricks I use to keep me on the straight and narrow when I’m tempted to raid my emergency savings:

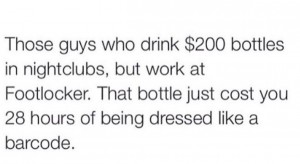

1.Measure the purchase against the number of hours you have to work to pay for it. This Instagram courtesy of @tank.sinatra kind of says it all, but for real.

Add up all the time you spend on work, including dressing, commuting, answering emails before bed, and even vacating work. Then divide those hours into your salary. That’s your true hourly wage.

Next time you’re thinking of bailing on your budget, calculate how many hours you’ll have to work to pay for the splurge. Suddenly, even just a venti non-fat, no-whip, 2-pump mocha isn’t as exciting when it equals an extra hour of sitting at your desk. (This tip is courtesy of one of my favorite books ever: Your Money Or Your Life.)

2. Calculate the number of days it will take to reach your goal. A USC study found that when people think of the number of days it will take to reach a goal versus the number of years, they were much more likely to start saving when they knew the number of days. For example, your newborn has 6,570 days until college. If you’re 30 years out from retirement, that’s only 10,950 days. Even 20-somethings only have about 14,600 days to work…

3. Think of your “walking away fund.” At the end of the day, financial wellness is truly about having choices. Elizabeth Warren had one when she ended up a single mom, I had one that allowed me to walk away from a toxic marriage and my friend Susan (not her real name) had one that empowered her to walk out of a job rife with sexism and office politics.

Years ago, I had the privilege of meeting a famous radio personality who shared a story that changed my life. He said:

“A couple weeks ago I was visiting the maternity wing at the hospital and someone passed me my newborn baby granddaughter. For just a second I had a flashback to what seemed like just 6 weeks ago, when someone was passing me a joint at Woodstock. Time flies, man. Life is too short to stay in a job you hate, a marriage you hate or anything you hate.”

If there is anything you hate about your life, your “walking away” fund can be your ticket out. Think of that when you’re tempted to blow it.