Investing 101: Understanding Your 401k Options

November 13, 2017If you’re like a lot of people, even if you have gotten help choosing the investments in your 401k, you may not really understand how those investments work or what they are made up of. I felt that way for a long time.

Like fish in moving water

I still remember choosing investments for my first retirement plan, a 403b. I really had absolutely no idea what I was doing — even after studying for and taking various securities exams, I was still a little bit fuzzy on some things.

To me it was like looking at a fish swimming under moving water. You can kind of see it, but only in the most general terms. The variations in the color of its scales, or features of its fins are distorted so much that even though you know it’s a fish, you can’t tell much more than that. Likewise, you may know you’ve got an investment in your 401k, but, beyond that, who knows what’s in that thing!

Understanding some basic terms

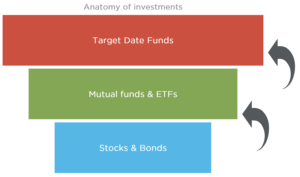

To help de-mystify some of the terminology, I’d like to break down some different terms that you might come across. Here’s a basic idea of how it works:

Mutual Funds

A mutual fund is basket of investments in stocks and/or bonds that are chosen to meet a certain goal. Some mutual funds are professionally managed (often called “actively managed”) by a fund manager who buys and sells investments as she/he sees fit to earn the highest returns within certain parameters. The name of the fund will oftentimes tell you what is in it.

For example, a large cap mutual fund will hold stock in large companies. It may own stock in a few companies or in hundreds of companies. The fund manager gets to choose which stocks or bonds to buy in a mutual fund.

Index Funds

Index funds are a subset of mutual funds that are what we often call “passively managed” and the word “index” will usually be in the name of the fund. An index fund will typically be invested in all of the funds of a certain index, such as the S&P 500, Dow Jones, Russell 2000, etc. Indexes are made up of all of the available stocks or bonds that fall into a certain category. The most notable difference between index funds and actively managed funds is cost — index funds typically have much lower fees.

For example, the Russell 2000 Index tracks the stock of 2,000 small companies in the United States. Therefore, a Russell 2000 Index Fund would likely own stock in most of the 2000 companies represented in that index.

The idea behind investing in an index is that it provides very broad diversification within a certain category at a lower cost. This means that if something really bad or really good happens to one of the companies represented in the Russell 2000 index, it isn’t very likely to affect the overall index very much. If one of the companies goes bankrupt, you have the other 1999 companies to counteract that effect.

ETFs

ETF stands for Exchange Traded Fund and they are kind of like an index mutual fund in make up — the difference is how they are traded on the active market. With mutual funds (including index funds), when you request to buy or sell a fund, the trade is executed at the end of the trading day (4pm ET on days the market is open) so that is the price you get. ETFs, on the other hand, trade the moment you request a buy or sell transaction, so are often preferred by more active investors.

ETFs are typically also made up of stocks or bonds that fall into a certain category and are not actively managed — they are passively managed (like index funds). For example, there could also be a Russell 2000 ETF, and as long as a stock is part of the Russell 2000, it will be purchased and held as part of that ETF.

You are unlikely to have direct access to ETFs within your 401k or 403b account, but the funds that are available may use ETFs instead of individual stocks to achieve their investing objective.

Target Date Fund

A lot of plans are using these — sometimes they’re called “Target Retirement” or something similar, but the dead giveaway that they’re a Target Date fund is when there is a year in the title of the fund. The “target date” they are referring to is your retirement date (or the year closest to when you plan to start making withdrawals from your account).

Target Date funds are mutual funds (sometimes even called “fund of funds”) that are typically professionally managed to meet certain criteria so that the fund will be appropriate for someone with a specific time frame left before they will need to start withdrawing the money from their account. So, the closer you get to the targeted date, the more conservative the fund will become.

The idea here is that YOU don’t have to worry about selecting investments, the fund manager does all of that for you. But what is IN the account? A Target Date Fund will hold a variety of investments, usually other mutual funds or ETFs.

Target Date funds are basically a “set it and forget it” option for people who want to be hands-off but know that they are still giving their savings access to growth that’s appropriate for their timeline.

Stocks

Mutual funds are made up of a variety of different stocks (or bonds, if it’s a bond fund). Owning a share of stock simply means that you own a tiny percentage of a company.

Bonds

We’ve talked a lot about stocks but not so much about bonds. If you own a bond of a certain company, municipality or the federal government, it means that entity owes you money. They have borrowed from you and must pay you back with interest. Because they are an obligation versus just part ownership in a company that could go gangbusters or go bust, bonds are considered more conservative investments because you’re more likely to get your money back with interest and hopefully some growth. Bonds can also be held in a mutual fund or ETF.

So, there you have it: Target date funds hold mutual funds and ETFs, and mutual funds and ETFs hold stocks and bonds. Which essentially means that you may be invested in a target date fund or mutual funds and ETFs, but either way, somewhere under all of the layers, you are probably invested in individual stocks and bonds.