Employees we coach report major reductions in financial stress and improvements in job satisfaction.

Our personalized financial coaching empowers employees to maximize their compensation and benefits.

Over

2.5M

employees reached

86%

of users report increased benefits satisfaction

54%

of users initially reporting high financial stress improve to low or no stress

72%

of users who report low credit scores go on to boost their score to at least 740

81%

of users with little/no emergency savings fully-funded their emergency savings account

We are trusted by over 20,000 employers around the world.

Financial wellness for everyone

Financial Coaching + Financial Technology

When passionate, experienced coaches come together with market-leading technology, remarkable transformations happen. We call it mass personalization and it is changing financial lives at scale.

Our coaches are and always will be at the core of what we do—while our technology amplifies their knowledge, expertise, and proven coaching strategies, driving meaningful change for millions.

Our Platform

No two financial journeys are alike, and people learn differently. Our integrated, multi-channel platform meets each employee where they are and propels them forward, delivering tangible outcomes for your workforce, organizational culture, and bottom line.

One place for employee wellness

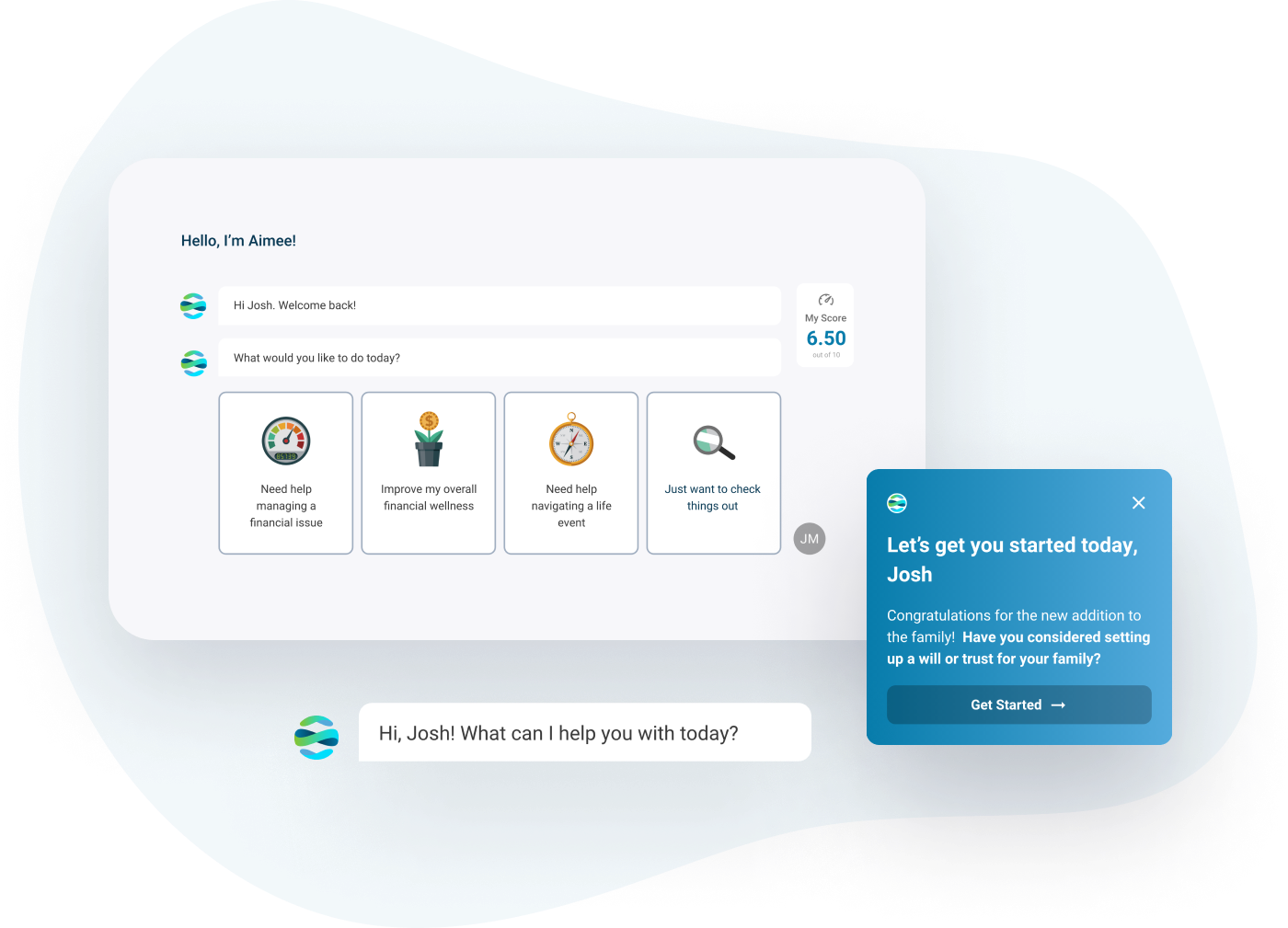

Personalized Financial Wellness Hub

An interactive homebase and learning center tailored to each employee’s unique financial journey and gamified to make taking critical steps forward feel simple and fun.

Includes:

- Access to live coaches and Aimee, our AI-powered virtual financial coach

- Full integration of employee benefits

- Interactive tools, calculators, and life event guides

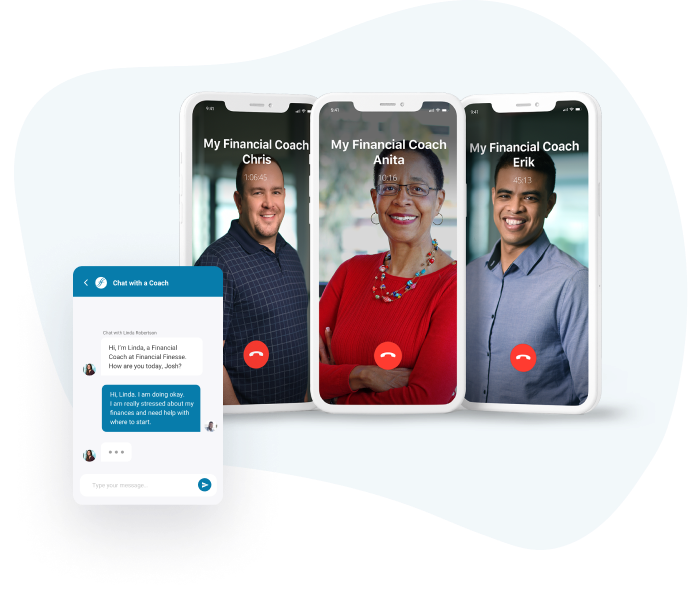

Unlimited human connection

CFP® financial coaches, on-demand

Employees have unlimited access to experienced CFP® coaches who have intimate knowledge of their benefits and a passion for changing financial lives.

Includes:

- Dedicated employer coaching line

- Online chat

- Live workshops and webcasts

AI-powered coaching

Aimee, your employees’ virtual coach

The only AI-powered coach backed by research, behavioral science, and 25 years of live coaching experience.

Includes:

- Ongoing personalized coaching to help employees maximize both their compensation and benefits

- Dynamic Financial Wellness Score™ and Action Plan

- Instant answers to financial questions with AI-powered search

End-to-end support

From program design to results

We get to know your workforce, benefits, challenges, and objectives and build customized programs tailored to your employees’ unique needs.

Includes:

- Tailored program design

- Custom marketing

- Data and analytics and ROI analysis

- Ongoing consulting and optimization

For EMPLOYEES

Do I have Financial Finesse?

Over 20,000 employers offer their employees unlimited access to our financial coaching solutions at no cost as an employee benefit. Enter your company email address to find out if your employer offers Financial Finesse, too.