Why a Lower Paying Job May Still Be Worth More

April 05, 2017When looking at job opportunities, it can be easy to be wooed by increases in salary. I learned the hard way that it’s not the only thing that matters when I took a new job many years ago for a couple thousand more per year, only to find that my actual take-home pay was lower because my new employer didn’t offer the premium benefits I’d enjoyed at my first job. But how do you know which benefits are better than others?

While you can’t put a price on things like “dress for your day” or bring your dog to work policies, you can figure out how much a lot of benefits are actually worth to you, personally, in actual dollar amounts. I’ll use my own benefits as an example since Financial Finesse is a well-recognized employer of choice. Obviously you’ll have to use your own numbers according to the benefits available to you and who would be covered in your family, but here’s a good framework to start with:

Health insurance – Definitely find out what your premium would be to factor that in, but don’t only look at that, especially if the employer covers your costs like they do at Financial Finesse. Is there a high-deductible option that comes with a health savings account and does the employer make a deposit into that account on your behalf? That’s also part of your compensation. If I were comparing offers, I’d also want to know the maximum I’d be on the hook for with each health plan since coverage levels matter as well. It’s all well and good if your employer covers your premium, but that could seem irrelevant if any costs incurred would require you to spend $5,000 of your own money to hit your deductible before any coverage kicks in.

- HSA deposit to my account for individual coverage: $1,500 (This also happens to be my deductible. If I had to pay a premium, I would subtract that amount from this to arrive at the net increase to my compensation.)

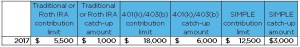

Retirement plan – Any match your employer gives you should be considered additional compensation, so definitely take that into account. Some employers even make discretionary deposits regardless of your own level of contribution, which should absolutely be accounted for when considering total pay. Financial Finesse basically matches me 4% as long as I contribute 5%, which is a no-brainer. Contributing less than 5% is the same as saying, “No thanks. I don’t want that extra bit of pay.”

- Annual employer match: 4% of my eligible pay = over $3,000

Financial wellness benefit – Offering a workplace financial wellness benefit is becoming an increasingly common (and smart, if you ask me) way for employers to demonstrate their commitment to employee wellness. In fact, it can be a great resource in helping you to make the most of all your other benefits! How you quantify this benefit will depend on what’s offered. At Financial Finesse, all employees have access to calling our Financial Helpline, which is the equivalent of having a CERTIFIED FINANCIAL PLANNERTM professional on retainer. When I was an independent financial coach working with the general public, I charged clients $300 per quarter for a similar service. That meant they had unlimited access to call, email or meet with me as long as they paid that fee, similar to the Financial Helpline that many of our clients offer to their employees. If the offer you’re looking at includes an unlimited benefit like Financial Finesse, that’s the best way I know how to quantify it.

- Annual savings by not having to hire a financial coach: $300 x 4 quarters = $1,200 (Note that this has nothing to do with what employers actually pay for their employees to have access to financial wellness but instead is what you’d have to pay if you sought an equivalent service on your own.)

- Not included in this number: The financial benefit of using a financial wellness program to pay off debt, create a budget, increase savings for the future or invest appropriately along with reduced financial stress. Value: priceless

Professional development support – This depends heavily on your career field and any credentials you have to maintain but can be a real differentiator. I have three professional credentials that aren’t cheap to maintain on an annual basis. Financial Finesse supports all of them, but my last employer only supported part of them, which is a big difference to my wallet. Beyond that, each employee at Financial Finesse also has a $250 per year personal professional development budget to be spent on things related to enhancing their job function such as books, classes, conferences, and even role-specific consultants. For mine, I add up all my credential licensing fees, professional association dues, cost of continuing education and the professional development fund.

- Annual savings by having my professional expenses reimbursed: about $1,750

Life insurance – Most employers offer employees automatic coverage of at least a year’s salary should the employee pass away while they are employed. The differentiator is when they cover more than that. Quantifying that truly depends on your personal situation. For some people, one times their annual salary is enough so additional coverage might not factor in as applicable compensation to consider. If you would need more coverage than the employer offers, you can figure out the savings based on what you pay for any additional policies you have outside of work.

- Annual savings by having a portion of my needed life insurance covered: $50

To add it all up, I’m actually receiving at least $7,500 in benefits beyond my salary and insurance coverage – not too shabby!

There are plenty of other benefits to consider as well, depending on your personal situation and what you need. For example, your employer may offer discounted pet insurance, but that’s only applicable in your calculation if you’d switch your pet insurance over and get a discount. Another example would be pre-paid legal assistance, a benefit that’s really handy for people who need to draft estate planning documents or own rental property and need a little real estate legal advice but not as useful if you’re all set it those areas. This also doesn’t include the more typical benefits that the majority of employers provide like disability insurance, an EAP and obviously unemployment insurance. Since you’re likely to have those benefits at any place you work, they won’t really help in making a decision even though they are useful and important benefits to have and appreciate.

Kelley Long is a resident financial planner with Financial Finesse, the leading provider of unbiased workplace financial wellness programs in the US. For more posts by Kelley or to sign up to have her weekly post delivered to your inbox each Wednesday, please visit the main blog page and sign up today.