What’s Your Plan For a Financial Independence Day?

May 10, 2023Continue reading “What’s Your Plan For a Financial Independence Day?”

Continue reading “What’s Your Plan For a Financial Independence Day?”

Using after-tax 401(k) contributions to execute backdoor conversions to a Roth IRA can be an effective strategy if you want to utilize these funds to retire early. When do employees think about executing this strategy? Consider the following factors:

At a fundamental level, after-tax Roth IRA conversions allow folks who retire early access to retirement principal without the 10% penalty typically assessed on early withdrawals from these accounts.

In a Roth IRA, you can access contributions anytime because you have already paid tax on the money. You can access the after-tax conversion basis directly rolled into your Roth IRA from your 401(k) without penalty as well. However, each taxable conversion has its own 5-year rule, and if you withdraw the funds within the first five years, unless you have a qualifying reason, the withdrawal may be penalized.

Investments in Roth IRAs have the potential to grow with the market, and earnings are distributed tax-free as long as you hold the account until the age of 59.5 or 5 years, whichever is longer. You may be able to withdraw from your Roth IRA if you have a qualifying reason to take the money out.

Early withdrawals are subject to Roth IRA ordering rules for distribution:

Seek tax advice before any conversion so you understand the tax implications for your specific situation.

Certain employer retirement plans allow employees to make three types of contributions:

Employees can contribute up to $22,500 (plus a $7,500 catch-up contribution if over 50 years of age) to the pre-tax and/or Roth 401(k) portion of the retirement plan in 2023.

In addition, if your plan allows it and depending on if your employer contributes or not, you may be able to contribute up to another $43,500 to the after-tax voluntary bucket. The IRS aggregate limit of employer and employee contribution increased to $66,000 in 2023 for most workplace retirement plan accounts like 401(k)s.

Use the following equation to figure out how much you can contribute to the after-tax bucket in your retirement plan through work:

| After-tax Contribution Equation | ||||||

| $66,000 is the IRS limit in 2023 | Minus | Pre-tax and/or Roth Contribution$22,500 (+$7,500 if over 50 years) | Minus | Employer Contribution(Discretionary and/or Non-Discretionary) | Equals | Potential After-tax Contribution Allowable |

Generally, when completing a 401(k) after-tax voluntary conversion to a Roth IRA, the conversion principal from a direct after-tax rollover is deposited into a Roth IRA, and earnings are rolled over into a Traditional IRA. However, earnings can also be converted to a Roth and tax paid.

When money is converted from the after-tax voluntary bucket of a 401(k) to a Roth IRA over a series of years, employees can build a significant amount of converted principal available to be accessed in early retirement that would otherwise likely be locked up until age 59.5. Though the conversion basis can be accessed, if conversion earnings are distributed before 59.5 and/or five years, whichever is longer, the gains are taxed and penalized.

In most cases, pre-retirement pro-rata distribution rules apply to unqualified early distributions from a 401(k). If you have a Roth 401(k) and take an early distribution, it will most likely be a mix of taxable (with penalty) and nontaxable funds.

After-tax conversions work in Roth IRAs because distribution rules are ordered as follows:

Let’s say you are 30 years old and looking to retire before the age of 50. Having money in a retirement account that is accessible, without penalty, is important regardless of age. Each year for 10 years, you make after-tax contributions to your 401(k) of $10,000, which grow to $11,000 before you request an in-service conversion rollover of this money into a Roth IRA. You invest the Roth IRA for growth, and it earns another $10,000. That growth will be tax and penalty-free as long as you wait until age 59.5 and at least five years to withdraw the earnings. However, the basis that you have converted over the years from your after-tax voluntary 401(k) account can be taken out without penalty or tax, regardless of age.

Here is what happens if you decide to withdraw the entire amount prior to age 59.5:

401(k) Contributions and Gains

After-tax contributions to 401(k) – $100,000

Total gains realized on after-tax contributions – $10,000

Backdoor Conversion to Roth IRA

Basis converted to Roth IRA – $100,000

Growth converted to Roth IRA and taxed upon conversion – $10,000

Withdrawal from Roth IRA prior to age 59.5

Contributions (tax and penalty-free) – $0

Taxable Conversion (10% penalty if held less than 5 years) – $10,000

After-Tax Conversion (tax and penalty free) – $100,000

Gains realized after conversion to Roth IRA (taxable and 10% penalty) – $10,000

* There may be plan-specific rules. Please check with the administrator for your work retirement.

* There are always exceptions to the rules, so before conversion, please seek advice from a tax expert that will help you understand the conversion tax implications.

* There are different distribution rules for after-tax contributions made before 1987. Consult your tax advisor for more information.

* Conversions may affect net unrealized appreciation (NUA) treatment on employer’s stock positions.

Preparing for retirement is an essential part of financial planning. Employer-sponsored retirement plans, such as 401(k) plans, are a common tool for saving. While contributing to a 401(k) can be a great way to save for retirement, it’s important to consider other options as well.

Are you fortunate enough to work for a company that offers to match employer-sponsored retirement plan contributions? If so, you should put the required minimum into the account to get that free money. Doing less is basically like turning down a raise!

Once you’re doing that, there are reasons that you may want to save additional funds outside the 401(k). Of course, if you don’t have a match or a 401(k) available, you may also need another way to save. Besides not having a 401(k) option, the most common reason to invest outside a 401(k) is investment selection. So, here are some other common options:

For the self-employed, there are actually many different tax-advantaged retirement accounts you can contribute to. If you work for a company that doesn’t offer a retirement plan, you can still contribute to an IRA. If this is the case, you can contribute up to $7,000 (or $8,000 if 50+) to an IRA. Additionally, you can deduct traditional IRA contributions no matter your income. However, income limitations exist on deducting contributions when you already have a 401(k) or 403(b) available.

A popular choice these days is the Roth IRA. This is partially because of the tax benefits. However, there is also more flexibility in accessing Roth IRA money early versus traditional or even Roth 401(k)s. For example, you can withdraw your Roth IRA contributions without taxes or penalties. Another benefit is your ability to withdraw up to $10k in growth for a first-time home purchase. You don’t have that option with a 401(k), at least not without tax consequences.

If you have access to a high-deductible health insurance plan, you can contribute to a health savings account (HSA). Contributions are limited to $4,150 per person or $8,300 per family (plus an extra $1,000 if age 55+). The contributions are tax-deductible, and the money can be used tax-free for qualified health care expenses. If you use the money for non-medical expenses, it’s subject to taxes plus a 20% penalty. However, the penalty goes away once you reach age 65, turning it into a tax-deferred retirement account that’s still tax-free for health care expenses (including most Medicare and qualified long-term care insurance premiums). You may also consider avoiding using the HSA even for medical expenses and investing it to grow for retirement.

Each person can purchase up to $10k per year in Series EE US Government Savings Bonds. For Series I Savings Bonds, that limit is $10k (plus another $5k from tax refunds). The federal government guarantees these tax-deferred bonds, which don’t fluctuate in value. As such, they can be good conservative options for retirement savings. However, you can’t cash them in the first 12 months, and you lose the last 3 months of interest if you cash them in the first 5 years. Interest rates may remain low, but the I Bonds are based on inflation, which is slowly creeping up.

If you’ve maxed out your other options, you can always invest for retirement in a regular taxable account. You can minimize taxes by investing according to your tax bracket. For example, invest in tax-free municipal bonds if you’re in a high tax bracket. Holding individual securities for at least a year will keep capital gains taxes low. You can also choose low-turnover funds like index funds and ETFs. Another strategy is to use losses to offset other taxes, including up to $3k per year from regular income taxes. The excess carries forward indefinitely. Just be aware that if you repurchase an identical investment within 30 days, you won’t be able to take the loss off your taxes.

Regardless of how you choose to save for retirement, the most important thing is that you save enough. Run a retirement calculator to see how much you need to save. Then, increase contributions through payroll or direct deposit. If you can’t save enough now, try gradually increasing your savings rate each year. Like it or not, your ability to retire depends on you.

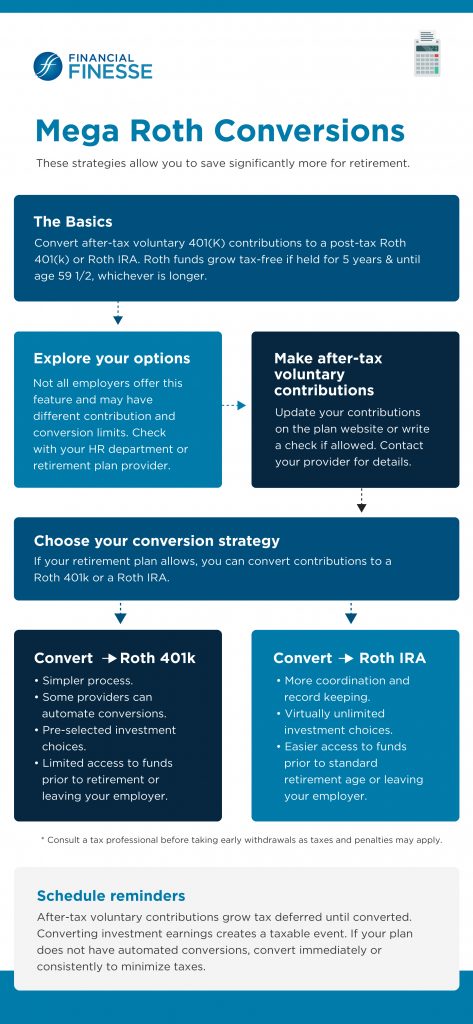

One increasingly popular strategy we have seen is the backdoor Roth conversion through an employer’s workplace retirement plan. If your employer’s plan allows, this strategy will enable you to convert after-tax voluntary 401(k) contributions to a Roth 401(k). When is it a good idea to contribute to an after-tax voluntary 401(k) and convert to a Roth 401(k)? Here are some factors to evaluate if you are considering this strategy:

At a fundamental level, converting after-tax voluntary 401(k) money to a Roth 401(k) allows employees to save significantly more, tax-free, for retirement.

You don’t get a current-year tax deduction for the money deposited after-tax and then converted to a Roth 401(k), but the funds grow and are distributed tax-free as long as you hold the account until the age of 59.5 and it has been 5 years since your initial contribution into the Roth 401(k).

Some employer retirement plans allow employees to make three types of contributions 1) pre-tax, 2) Roth, and 3) after-tax voluntary. After-tax voluntary contributions have already been subject to income tax.

Generally, employees can contribute up to $23,000 (plus a $7,500 catch-up contribution if over 50) to their pre-tax and/or Roth portion of the 401(k) in 2024. The combined annual IRS contribution limit is $69,000 in 2024 for most employer-sponsored retirement plans.Further, if your plan allows it and depending on whether your employer contributes or not, you may be able to make after-tax voluntary contributions above the basic limit.

It’s a good idea to work with your retirement plan administrator to find out exactly how much you can contribute (if the plan allows) to the after-tax voluntary account, but to get an idea, use the following equation:

| After-tax Contribution Equation | ||||||

| $69,000 is the IRS limit in 2024 | Minus | Pre-tax and/or Roth Contribution $23,000 (+$7,500 if over 50 years) | Minus | Employer Contribution(Discretionary and/or Non-Discretionary) | Equals | Potential After-tax voluntary Contribution Allowable |

In addition to contributing to the after-tax voluntary portion of your 401(k), your company’s plan may allow you to convert this contribution to your Roth 401(k). You may be able to contribute up to $46,000 in 2024 of after-tax voluntary dollars and then convert all of it to your Roth 401(k)! That’s right – up to $46,000 growing tax-free for retirement. Some plans also allow you to roll this money outside the plan via a rollover to a Roth IRA.

If your plan doesn’t allow the backdoor option while working, you’ll have to wait until you separate from your employment. Typically, you can then roll after-tax voluntary contributions to a Roth IRA and after-tax voluntary earnings to a pre-tax Traditional IRA account, or you can convert the earnings and pay tax on that portion of the conversion.

Henry has a great job as a software engineer. He earns a significant income and lives a simple life. He maxes out his pre-tax contribution to his 401(k), which is $23,000 in 2023, and his company contributes $9,500. Henry also contributes an additional $36,500 to the after-tax voluntary portion of his 401(k).

| After-tax Contribution Equation Example | ||||||

| $69,000 is the IRS limit in 2024 | Minus | Pre-tax and/or Roth Contribution $22,500 (+$7,500 if over 50 years) | Minus | Employer Contribution(Discretionary and/or Non-Discretionary) | Equals | Potential After-tax Voluntary Contribution Allowable |

| $69,000 | – | $23,000 | – | $9,500 | = | $36,500 |

His retirement plan allows him to convert the after-tax voluntary contributions to his Roth 401(k). In fact, if his plan allows, Henry can set up his conversions to happen automatically as soon as he contributes his after-tax voluntary dollars. He continues to convert the money to his Roth 401(k), building up tax-free funds for retirement.

The 401(k) Backdoor Roth Conversion is an excellent opportunity to save more for retirement in your 401(k) than the pre-tax and Roth contribution limits will allow. It makes the most sense for those who already have a stable financial foundation and do not anticipate liquidity needs before retirement.

* There are always exceptions to the rules, so before conversion, seek advice from a tax expert that will help you understand the conversion’s tax implications to your specific situation.

* There may be plan-specific rules. Please check with the administrator for your workplace retirement plan.

* There are different distribution rules for after-tax voluntary contributions made before 1987. Consult your tax advisor for more information.

* Conversions may affect net unrealized appreciation (NUA) treatment on employers’ stock positions.

Are you wondering if you should convert your retirement account to a Roth by the end of the year? After all, there’s no income limit on IRA conversions. Many employers are now allowing employees to convert their company retirement plan balances to Roth while they’re still working there. At first glance, it may sound appealing. Earnings in a Roth can grow tax-free, and who doesn’t like tax-free? However, here are some reasons why now might not be the time for a Roth conversion:

1) You have to withdraw money from the retirement account to pay the taxes. If you have to pay the taxes from money you withdraw from the account, it usually doesn’t make financial sense as that money will no longer be growing for your retirement. This is even more of a tax concern if the withdrawal is subject to a 10% early withdrawal penalty.

2) You’ll pay a lower tax rate in retirement. This can be a tricky one because the tendency is to compare your current tax bracket with what you expect it to be in retirement. There are a couple of things to keep in mind though. One is that the conversion itself can push you into a higher tax bracket. The second is that when you eventually withdraw the money from your non-Roth retirement account, it won’t all be taxed at that rate.

You can calculate your marginal tax bracket and effective average tax rate here for current and projected retirement income. (Don’t factor in inflation for your future retirement income since the tax brackets are adjusted for inflation too.) The tax you pay on the conversion is your current marginal tax bracket. However, the tax you avoid on the Roth IRA withdrawals is your future effective average tax rate.

3) You have a child applying for financial aid. A Roth conversion would increase your reported income on financial aid forms and potentially reduce your child’s financial aid eligibility. You can estimate your expected family contribution to college bills based on your taxable income here.

Of course, there are also situations where a Roth conversion makes sense:

1) Your investments are down in value. This could be an opportunity to pay taxes while they’re low and then a long-term investment time horizon allows them to grow tax-free. When the markets give you a temporary investment lemon, a Roth conversion lets you turn it into tax lemonade.

2) You think the tax rate could be higher upon withdrawal. You may not have worked at least part of the year (in school, taking time off to care for a child, or just in between jobs), have larger than usual deductions, or have other reasons to be in a lower tax bracket this year. In that case, this could be a good time to pay the tax on a Roth conversion.

You may also rather pay taxes on the money now since you expect the money to be taxed at a higher rate in the future. Perhaps you’re getting a large pension or have other income that will fill in the lower tax brackets in retirement. Maybe you’re worried about tax rates going higher by the time you retire. You may also intend to pass the account on to heirs that could be in a higher tax bracket.

3) You have money to pay the taxes outside of the retirement account. By using the money to pay the tax on the conversion, it’s like you’re making a “contribution” to the account. Let’s say you have $24k sitting in a savings account and you’re going to convert a $100k pre-tax IRA to a Roth IRA. At a 24% tax rate, the $100k pre-tax IRA is equivalent to a $76k Roth IRA. By converting and using money outside of the account to pay the taxes, the $100k pre-tax IRA balance becomes a $100k Roth IRA balance, which is equivalent to a $24k “contribution” to the Roth IRA.

Had you simply invested the $24k in a taxable account, you’d have to pay taxes on the earnings. By transferring the value into the Roth IRA, the earnings grow tax free. This calculator helps you crunch your own numbers.

4) You want to use the money for a non-qualified expense in 5 years or more. After you convert and wait 5 years, you can withdraw the amount you converted at any time and for any reason, without tax or penalty. Just be aware that if you withdraw any post-conversion earnings before age 59½, you may have to pay income taxes plus a 10% penalty tax.

5) You might retire before age 65. 65 is the earliest you’re eligible for Medicare so if you retire before that, you might need to purchase health insurance through the Affordable Care Act. The subsidies in that program are based on your taxable income, so tax-free withdrawals from a Roth account wouldn’t count against you.

6) You want to avoid required minimum distributions (RMDs). Unlike traditional IRAs, 401ks, and other retirement accounts that require distributions starting at age 72 (or 70½, depending on your age), Roth IRAs are not subject to RMDs so more of your money grows tax free for longer. If this is your motivation, remember that you can always wait to convert until you retire, when you might pay a lower tax rate. Also keep in mind, Roth conversions are not a one-time-only event. You can do multiple conversions and spread the tax impact over different tax years if you are concerned about pushing your income into a higher tax bracket in any particular year.

There are good reasons to convert and not to convert to a Roth. Don’t just do what sounds good or blindly follow what other people are doing. Ask yourself if it’s a good time for you based on your situation or consult an unbiased financial planner for guidance. If now is not the right time, you can always convert when the timing is right.

There are multiple reasons to contribute to a Roth IRA, but if you make too much money, the Roth may not seem to be an option. However, there are a few things to keep in mind before completely writing off the Roth IRA.

One is that the income limits are based on MAGI (modified adjusted gross income). That means if you contribute enough to a pre-tax 401(k) or similar qualified retirement plan, you may be able to bring your MAGI below the income limits. (Here is a little more on MAGI.)

The bigger point here for people whose MAGI far exceeds the income limits is the fact that there is no income limit to converting a traditional IRA into a Roth IRA. This is the key that allows people who make too much money to put money directly into a Roth IRA to still participate.

You can simply contribute to a traditional IRA and then convert your traditional IRA into a Roth IRA. Anyone can contribute, regardless of income levels, but many people don’t because it’s not tax-deductible if you earn too much to contribute to an IRA and are covered by a retirement plan at work.

This is called a “backdoor” Roth IRA contribution. Since it’s really a conversion rather than a contribution, you may have to wait 5 years before you can withdraw the amount you converted penalty-free before age 59 1/2. You’ll have to file IRS Form 8606 to document the non-deducted contribution to the traditional IRA, which will offset the 1099-R form you’ll receive for the conversion.

There is a potentially huge caveat to this strategy though. If you have other funds in a traditional (pre-tax) IRA already that you aren’t converting, you have to pay taxes on the same percentage of the conversion amount as you have in total IRA dollars that are pre-tax. That means you could end up owing taxes on the conversion even if all the money you convert was nondeductible and thus after-tax.

For example, let’s say that you have an existing IRA with $95k of pre-tax money and you contribute $5k to a new IRA after-tax. Since 95% of your total IRA money is pre-tax (because it was already there before and presumably contributed pre-tax), 95% of any money you convert to a Roth IRA is taxable even if you convert the new IRA with all after-tax money.

In other words, the IRS looks at all of your IRAs as if they were one account and taxes your conversions on a pro-rata basis. In this case, you would owe taxes on 95% of the $5k you convert — basically you’d have $4,750 of taxable income. So you can still do it, and $250 would be converted without causing a tax effect. It’s just not a tax-free transaction.

The good news is that there may be a way to avoid this. If your current job’s retirement plan will allow you to roll your existing IRA money into your existing employer’s retirement plan, then you’d be eliminating the need to pro-rate by no longer having an existing pre-tax IRA. If you move your IRA into your 401(k), then complete the “backdoor” transaction, the only IRA money you would have in this example would be the $5k after-tax IRA, so you won’t pay any taxes on the conversion since 0% of your total IRA money is pre-tax.

Even if you can’t avoid the tax on the conversion, it’s not necessarily a bad deal. After all, you or your heirs will have to pay taxes on your IRA money someday. By converting some (or all) of it into a Roth, at least future earnings can grow tax-free. It’s probably not worth it if you have to withdraw money from the IRA to pay taxes on the conversion.

So there you have it. You can contribute to a Roth IRA one way or another as long as you have some type of earned income. Otherwise, you won’t be able to contribute to a traditional IRA either.

Are you wondering if you should convert your retirement account to a Roth by the end of the year? After all, there’s no income limit on IRA conversions and many employers are now allowing employees to convert their company retirement plan balances to Roth while they’re still working there. At first glance, it may sound appealing since the earnings in a Roth can grow tax free, and who doesn’t like tax free? However, here are some reasons why now might not be the time for a Roth conversion:

1) You have to withdraw money from the retirement account to pay the taxes. If you have to pay the taxes from money you withdraw from the account, it usually doesn’t make financial sense as that money will no longer be growing for your retirement. This is even more of a tax concern if the withdrawal is subject to a 10% early withdrawal penalty.

2) You’ll pay a lower tax rate in retirement. This can be a tricky one because the tendency is to compare your current tax bracket with what you expect it to be in retirement. There are a couple of things to keep in mind though. One is that the conversion itself can push you into a higher tax bracket. The second is that when you eventually withdraw the money from your non-Roth retirement account, it won’t all be taxed at that rate.

Let’s take an example where you retire with a joint income of $125,900 in 2022. Because of the $25,900 standard deduction for married filing jointly, your taxable income would be no more than $100,000. Of your taxable income, the first $20,550 would only be taxed at 10%, and everything from there up to $83,550 is taxed at 12%. Only the income over $83,550 is taxed at the 22% rate. As a result, you would be in the 22% bracket but actually pay only about 13% of your income in taxes.

You can calculate your marginal tax bracket and effective average tax rate here for both your current and projected retirement income. (Don’t factor in inflation for your future retirement income since the tax brackets are adjusted for inflation too.) The tax you pay on the conversion is your current marginal tax bracket, but the tax you avoid on the Roth IRA withdrawals is your future effective average tax rate.

3) You have a child applying for financial aid. A Roth conversion would increase your reported income on financial aid forms and potentially reduce your child’s financial aid eligibility. You can estimate your expected family contribution to college bills based on your taxable income here.

Of course, there are also situations where a Roth conversion makes sense:

1) Your investments are down in value. This could be an opportunity to pay taxes on them while they’re low and then have a long-term investment time horizon to allow them to grow tax free. When the markets give you a temporary investment lemon, a Roth conversion lets you turn it into tax lemonade.

2) You think the tax rate could be higher upon withdrawal. You may not have worked at least part of the year (in school, taking time off to care for a child, or just in between jobs), have larger than usual deductions, or have other reasons to be in a lower tax bracket this year. In that case, this could be a good time to pay the tax on a Roth conversion.

You may also rather pay taxes on the money now since you expect the money to be taxed at a higher rate in the future. Perhaps you’re getting a large pension or have other income that will fill in the lower tax brackets in retirement. Maybe you’re worried about tax rates going higher by the time you retire. You may also intend to pass the account on to heirs that could be in a higher tax bracket.

3) You have money to pay the taxes outside of the retirement account. By using the money to pay the tax on the conversion, it’s like you’re making a “contribution” to the account. Let’s say you have $24k sitting in a savings account and you’re going to convert a $100k pre-tax IRA to a Roth IRA. At a 24% tax rate, the $100k pre-tax IRA is equivalent to a $76k Roth IRA. By converting and using money outside of the account to pay the taxes, the $100k pre-tax IRA balance becomes a $100k Roth IRA balance, which is equivalent to a $24k “contribution” to the Roth IRA.

Had you simply invested the $24k in a taxable account, you’d have to pay taxes on the earnings. By transferring the value into the Roth IRA, the earnings grow tax free. This calculator helps you crunch your own numbers.

4) You want to use the money for a non-qualified expense in 5 years or more. After you convert and wait 5 years, you can withdraw the amount you converted at any time and for any reason without tax or penalty. Just be aware that if you withdraw any post-conversion earnings before age 59½, you may have to pay income taxes plus a 10% penalty tax on them.

5) You might retire before age 65. 65 is the earliest you’re eligible for Medicare so if you retire before that, you might need to purchase health insurance through the Affordable Care Act. The subsidies in that program are based on your taxable income so tax-free withdrawals from a Roth account wouldn’t count against you.

6) You want to avoid required minimum distributions (RMDs). Unlike traditional IRAs, 401(k)s, and other retirement accounts that require distributions starting at age 72 (or 70½, depending on your age), Roth IRAs are not subject to RMDs so more of your money grows tax-free for longer. If this is your motivation, remember that you can always wait to convert until you retire, when you might pay a lower tax rate. Also keep in mind, Roth conversions are not a one-time-only event. You can do multiple conversions and spread the tax impact over different tax years if you are concerned about pushing your income into a higher tax bracket in any particular year.

There are good reasons to convert and not to convert to a Roth. Don’t just do what sounds good or blindly follow what other people are doing. Ask yourself if it’s a good time for you based on your situation or consult an unbiased financial planner for guidance. If now is not the right time, you can always convert when the timing is right.

The Society of Actuaries Aging and Retirement Strategic Research Program and Financial Finesse are pleased to make available a series of briefs focused on retirement literacy issues. The first brief in the series explores retirement from a holistic perspective looking at non-financial issues. The second brief looks at retirement planning and the things to consider throughout one’s career. The third brief explores the types of expenses that may occur in the first year of retirement. The fourth brief provides a resource for better understanding retirement tools. The briefs were developed by a team led by Greg Ward of Financial Finesse.

I was doing some workshops for a group of pre-retirees (talk about envy!) and we were going over a lot of the basic questions that group often has:

But the question that seemed to generate a lot of interest was if there were any strategies surrounding taking the Required Minimum Distribution (RMD), which is when you have to begin withdrawing funds from 401(k) accounts, pre-tax IRAs and some annuities at age 70 1/2. The strategies listed below can help you be more efficient in deciding which dollars you should consider using to pay your RMD.

A lot of people have a misconception that if you have several retirement accounts you need to withdraw the required amount from each account. While you can do that, it’s important to understand what you’re allowed to do, since it varies by account type.

If you have more than one IRA, you have a choice to withdraw each account’s required amount or you can take the combined distribution from one account. An important consideration here is that you cannot group your employer sponsored plan(s) like a 401(k) into this strategy. If you have more than one 401(k) (including Roth!) you would actually need to figure out the RMD from each 401(k) separately and withdraw from each one.

What if you have an investment that is doing very well and it’s time for you to take your RMD, do you absolutely have to sell that investment? Well if it is your only investment holding yes, but many people have more than one holding.

Consider selling an investment that is not returning as much as others, i.e. dollars that you have in a money market account or perhaps a mutual fund you’ve been thinking of selling anyway. This can also provide an opportunity for re-balancing.

For example, say you have too much in bonds, by selling off a portion of bonds you can make your RMD and get back to a percentage in bonds that you are comfortable with.

What happens if you don’t need the money that the RMD forces you to take? (I know, nice dilemma!) Well you still have to take it, unless of course you like the penalty for not taking it (50% of the amount you should have taken). So what are your choices?

Of course you can spend it, I mean after all you worked hard for it, but you could also re-invest. Some things to consider might be tax efficient investments, such as municipal bonds or if you are working, consider funding a Roth IRA where future growth can be pulled out tax free (after you have held the account for 5 years).

If you must take an RMD and you normally donate to charity, consider making your donation directly from your IRA account. This is called a Qualified Charitable Distribution and can help lower your taxes, especially if you no longer itemize your deductions because the standard deduction is so much higher than it use to be. You can give up to $100,000 from your IRA each year in this way.

For example, say your RMD for the year was supposed to be $10,000 and you normally give $2,000 to charity each year. You could have the $2,000 sent directly from your IRA to the charity and withdraw the remaining $8,000 RMD from your IRA account. That way, you would not have to pay tax on the $2,000 donated to charity.

If you are in the 22% tax bracket, then you would save $440 in taxes by doing it that way. Otherwise, with a $2,000 charitable donation, you may not be able to itemize your deductions to receive a tax benefit. See IRS Pub 590-B “Qualified charitable distributions.” section for more information.

Bottom line, just because you have to take your RMD, doesn’t mean you can’t be tax efficient by re-investing the money!

Keep in mind that your strategy may be quite simple or may employ some of the above tips, but the one constant is that you want to continue to be on time with your RMD and whenever possible, make it as advantageous for you as you can.

For people who strive to put the maximum amounts away into accounts with annual limits such as 401(k)/403(b) plans and Health Savings Accounts, switching jobs mid-year requires some additional diligence to make sure you’re not going over.

Most company benefits departments will take steps to ensure you don’t go over the limit with contributions from your paycheck, but if you already made deposits to accounts at your prior job that year, your new job won’t automatically know to factor that in – you have to take steps to guard against that. (these issues can also arise if you have more than one job with benefits)

This issue sometimes doesn’t come to light until after the end of the year when you’re filing your taxes and your tax accountant or software points out that you put more than the annual limit into your 401(k)’s. It’s important to know that the limits are across all accounts, not per account.

| 401(k) & 403(b) contribution limits | ||

| 2022 | 2021 | |

| Amount you can put in via payroll | $20,500 | $19,500 |

| Additional if you’re age 50 or older | $6,500 | $6,500 |

What to do if you over-contributed: First of all, it’s important that you act quickly – there is a deadline to fix this without incurring penalties, which is April 15th of the year following the over-contribution.

For example, let’s say you over contribute by $5,000 and the administrator attributes $500 worth of growth to that amount – you’ll receive a check for $5,500 and include $5,000 on last year’s tax return to reflect the return of your deposit and $500 on next year’s return to reflect the income on that deposit.

As long as you do this by April 15th, you will avoid any penalties. Waiting until after could incur a 10% early withdrawal penalty or even 100% double taxation of the amount you over-contributed, so you’ll want to get this done ASAP.

Why you might intentionally go over and put yourself in this position: One reason you might intentionally over-contribute to your retirement when switching jobs is if your new job offers a better match than your previous job, and you’d be sacrificing some of the available match if you contributed less.

If that’s the case, you may decide to max out your new match, then withdraw from your old job’s account to reconcile it. If you’re planning to do this, you’ll want to wait until after you’ve successfully withdrawn your overage before rolling your old account into your new plan or an IRA.

There are several ways this can happen, especially if you switch mid-year into or out of an HSA-eligible plan. For example, if you had already put the maximum amount into your HSA before switching jobs only to find that your new job doesn’t have an HSA-eligible option, you may want to calculate the eligible amount and withdraw the excess before you file your tax return for that year.

Health Savings Account contribution limits

| 2022 | 2021 | |

| Limit for individual | $3,650 | $3,600 |

| Limit for family | $7,300 | $7,200 |

| Additional for 55 or older | $1,000 | $1,000 |

What to do if you over-contributed: As long as you catch this before you file your federal tax return (including extensions), you can simply request that the additional funds be returned to you, then make sure you include them in your income for the year they were contributed. Similar to retirement fund overage withdrawals, if there are any earnings attributed to the amount you over-contributed, those will also be distributed and taxed as regular income.

If you decide not to do this or miss the deadline, then you can leave the excess contributions in the HSA and pay a 6% excise tax on the amount over-contributed. Note that if you have your account invested for aggressive growth, you may find that paying the excise tax still leaves you ahead in the long run, but for the majority of people these days who simply use the savings account feature of HSAs, they usually opt to withdraw the excess rather than pay 6% tax on it.

This can happen if you have higher income or received a very large bonus that would take your total wages for the year over the annual Social Security withholding limit. Most people don’t know this, but you don’t pay Social Security on every penny you earn – it stops when you get to a certain limit. For 2022, that limit is $147,000 or $9,114 in tax.

Employers are required to withhold FICA tax according to the wages they pay you, so if you have more than one job during the year and your total wages exceed the limit, you’ll need to claim the excess as a credit against your income tax when you file your return. (IRS Publication 505 has more on this) If you only have one job and your employer made the mistake, then you should first try to get them to refund you the money and if not, then you’ll need documentation to file Form 843.

Dealing with the loss of a loved one is obviously one of the most difficult periods in anyone’s life. Dealing with grief can be compounded by dealing with the financial matters that need to be wrapped up – things like probate, insurance claims, and dividing assets can be time consuming and stressful. Today I want to focus on the benefits that survivors may be entitled to if a loved one is still working when they pass away.

If your loved one had a pension with their employer, it is likely that plan has some type of pre-retirement death benefit. Each plan will have different options available to a surviving spouse or beneficiary, so it is important to reach out to the plan administrator to see what your options are to claim this benefit. You can get that information from HR at the company where the pension started.

While not all employees still have access to a pension, most will have access to an employer-sponsored retirement plan like a 401(k) or 403(b), and hopefully they were saving into it. Assuming the account had named beneficiaries at the time of death (good reminder here to make sure you have updated beneficiaries on your accounts), those beneficiaries are entitled to that money before probate is completed. There are certain deadlines on making decisions, so you may need to address this before other things in the estate.

You will want to reach out to the 401(k) plan administrator to initiate the process of transferring the account – you can usually find this information on any recent statements or from HR at the company where they worked. You should also check with a tax professional to discuss the tax implications of your strategy with the funds.

Many employers offer basic life insurance benefits to their employees at no cost to the employee. In addition, your loved one may have purchased additional coverage at work. In the best case, the employer will reach out to you with that information, but it is worth a call to their HR or benefits group to see what life insurance coverage your loved one had. Remember, life insurance proceeds are tax-free to the beneficiary, and they are not included in probate, although they may be taxable to the estate in certain instances.

If your loved one provided the health insurance for you through work, you may continue that through COBRA coverage for up to 18 months. You should also explore other coverage options to see what the most cost-effective option for you is – if you have insurance available through your job, this would be a qualifying event, allowing you to enroll mid-year if needed, but there is a time limit to making that change from the date of death.

I also encourage everyone to review all your beneficiary designations, your will, and other estate planning documents to make sure things are up to date. Also, maintaining a simple file with who to contact for all your accounts and policies – including those at work – will make it much easier for your loved ones to know who to contact should something happen to you.

If you have the option of making Roth contributions to your employer’s retirement account, should you do it? With a traditional pre-tax contribution, you only pay taxes when you withdraw the money. With a Roth contribution, you pay the taxes before you contribute, but the earnings can be withdrawn tax-free as long as you’ve had the account at least 5 years and are over age 59 ½.

I recently spoke to one employee who has made all Roth contributions and so virtually all of her retirement savings (except for matching contributions) is in a Roth 401(k). When I asked her why, she said it was because she heard from Suze Orman and Dave Ramsey that this was a good thing to do.

One of the problems with taking financial guidance from media personalities is that their advice tends to be overgeneralized. In this case, I’d say it’s worse than that because I would argue that most people are better actually better off making mostly pre-tax contributions even if they retire in the same tax bracket!

When this employee retirees, almost all of her income will be tax-free. (Her taxable income will be low enough for her Social Security benefits to be tax-free and her husband has no retirement savings.) That sounds great except that if she and her husband were retired today, they would still be eligible to have at least $24,400 of tax-free income in retirement because of their standard deductions, even without the Roth.

If she had contributed to a pre-tax 401(k), she would have paid no tax on the contributions and then no tax on $24,400 of withdrawals each year. (The next $78,950 would still only be taxed at 10 or 12%, much less than the tax rate she would have avoided on her contributions.)

The good news is that she still has plenty of time to make future pre-tax contributions and lower her current taxes before she retires. This would allow her to either save more and/or use the tax savings for other goals. However, her projected retirement income based on these future contributions would still not allow her to take full advantage of her standard deductions in retirement.

This isn’t to say that everyone should make all pre-tax contributions either. There are good reasons to have at least some money in a Roth account, especially if you plan to retire before you’re eligible for Medicare at age 65 since having some tax-free income can lower your health insurance premiums in the exchanges.

A Roth account can also be more beneficial if you think your tax brackets will actually be higher in retirement. Roth IRAs also have other benefits in terms of more flexibility with investment options and withdrawals.

So what’s the moral of the story? Don’t always believe what you hear or read from so-called “financial gurus.” Their advice/entertainment is meant to be generalized and may be misapplied to your situation. Instead, seek out more personalized guidance from a qualified and unbiased financial planner.

Did you know that if you have money in an IRA that you want to use for healthcare expenses tax-free, you may be able to roll it over to your HSA? As more people realize the power of the health savings account, we are getting more questions about this strategy. Here are the ins and outs of what to consider.

You are able to do a one-time tax-free rollover from a pre-tax/traditional IRA to an HSA if you meet the following conditions:

Some reasons why you would want to do rollover from an IRA to an HSA:

Some reasons why you wouldn’t want to do this:

This is a real-world example of when it might make sense to do a rollover from an IRA to an HSA:

Like most financial decisions, your individual situation determines whether it makes sense to do a rollover from your IRA to your HSA, but in the right situation it can be a really great idea.

One of the most common questions we receive centers around the decision with what to do with your old 401(k). We offer multiple ways to look at whether to stay or move strategically. But once you decide to move the funds from one firm to another, how do you best proceed? Here’s what to know in order to make the process as smooth as possible.

Have you ever seen an old movie, or a film set in the early days of the telephone? The switchboard operator actually had to plug and unplug the hardwire lines to connect calls. This a good metaphor for what happens when you initiate a rollover. You, as the account holder, function as the operator in terms of moving the funds from company to another.

Rolling money over from one account to another is a fairly common practice but here a few things you will want to consider when approaching this process.

First you need to know what paperwork is needed for the money to be released – the best place to find this out is to call your current provider. Do not take anyone else’s word for it. The receiving firm may have a decent idea of what the other firm wants, but there is no way to know for if you do not contact them.

To start, simply ask them what the procedure is to rollover your assets to another provider. That question may get you all the information you need, but before you hang up, make sure you know:

Be prepared that before you’re able to obtain this information that you may be transferred to an account retention department where someone may try to talk you out of your decision. It’s ok to be firm and state that you’ve made up your mind and to please give you the rollover information without further delay.

Once you know what will be required to get the money out, make sure you’re in touch with the company you’ve chosen to receive the money (either your new employer or the IRA company you’ve chosen). This side is likely to be a bit more flexible regarding the manner in which they receive the money from your old account, but here are somethings you will want to discuss with them in order to make the transition smooth:

You will likely also be asked how you want the money to be invested once it’s in your new account. Don’t let this decision delay the process, as you most likely can make changes once the funds are there, but make sure you make some type of selection so the process can be completed.

Once you are clear on what to do from both ends, you can start your switchboard operator magic. It is common to have to sell any mutual funds or other investments in the old account because the new account may not offer the same investment options.

In the case of retirement accounts this tends not be a big deal because there should be no tax ramifications for selling, but be aware as that may change your mind about this whole process. Transferring cash tends to be a simpler process than transferring shares of mutual funds or stocks anyway.

Next:

Hopefully this will help you navigate the steps to a rollover. Depending on your situation, the transaction may be more complex or you may be able skip steps. Also, if you are working with an advisor they can sometimes simplify the process. In either case, lean heavily on each firm to make sure they are both working toward getting your savings to the right place.

The stock market has taken investors on a pretty wild ride over the past several months. It is during these volatile times that we experience a higher number of calls from people who are concerned about their retirement savings and wondering what they should do. My most concerned callers are those who are getting close to retirement. With the bells from the 2008 financial crisis ringing clearly in their heads, they are asking, “What should I do if I retire into a bear market?”

Here are three different strategies to consider that can allow you to still retire when you want to without the market fluctuations (or downturn) affecting your plans or causing you to run out of money sooner than you originally projected.

To use some jargon, this is also called the time-based segmentation approach. With this strategy, you think of your money in 3 hypothetical buckets that are aligned with your spending needs and the time line for those needs. For example:

Bucket 1 (Short-term): This is the money that you anticipate needing to withdraw over the next 3 to 5 years. Most people will put this bucket in cash or in very conservative investments. The idea is that this money is protected from market down turns, while the rest of your investments can have time to recover (aka grow back with the market) before you need to begin withdrawing them.

Bucket 2 (Medium-term): This bucket is the money that you may need within a 5 to 10-year period. Most people would invest this bucket in medium and longer-term fixed income assets such as bonds or bond funds.

Bucket 3 (Long-term): This is basically the rest of your money, which you estimate you won’t need to withdraw for 10 or more years, and therefore what you want to keep growing. You’ll typically use stocks (aka equities) for this bucket, as you’ll have time for this money to recover from any longer-term bear markets and ideally will continue its growth over the years.

My colleague Chris Setter wrote in greater detail about the Bucket Strategy here.

The drawbacks: It can often be difficult to trust the process and not let emotions get in the way. During up markets, you may feel like the cash you set aside is just not working hard enough and that you should take on more risk.

Likewise, during down markets you might start feeling anxious and like you should move your money into cash for safety. Both reactions can hurt you, as it is nearly impossible to time markets and more often than not you will only contribute to a reduction in how long your money will last.

In addition, it can be challenging to manage money you have across different accounts like tax-free, taxable, and tax -deferred accounts as you may want to keep different types of investments in different types of accounts (for example, higher growth in a tax-free account like a Roth so that you can earn tax-free growth, while municipal bonds earning tax-free interest make more sense in a taxable account.)

What can make it work better: Sticking to your plan and having a strategy in place to replenish and reallocate your buckets while being mindful of the type of accounts your assets are invested is the key to success with this strategy.

Consider funding your short-term bucket by using the more conservative short to medium term bonds in your medium-term bucket, as they are typically the assets that will be most stable. To replenish your medium-term bucket, you can take the gains from the assets that have grown in your long-term bucket and reallocate them.

Ideally you are following an appropriate asset allocation strategy based on your goals, time horizon and cash needs, so this should flow into your existing investment process.

With this approach, the goal is to take retirement savings that you need to fund essential expenses (such as housing, healthcare and daily living expenses) and invest them into assets that produce guaranteed income such as annuities. The remaining savings would only be used for discretionary expenses (like travel, non-essential home improvements, etc.) and would remain invested in more growth-oriented vehicles such as stocks.

The drawbacks: The drawback to this method is that some discretionary expenses might actually be considered essential to an individual with a certain retirement lifestyle in mind. If for some reason their discretionary assets did not last, then those individuals might have preferred to continue working until that lifestyle could have been accomplished versus living more frugally in retirement.

What can make it work better: If that’s the case, then maybe think of your savings again in 3 buckets, but with different labels: the Essentials, the Discretionary Non-Negotiables (such as a country club membership), and the truly Discretionary (like taking your whole family on a Disney cruise when times are good, versus just hosting the grandkids at your home when the market is down).

Individuals looking to secure a minimum retirement lifestyle could then place the expenses that are essential and non-negotiable into guaranteed income buckets, and the remaining assets to the truly discretionary items that they would not really miss if push came to shove.

A systematic withdrawal refers to the process of taking money out of your retirement accounts based on regularly scheduled fixed (percentage or dollar) amounts. For example, a popular systematic withdrawal rule is the 4% rule. The idea behind this rule is that you can “safely withdraw” 4% a year from your savings for the duration of your retirement and as long as you stick to that amount or less, you shouldn’t (in theory) run out of money.

The drawbacks: As my colleague Scott points out in his article, the drawbacks include not taking into account the timing at which you retire (for example, a 40% down market) or the various income needs, lifestyle, and family dynamics of individuals. In other words, one size doesn’t fit all, which means there is no guarantee that the 4% rule in and of itself is the best approach for you.

What can make it work better: This approach can work in the above considerations as long as you also build in decision rules around certain triggers that would lead you to take action during certain market events. For example, perhaps you would reduce your withdrawal percentage during down markets, and/or possibly tap into stable and liquid assets (such as a cash savings account) to help meet your needs while allowing the investment assets that have taken a beating some time to recover.

For example, a colleague of mine shares that he plans to keep 3 years of expenses in cash, and when market downturns occur he might reduce his withdrawal to 3% and supplement his needs from his cash reserves.

Since there really isn’t a one size fits all approach, setting up these rules will require thought, foresight and planning.

All of these strategies require you to have an idea of what your annual financial needs will be – use these 5 steps to help determine the retirement income you are aiming for, and then consider consulting with a qualified and unbiased financial planner to help you determine what the best retirement withdrawal approach is for you. They can also help you maintain and update your strategy as you go along.

With proper planning and preparation, anyone can develop a strategy that can outlast the scariest of bear markets, while helping to ensure that your savings can last to infinity and beyond!

Lately, I’ve had a lot of heartbreaking conversations with folks who are working hard to be the best parents that they can be and are really struggling to balance finances and parenting. What I have noticed is that it seems that there are recurring themes of money mistakes that parents make based on their age and stage of life.

As a dad myself, I get it. It is so hard to always be “on” and make the right decision. Perhaps by sharing some of the common mistakes we regularly see, I can help you avoid similar situations.

Some of the most successful people I know had kids at a very young age. I’ve worked with many single parents who heroically balanced work and early parenthood to scratch their way to success. Often, the resilience and time management they learn in the process helps them later.

One super successful friend of mine started his family when he and his wife were 23 and in grad school. Today he is ranked as one of the 50 most influential people in the US in his profession. That said, they are the exceptions. My friend would tell you that the hardest times in his marriage were those years of school, work, parenting and living at the poverty level.

Without unbelievable willpower and a pretty great support system, most people don’t thrive when they start a family before they start the foundation of their career. That doesn’t mean you have to be in your dream job and have tons in the bank – just that you have put yourself on the right path.

My wife and I got married just a few weeks before I turned 23. She was a new nurse and as such, always had the night shift. I was still figuring out what I really wanted to do with my degree, so we decided to wait a few years to have kids. I’m so glad we did – 5 years later when we started our family, we were excited about the idea of having kids instead of worrying about how that would change things because we were both more settled in our careers.

I know that it may sound preachy and that isn’t my intent. But as we published in a recent Society of Actuaries essay – our research, and research of leading think tanks, shows that having a committed partner and a career path before a baby goes a long way towards long-term financial wellness.

The hardest, but sometimes best, thing we can say to our kids is, “No.” However, in today’s crazy culture of over-scheduled kids, we sometimes don’t even let our kids say “No” because we get worried that they will miss out on something. As activities like sports, music, dance, etc. start at younger ages, sometimes we can forget that our kids haven’t even asked us about playing soccer, but here we are signing them up like their futures depend upon it.

I can’t tell you how many friends I have talked to over the years who have said something to the effect of, “When did our kids activities start running every minute of our lives?” Not only does this impact the time you have to spend with your spouse, your family, friends and even your kids – but it is expensive!

My youngest daughter has been involved in cheerleading over the years and one of the things we had to say at one point was that once she got to high school she could no longer do competitive cheer. It just didn’t make sense to pay huge amounts of money for her to do an activity she was already doing at school, which also required us to drive half way across town two or more times a week (not to mention the cost and time of traveling to those competitions).

My daughter’s initial reaction was not good – she didn’t like it at all. But we stood our ground, then discussed how the money could be directed to other things important to her like vacation and her college fund. She eventually calmed down and I’m happy to report that a month or two into high school, she even said how glad she was to not be doing competitive cheer because she didn’t think she could balance that time commitment with everything else.

It’s important to encourage your kids to try new things and discover their passions. But it is perfectly OK to set limits on your monetary and time commitment to anything – especially below the middle school level.

No matter where you get your news, you’re probably seeing the same thing we hear every day in talking with people about finances: student loan debt is financially killing people – students AND parents.

Sometimes student loans are unavoidable. My wife entered college right when her dad’s business hit hard times. She got some grants and worked a ton, but she still had to borrow about 1/3 of the cost of her education. That’s what the program was originally designed for – to get students over the final line.

Somehow over the years, costs have risen faster than incomes and more and more people are borrowing to fill the gap. That said, many people are focused on their “dream school” and not their return on investment for education. All education – from technical training to Harvard Law – is a great opportunity as long as you measure the expense against the benefit.

My oldest daughter is majoring in elementary education. She realized early on that our contribution would cover a state school, but she would have a ton of debt at most private or out of state schools. On a teacher’s salary that didn’t make sense, so she’s heading to a state school.

On the other hand, my youngest wants to major in supply chain management. She only has one in-state option in a new program or two nearby states have highly rated programs. Both of those out of state schools will offer her in-state tuition if she gets the ACT score she’s shooting for. Even if she gets a mediocre score, it would probably only mean borrowing about $10,000 – $14,000 for one of those top programs.

That is probably a good investment for a highly rated program. It’s worth noting that her “dream school” for her major would result in about $75,000 of debt or more. On a standard 10-year repayment that would mean an extra $638 per month for essentially the same degree! Needless to say, it’s not even on her list.

So, when talking to your kids about their post-high school education, don’t focus on the name or the cool campus – come at it from a longer-term perspective by setting a maximum amount of debt that jobs in their major can support and don’t go over that amount. A common rule of thumb is that total student loan debt upon graduation should not exceed the first year’s salary in your major’s field in order for the payments to be affordable. If at all possible, stay well below it!

According to a recent study by Merrill Lynch, American parents are setting aside $250 billion annually for retirement while spending $500 billion per year helping their adult children! Think about that for a minute: using twice as much to help your adult kids as you’re using to help yourself.

According to the study, 79% of parents are helping their adult children and most alarming is that 25% of the time people are dipping into their retirement funds to do so. I get it, we all want our kids to succeed because we love them dearly. But I often describe it to people like what you hear from the flight crew before takeoff: if oxygen masks are deployed, put your own mask on first before assisting anyone else. The same concept applies here.

You don’t have to be independently wealthy to help your kids, but you should run a retirement calculation to make sure that you are on track for retirement and that the help you provide won’t jeopardize that. You also want to make sure that you are not making your kids dependent on you, but instead helping them to become self-sufficient. Then you’ll be able to enjoy knowing that not only are you going to be able to enjoy retirement but that you will be able to see your kids enjoy the help.

The last stage of mistakes I’ve seen parents make is worrying about running out of money – not for themselves but that they won’t be able to leave an inheritance to their kids. Of all the mistakes, this is probably the least frequent, but it is still very real and it makes me sad.

It is disheartening when someone works their whole life and then doesn’t do those “bucket list” things because they are worried about their kids again. What’s worse is that usually when I see this, it’s not a vacation that someone goes without but things that really impact their quality of life – I have seen my own family members not want to spend money on things like hearing aids, medical treatments or making accessible improvements to their homes so that they don’t “spend their kids’ inheritance.”

I don’t have a financial solution for this one but just some advice: Remember that your children and grandchildren love you and want you to be healthy and happy. They would rather see you enjoy the fruits of your labor and maintain your quality of life than get a few extra bucks after you are gone. Believe me, they tell me all the time in my line of work.

Do you feel overwhelmed thinking about retirement planning? It’s one of the most common topics we’re asked about. One way to make it more manageable is to break it down into a series of decisions:

This is the most complex and the most important question. After all, none of the other questions matter if you don’t have enough in retirement savings.

While there are lots of rules of thumb, the actual number depends greatly on your particular situation like your expected retirement expenses, how much you’re projected to receive in Social Security and pension benefits, when you plan to retire, how much you’ve currently saved, and how aggressive an investor you are. Your best bet is to run a retirement calculator that takes these factors into account. If you’re unable to save the amount you need, consider slowly increasing your retirement savings over time (some retirement plans have a contribution rate escalator that will do this for you automatically) and/or adjusting your retirement goals.

First max out any match your employer is offering you. It’s hard to beat a 50% or 100% guaranteed return on your money.

Second, contribute as much as you can to an HSA if you’re eligible. That’s because the money not only goes in tax-free but can be used tax-free for qualified health care expenses, which you’ll almost certainly have in retirement. (This includes select Medicare and qualified long term care insurance premiums.) HSAs can also be used for any purpose penalty-free starting at age 65. That’s why you might also want to avoid tapping into your HSA even for qualified health care expenses and instead invest it to grow for retirement.

Unless you have unique investment options in your employer’s retirement plan that you want to take advantage of, you might want to contribute to an IRA next. That’s because you’ll have more flexibility in how the money is invested (almost anything) and how it can be withdrawn. You can use IRAs penalty-free for qualified education expenses and up to $10k for a first-time home purchase. Roth IRA contributions (but not earnings) can also be withdrawn for any reason without tax or penalty. If your income is too high to contribute to a Roth IRA, here’s a backdoor method.

Then go back and contribute as much as you can to your employer’s retirement plan. (If you have access to a 457, start with that because there’s no early withdrawal penalty.) If you max out your pre-tax and/or Roth contributions, see if you can make after-tax contributions and convert them to a Roth to grow tax-free. Finally, if you’ve maxed out all of the above, other options include cash value life insurance or just a regular taxable account.

You may want to invest in your employer’s retirement plan, an HSA, a Roth IRA, and a taxable account all differently. However, the commonality is to make sure you’re properly diversified according to your time frame and risk tolerance and to minimize costs as much as possible. Then stick with your plan and don’t chase performance or try to time the market. If you take these steps, you’ll find that investing is actually the simplest part of your retirement planning.

You need to consider your options for health insurance before you’re eligible for Medicare at age 65 and for supplementing basic Medicare coverage afterwards. Keep in mind that Medicare and other health insurance policies don’t cover long term care. Medicaid does but it may require you to spend down most of your assets and a growing number of institutions no longer accept it so you may want to consider a long term care insurance policy. Finally, if you’re worried about running out of money in retirement, an income annuity provides you income you can’t outlive.

You’ve spent your whole life building up retirement assets and now you’ve got to decide how to use them. If you can afford to delay Social Security, you may want to do so to allow your retirement and survivor benefits to grow. If you can take a pension as a lump sum, here are some things to consider. Finally, see how much you can safely withdraw from your retirement savings and how to minimize taxes on those withdrawals.

As you can see, there’s a lot involved with retirement planning, but breaking it up into key decisions can help. (You should address the first three questions now, the fourth when you get closer to retirement, and the last in retirement.) If you have more questions or would like to walk through the decisions, you may want to consult with an unbiased financial planner. In any case, make sure you have a plan and continue to monitor and update it periodically. Your future (retired) self will thank you.

Many of us work with two kinds of coworkers – those who say they can’t wait to retire and those who swear they love their jobs so much they plan to die at their desks. I get the first group. Who doesn’t want to retire to a life of leisure without alarm clocks, meetings, conference calls, or commuting in traffic?

The second group, however, I view with a somewhat skeptical eye. Sure, some of us have dream jobs that we can’t wait to dive into every day and we would be very happy working in them until we are simply unable to do so. But when it comes to working past “normal” retirement age (let’s call it 65 since that is when Medicare kicks in for American workers), how many of us are going to work that long because we truly want to, and how many of us are masking the reality that we might actually need to work well into retirement age due to financial reasons?

Even if you are unsure as to which of these two camps you may find yourself, a good first step for all of us is to periodically run a retirement income projection to estimate how much of our pre-retirement income we could potentially replace at retirement time. Knowing how much income we could potentially generate for ourselves in the future across a variety of potential retirement ages can help us plan not only for the retirement lifestyle we prefer, it can also help us plan for the possibility that life may hand us a giant bucket of lemons and force us to retire earlier than expected due to unforeseen events, such as a health issue or a late career downsizing.

If you work with a financial planner, ask him or her to give you an estimate of your future retirement income, or you can use the retirement estimator calculator to do it yourself. You will also want to get an update of your future Social Security retirement benefit amounts from the Social Security Administration at www.ssa.gov.

A major concern among both employers and workers is just how engaged we are likely to be in our work past age 65. Exactly what does it mean to be engaged on the job? According to an Aon Hewitt study, employee engagement describes the level of an employee’s psychological investment in their organization rather than simply showing up and going through the motions to collect a paycheck.

If you truly are engaged in your job, and you love what you do, where you do it, and with whom you do it with, then you are in your happy place career-wise and should certainly keep working as long as you wish. But what if someday you become that less-than-engaged worker, yet you aren’t ready or can’t yet afford to retire? What are your options then?

You could try to hang on longer and maybe find a way to love your currently uninspiring position, but that seems like a disservice to both you and your employer. Instead, you could contemplate a late-career job change to something you do love that engages you more fully. This proposition is not as scary as it may seem. According to the New Careers for Older Workers study conducted by the American Institute for Economic Research (AIER), 82% of survey respondents not only made a successful career change after age 45, but many of them also received higher earnings.

As an alternative, you could also restructure your lifestyle to live on less. This way, you could successfully retire from a job where you’ve lost that lovin’ feeling without prematurely draining your retirement savings.

You’ve inherited an individual retirement account (IRA) – now what? Should you spend that money or save it for later? What are the consequences of either choice? Although there are several rules to follow regarding the method and timing of distributions from inherited IRAs, it is important to understand that distributions from inherited IRAs are not subject to the usual 10% penalty for distributions received before you reach age 59 ½. The IRS rules for distribution of inherited IRA funds are different depending upon several conditions:

If you inherited a traditional IRA from your spouse and were named the sole beneficiary, you may choose any of these options:

If you are named as the beneficiary of an IRA from a parent, grandparent, sibling, aunt/uncle, friend, etc. (aka anyone you weren’t married to when they died) then the rules are different – you may not treat the inherited funds as your own. However, the other options available to a spouse are also available to a non-spouse. A non-spouse traditional IRA beneficiary may:

With the exception of treating the inherited Roth IRA as your own (not an option in this instance), a non-spouse beneficiary of a Roth IRA has the same remaining options as does a spousal beneficiary:

Inheriting an IRA is, of course, a bittersweet occasion where we have to simultaneously deal with the physical and emotional loss of someone we care about and also face some critical financial decisions. For more information and details regarding this important topic, refer to IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs). You might also want to consult with a qualified financial or tax advisor for advice on your particular situation.