In Search Of The ‘Perfect’ Investment

December 07, 2017Do you know what the “perfect” investment would look like? According to a chart in this article of returns for a hypothetical “Mystery Fund” with “perfect returns,” it would have consistent, safe, growth. It turns out that this mystery fund is actually Bernie Madoff’s supposed “returns” to make the point that “if it’s too good to be true, it generally is.”

No such thing

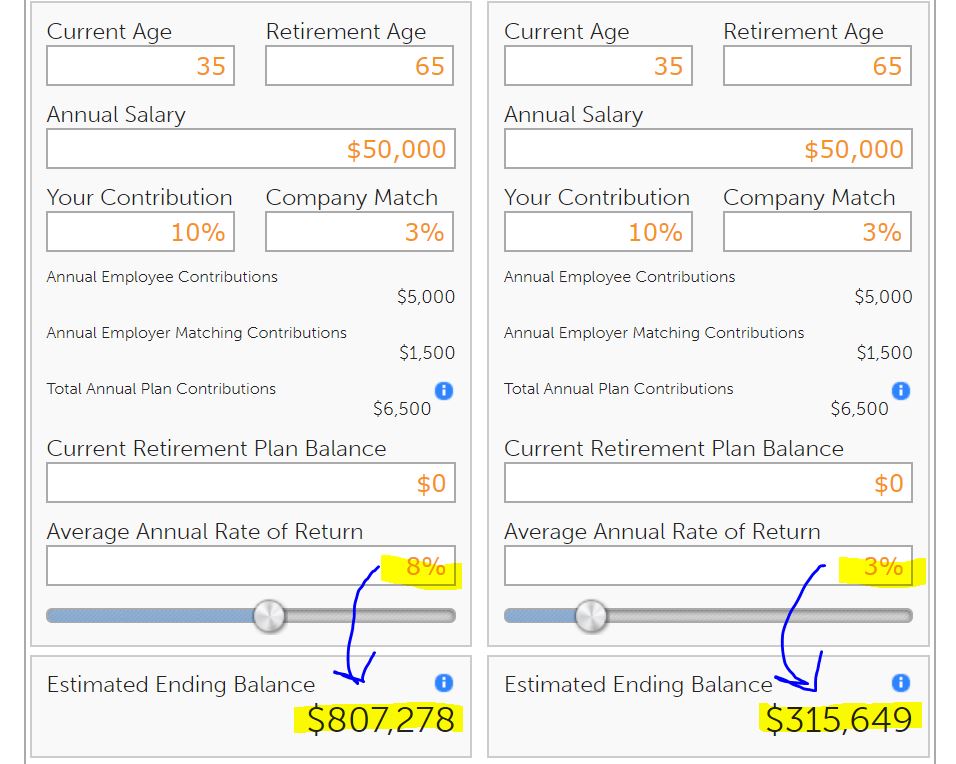

In the real world, there is no investment that offers safe, consistent, high returns like that. Instead, there’s a tradeoff between safety/consistency and long term returns. The “perfect investment” along that spectrum depends largely on your time horizon.

Short term versus long term = different focus, different results

For short term goals, the focus should be on return of principal rather than return on principal. That’s because earning a higher rate of return won’t make a significant difference over just a few years, but a big loss may mean having to delay or underfund your goal. For longer term goals, losses are much more likely to be dwarfed by your gains.

For example, if you earn just 2% in a savings account for 3 years, $10k would only grow to about $10,600. Earning a 10% rate of return (the long term average in the stock market) would give you about $13k – not bad. However, a 40% loss (like in 2008) would leave you with under $8k.

On the other hand, earning 10% over 30 years would mean having over $174k (versus just $18k at a 2% return) and a 40% loss would still leave you with over $100k. While that 40% loss would still sting (and perhaps much more since you’re losing more money), you’d still end up with much more than you would have had with the safe 2% return. The longer your time horizon, the less likely you are to lose your principal.

Of course, this assumes you’re invested in a diversified mix of stocks. An individual stock can go all the way to zero. For that to happen to the stock market as a whole, we’d have to be in something like a nuclear war, an alien invasion, or a zombie apocalypse, in which case your investments are the least of your worries.

Do you really think that’s perfect?

There’s one other thing to keep in mind. I’m not so sure that most investors would actually see the mystery fund in the article as the perfect investment. After all, it trailed the S&P 500 from the mid-1990s to the early 2000s and from around 2006 to 2008. How many investors would have the patience to stick with that long a period of underperformance?

Most of the rest of the time, it simply tracked the market with only a couple of brief periods of outperformance so I’m not sure how many people would have even invested in it in the first place without hearing Madoff’s sales pitch.

Underperformance doesn’t mean unsuccessful

If you define success as consistently beating the market, you’ll never be satisfied. (Even Warren Buffett, arguably the most successful investor in history, has had long periods of underperformance.) You’ll find yourself chasing past performance, buying what’s high and selling when it’s low, which is pretty much the opposite of what you want to try to do.

Instead, you want to pick an investment strategy that matches your time frame and personal comfort with risk. Then stick with it! When it comes to investing, the “perfect” can truly be the enemy of the good.

Want more helpful financial guidance, delivered every day? Sign up to receive the Financial Finesse Tip of the Day, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.