Should You Use The Brokerage Window In Your 401(k)?

July 27, 2018Are you a hands-on investor seeking investments beyond your 401(k) plan’s core list of investment choices? If so, you may have an option available in your retirement plan at work that most retirement savers aren’t aware of – the self-directed brokerage account (SDBA). This “brokerage window” option available in some retirement plans gives participants the ability to invest in mutual funds, exchange-traded funds (ETFs) and in some cases individual stocks and bonds.

Who typically uses a self-directed brokerage account in a 401(k) plan?

According to Aon Hewitt, approximately 40% of employers offer self-directed brokerage account options, but participation rates remain low. Aon Hewitt found that only around 3 to 4 percent of retirement plan participants with access to SDBAs actually use this self-directed option.

The SDBA option has generally been more popular among retirement savers who have larger retirement plan balances or who work with an outside financial advisor. For example, Schwab recently reported that the average account balance of those using this option is just over $260,000. Compare this to Fidelity’s reported average balance of all 401(k) participants, which is just under $100,000.

What does a self-directed brokerage account offer?

The main benefit is that SDBAs give you more flexibility when it comes to the investment options available. Access to a wider range of investment choices than the default ones presented in your plan can be a refreshing alternative if you are generally unhappy with the investment options available in your plan.

For example, if your 401(k) plan does not include access to target date funds or asset allocation funds, you can use the SDBA to add this fund to your retirement portfolio. This can also be appealing if you are simply using the self-directed windows to gain access to asset classes not represented in your core investment lineup such as emerging market stocks, international small cap, and value or growth-oriented funds. SDBAs can even help you diversify with alternative asset classes such as real estate and commodities.

Beware of the paralysis of too many choices

But as behavioral finance studies on the paradox of choice have shown us, too many options can hinder participation rates in 401(k) plans. Choosing the right investments for your goals, risk tolerance, and time horizon also requires discipline. Most investors lack a written game plan or investment policy statement. As a result, many individual investors are prone to the “behavior gap” and underperform the actual funds they own due to mistakes related to emotional decision-making and market timing.

Self-directed brokerage accounts are designed for advanced investors who know how to research and manage their investments. FINRA warns investors that the additional choices commonly associated with self-directed accounts require additional responsibilities. In order to follow a disciplined investment plan, you can start by focusing on things within your control such as asset allocation, contribution rates, minimizing costs, and asset location (i.e., pre-tax vs. Roth 401(k)).

Pay attention to the fees

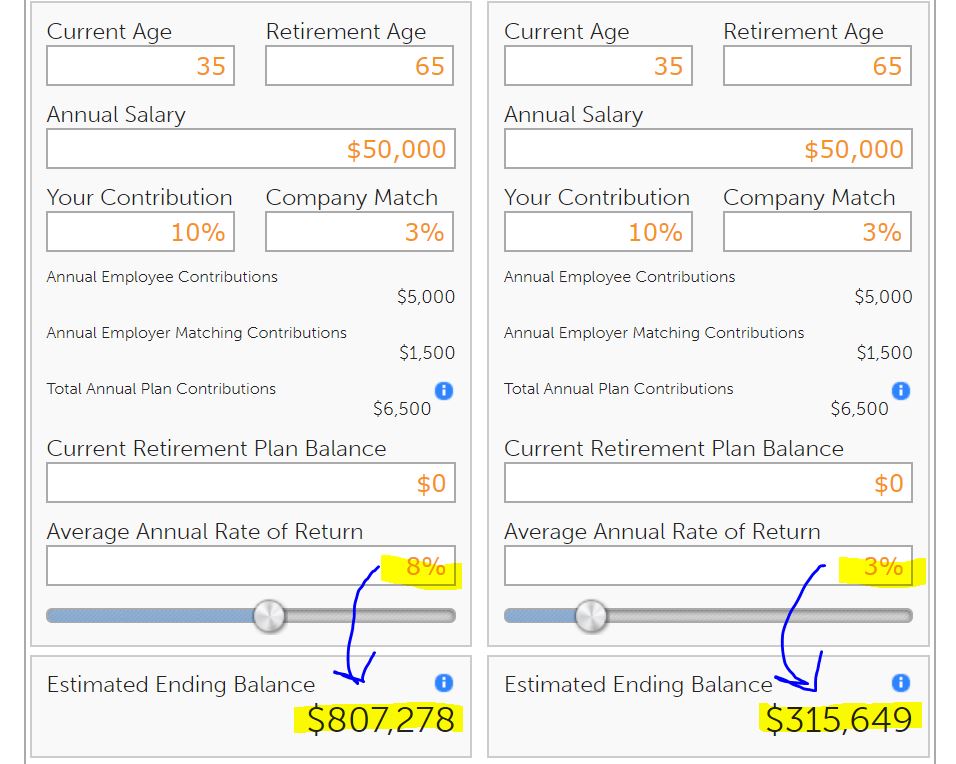

Minimizing your overall investment costs is one thing you have some control over as an investor. That’s why it is just as important to understand all fees and expenses associated with a self-directed brokerage account as it is to know your core 401(k) plan expenses.

Some 401(k) plans charge an annual maintenance fee for using the mutual fund or brokerage window. It is also necessary to identify if there are any commissions and transaction costs associated with trades made through SDBA accounts. You can check your plan’s fee disclosure to better understand the actual costs related to your 401(k) plan.

Check mutual fund expenses

In some cases, you may also see an increase in mutual fund expenses when you go outside your core investment options. This is because most funds available in the SDBA are retail share classes which tend to be much more expensive than the institutional funds many large retirement plans provide access. On the other hand, if your 401(k) plan has expensive mutual funds, the self-directed brokerage account is a potential remedy.

How does its performance compare?

Finally, it is important to note that there is a reason self-directed brokerage accounts are underutilized. The average investor is often better served simplifying their investments as much as possible. That is why it is important to establish benchmarks to track your performance.

Self-directed brokerage accounts give you an opportunity to try to outperform or diversify your plan’s core options. But if you choose to take the self-direct route and find that your investment performance consistently lags the core investment portfolio, you may need to take a simpler approach to your retirement savings plan.

A version of this post was originally published on Forbes.