The DIY Financial Checkup

August 08, 2016

When is the last time you had a financial checkup? Just like physical exams, regular financial exams lead to better overall financial health. While you can’t give yourself a thorough doctor’s exam, you can give yourself a comprehensive financial checkup with today’s abundance of useful online financial planning tools.

The first step in your diagnosis is to get all your important information organized in a central place. Some of this may be in paper form and some of it online. Gather these resources in advance so you have them on hand:

-your employee benefits such as retirement accounts, health/dental/vision insurance, disability insurance, HSA account, flexible spending accounts, commuter accounts, etc.

-the last month’s bank and brokerage account statements, including taxable accounts, IRAs and annuities

-a recent paycheck and your W4 (YTD cash flow statement if you are self-employed)

-estate planning documents, e.g., will, trust, power of attorney, healthcare directive

-additional insurance policies, e.g., homeowner’s, auto, umbrella liability, life, disability

-mortgage statement

-credit card statements, student loans, car loans, etc.

-financial plan, if you have one

-your budget, if you have one

What’s your financial position?

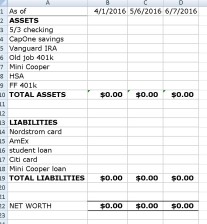

Pull together a summary of everything you own and everything you owe. (Download an easy net worth and budget worksheet here.) Subtract what you owe from what you own. That’s called your “net worth.”

Is your net worth positive or negative? Has it increased or decreased since the last time you calculated it and by what percentage? As my fellow planner Kelley Long says, “Your net worth is the ultimate measure of your ability to weather financial storms and maintain financial choices in life. The higher your net worth, the more financial freedom you can afford.”

Next, calculate your debt to income ratio by dividing your monthly gross pay by your total monthly recurring debt payments (mortgage, credit cards, student loans, car loans, etc.) The lower your debt to income ratio is, the better your financial position. FYI, mortgage lenders often look for a total debt to income ratio of no more than 36% of gross income.

Do you have sufficient cash reserves?

According to our 2016 Financial Stress Research, good cash management is the biggest differentiator between those workers who have no financial stress and those who have overwhelming financial stress. The foundation of cash management is a solid emergency fund to deal with inevitable unexpected events that happen to all of us. While the common guidance is to have at least three to six months in living expenses in savings or money market funds, it’s also important to make sure you have enough additional cash on hand to handle health, auto and property insurance deductibles as well as home and auto repairs. Bankrate.com has a helpful emergency savings calculator to figure out exactly how much you should keep in liquid savings. If your emergency fund could use some work, use this daily savings calculator to figure out how small savings, like $5 or $10 per day, can add up to a big cash cushion over time.

Could you survive a financial earthquake?

The purpose of insurance is to protect you and your family against catastrophic loss. The big idea behind insurance is that people pool their risks of catastrophic events. If you do suffer a loss and are adequately insured against it, you can be restored to your financial position before the loss. Do you have the insurance you need? Here are some guidelines for determining if you are sufficiently covered:

Health insurance – Everyone needs it, no excuses. If you don’t have health insurance, get it right away.

Disability income insurance – How would you pay the bills if you couldn’t work due to injury or illness? Many employers offer short and long term disability insurance. Make sure you take advantage of them during your next open enrollment period. This is particularly important if you are single or if you are the sole breadwinner in the family. To determine how much coverage you need and whether a supplemental policy is in order, use this calculator.

Life insurance – If someone else depends on your income for their living expenses, you need life insurance. There are different methods for determining how much insurance is ideal. For most people, the less expensive term insurance meets their needs. Use this calculator or download this worksheet to see if your coverage fits your situation. Subtract the coverage provided by your employer to determine what you need to purchase on your own.

Homeowner’s insurance – Per the Wall Street Journal, your homeowner’s insurance should provide enough to rebuild and furnish your home if it were wiped off the map. Does your policy reflect the current value of your home, any improvements you have made to it plus the cost to replace its contents? Basic homeowner’s policies do not cover you for things like floods and earthquakes. If those are common in your region, you may need to add specific coverage.

Renter’s insurance – Not a homeowner? When I was a young professional in Washington, D.C., my apartment was burglarized twice. Only then did I purchase renter’s insurance. Renter’s insurance covers the value of the stuff in your apartment that belongs to you like furniture, clothing and electronics. If the value of all those items exceeds the insurance deductible, consider renter’s insurance to cover your valuables.

Umbrella liability insurance – According to fellow planner Scott Spann, most people facing a judgment from civil litigation probably assume that their homeowner’s or auto policy would cover them. Low cost umbrella liability coverage provides an additional layer of protection in the case of a civil lawsuit. Consider policy coverage that is at least twice your net worth – more if you are a high earner.

Are you on track to replace 80% of your income in retirement?

Running a retirement calculator is like stepping on a scale. It is best done regularly in order to compare your results to your goal. Download our easy to use retirement estimator here.

While you may have run retirement estimates before, results can change depending on economic conditions. Review and update your assumptions about your savings rate, inflation and rate of return. For example, a recent report from McKinsey and Company suggests that investors may need to lower their sights, projecting that U.S. stock market returns over the next two decades could be between 4 and 6.5% annually.

If you’re not on track, what can you do to increase your retirement savings? Can you increase your contributions to a 401(k) or other employer-sponsored plan? Sign up for the contribution rate escalator. Contribute to a Roth or traditional IRA. According to our CEO, Liz Davidson, you can set yourself up for success by automating a process that would otherwise require a lot of effort and sacrifice.

How are you handling your taxes?

Did you get a big refund or owe a large sum on your most recent tax return? It may be time to adjust your withholding. This IRS withholding calculator can help you figure out the right number of allowances to claim. Additionally, are you taking full advantage of tax-deferred retirement accounts, your health savings account, and flexible spending accounts? Make a list of what you need to change during your next open enrollment period.

Do your investments fit your situation?

Do you have a written plan to guide your investing decisions? If not, consider putting together an investment policy statement using this easy guide. Start by updating your risk tolerance by downloading this worksheet.

Has anything changed with your willingness or ability to take investment risk, your time horizon or your required rate of return? What about your inflation expectations or the kind of investments you are willing to make? Evaluate your current portfolio to see if it meets your updated goals and make changes if it doesn’t.

How much do your investments cost you in fees? Calculate your fees both as a flat dollar amount and as a percentage of your portfolio. Do you think you are getting your money’s worth?

Hint: if they are higher than 1%, consider changing brokerage firms or moving to lower fee alternatives such as index funds. Thinking about doing it yourself? Check out this blog post from fellow planner Erik Carter on how to save and invest on your own without getting eaten alive.

What happens to all this when you die?

Has anything changed since you first put together your estate plan? Take a look at all your retirement accounts and insurance policies and make sure your beneficiary designations reflect your current situation. Second, review your will and other estate planning documents such as a living trust, durable power of attorney, healthcare directive and guardianship provisions. Are the documents current and reflective of your wishes? What needs to be brought up-to-date?

Don’t have an estate plan? Follow these simple seven steps. Even if you do have a current estate plan, you may still need to develop a digital estate plan to express your wishes about what happens to your digital life.

Did you give yourself a financial checkup? How did it work out? Let me know by emailing me at [email protected]