Here’s What To Think About When Deciding What To Do With Your Old 401k

April 11, 2025If you have an old 401(k) account from an old job (or maybe even 2 or 3), you’re not alone – the number of people that work (or plan to work) for the same company for their entire career continues to shrink and that trend appears likely to continue. That doesn’t mean you shouldn’t be taking advantage of the opportunity to save in a tax-advantaged way through payroll deductions at each job. It just means you could have one more loose end to tie up when you switch jobs.

There are several options for your old 401(k) money – for some people the answer may be obvious, but for others a bit more nuanced. Let’s take a look at those options, along with the pros and cons of each to see which makes the most sense for you.

Option 1: Leave the account where it is

Many companies will allow you to keep your retirement savings in their plans after you leave your job (although most require your balance to be above a minimum level, typically $5,000). If you haven’t taken any action yet because you are deciding what to do next, this “default” option may work out fine as there are some good reasons to leave your account right where it is. The good news is that you can always change your mind and move it at a later time.

Reasons you’d choose this option:

- Separation of service rules: If you leave your job in or after the year you turn 55, you are able to take withdrawals from your current 401(k) account without penalty prior to reaching age 59 ½, which is the normal age to access retirement savings without penalty.

- Investment options: If you like the investment options within your former employer’s plan, you can stick with that familiarity. In some cases, that plan may offer unique investment options that you may not be able to hold in an IRA or your current job’s plan.

- Lower costs: Many large employer-sponsored plans offer low-cost institutional share class mutual funds and index funds, which are generally less expensive to own than what’s available in individual accounts. While saving 0.5% each year on mutual fund expenses may not sound like much, it can really add up over a long period of time.

The thing to look out for:

- Some employers opt to stop covering specific administrative fees for the accounts of former employees, so keep your eye on your statements after you’ve left, and if you start seeing a fee, that would be a reason to explore options 2 or 3.

Option 2: Roll it into your new employer’s plan

Rolling your account into the 401(k) plan with your new employer likely includes the same benefits as keeping it with the old plan. However, old retirement accounts are often neglected over time since you are no longer making contributions to the plan. Rolling (or transferring) the money into the new plan can offer some additional advantages as well.

Reasons you’d choose this option:

- Simplicity: Having all your retirement savings together in your new plan could make it easier to track your progress while having everything under one log-in.

- Ability to borrow: While borrowing from your retirement plan while still working is not usually recommended, many plans allow you to take 401(k) loans. Often this loan has a reasonable interest rate, and you pay the interest back to yourself, not the employer or 401(k) company. Rolling your old plan into your new one can give you a larger base from which to borrow should the need arise. Be careful though! Borrowing from your 401(k) comes with risk to your retirement and must be considered very carefully.

It should be noted that you will want to do this as a direct rollover, moving money directly from plan to plan. This makes your life easier by completing the rollover while also making sure the move does not become taxable.

Option 3: Roll over to an Individual Retirement Account (IRA)

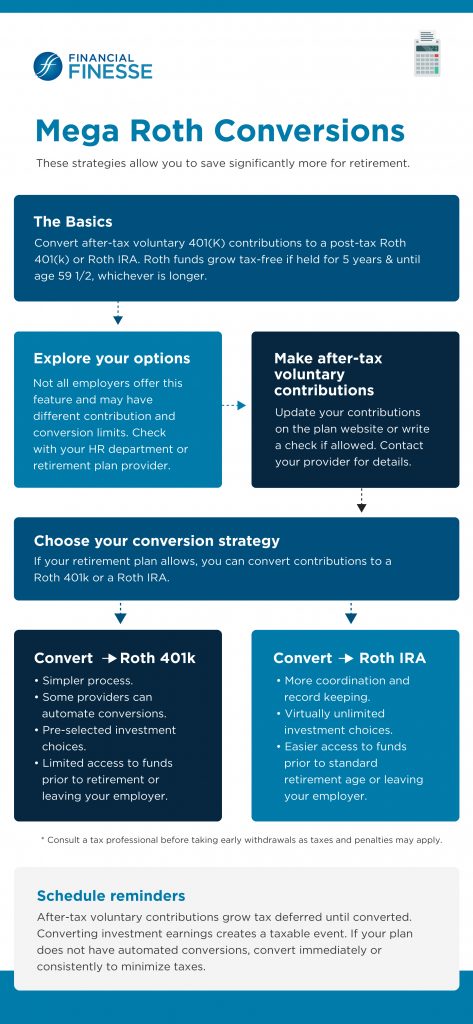

Much like moving the funds to your new employer’s plan, you can instead roll the money directly into an IRA. The pre-tax money would be deposited into a traditional rollover IRA and Roth funds into a Roth IRA. Alternatively, you could roll pre-tax money into a Roth IRA, though it’s important to consider that rollover conversions of pre-tax money are taxed as income.

Reasons you’d choose this option:

- Control: This option allows you to have the account at the financial institution of your choice. Many people like this idea as they feel they have more control of the funds and may have a larger selection of investment options beyond the limited menu of choices their employer’s plan may offer.

Reasons to NOT choose this option:

- No separation of service rules: Once you move your money out of your 401(k) and into an IRA, you lose the ability to access the funds penalty-free if you left your job at or after age 55 – you’d have to wait until 59 ½.

- Possible higher costs: Unless you work for a very small company with a limited 401(k) plan, your costs are likely to be higher overall with an IRA than with an employer-sponsored plan that can take advantage of institutional pricing.

- The pro-rata rule for pre-tax IRAs: If you’ve ever considered using the “back-door” Roth IRA strategy, be aware that the presence of a pre-tax IRA can trigger tax consequences due to the pro-rata rule. Make sure you’re clear on how that works if you anticipate a higher income along with a desire to continue saving into a Roth IRA.

Option you should avoid unless absolutely necessary: Taking the money as a cash distribution

This is the least appealing option and should only be considered in the most extreme cases of financial hardship. Cash distributions are fully taxable and may be subject to a 10% penalty if you are under age 59 ½. This option is especially tempting when you have a small balance, but do your best to avoid it. Those small amounts add up!

So, if you are considering a job change – or have already made a change – consider all of your options in terms of the retirement account(s) you have left behind. And remember, you have time to make this decision, assuming your account balance exceeds the minimum rules.