What Losing 30 Pounds Taught Me About Achieving Goals

January 04, 2018Last week, I wrote about setting goals. Let’s face it. That’s the easy part. What about actually achieving them?

Losing 30 pounds last year

Two of the most common topics for New Year’s resolutions are weight loss and finances. At the beginning of last year, I set a goal to go from 222 pounds to 185 pounds and 8-10% body fat. I knew this would be a stretch goal but also doable because that’s what I was about 10 years ago. I haven’t quite hit my goal yet, but I have lost 30 pounds to get to 192 and 11% body fat. Here’s what I learned along the way and how it can apply to achieving financial goals:

1. Track your progress. Measuring my weight every day was probably the most important factor for me in staying motivated. If the number went down, I was encouraged to keep going. If the number went up, I was jolted back on track.

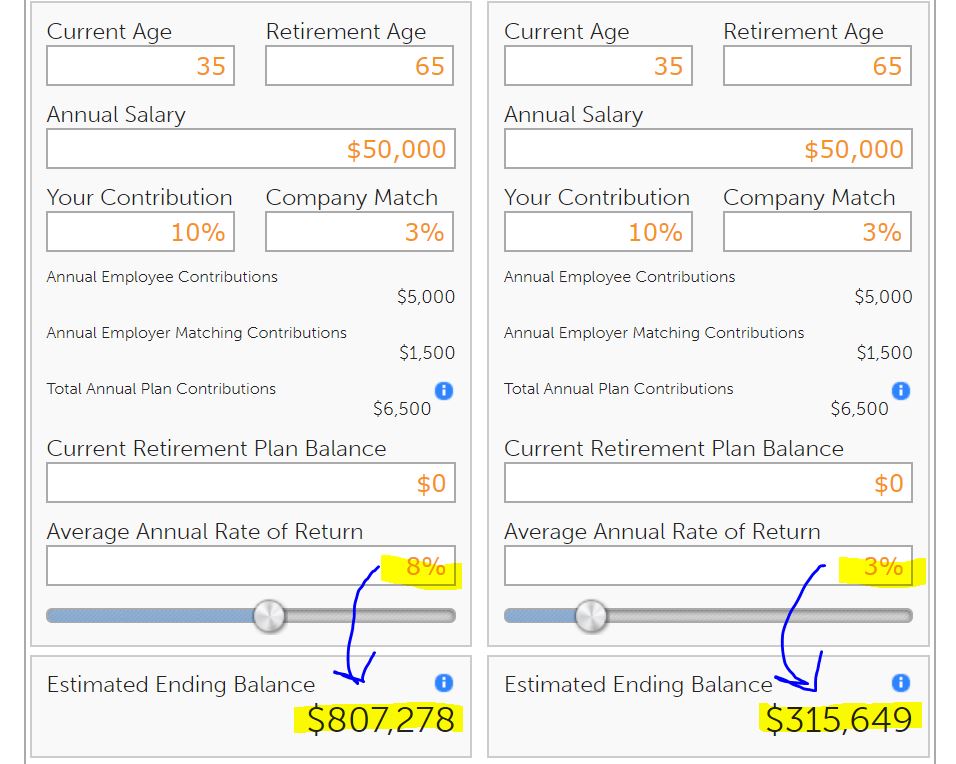

Find similar ways to measure your financial progress. It could be your debt or savings levels, credit score, retirement projections, or overall financial wellness. (Just realize that many of these financial metrics require a longer time interval to see progress than my daily weigh ins.)

I realize that weight isn’t the best metric for measuring fitness. (I also did more comprehensive full body composition tests at my gym every couple of weeks) However, it was the only one I could measure every day, which was important for my motivation. Something is often better than nothing. This bring me to…

2. Don’t make the perfect the enemy of the good. This can happen in several ways. If you’re like me, you may find yourself paralyzed into inaction by analysis paralysis of the “perfect” diet and exercise routine. When you inevitably fall off the horse, you may also feel discouraged to keep going. I had to accept that pursuing “perfection” is an ongoing process with many ups and downs and the key was to focus on doing the best I could at the time.

Your financial progress will likely be the same way. You will have unexpected expenses that will bust your budget. Your investments will decline from time to time. There will be moments when you make financial decisions you regret. Just stay focused on what you can do now to get back on track.

3. Get help. About halfway through the year, I hit a plateau and decided to join a boot camp style gym. I quickly discovered that my previous workouts weren’t as diverse and my form often needed correcting. I also found myself enjoying the workouts more and probably pushed myself harder than I would have on my own. As a result, I started making progress again.

A good financial planner can be like a personal trainer for your money. They can help you set reasonable goals and find the best way to accomplish them. At the very least, they can help hold you accountable for doing what you know you should do anyway.

Like hiring a personal trainer, a financial planner can be expensive. Many also sell overpriced financial products and services like the many dubious supplements and exercise gadgets out there. Fortunately, financial wellness is becoming as common an employee benefit as physical wellness programs. See if your workplace offers access to free financial education and guidance through an unbiased workplace financial wellness program.

4. Do what works for you. I read a lot about diet and exercise and talked to several friends about what they did. But in the end, everyone is different. Through trial and error (see #1 and #2 above), I had to find the right balance between doing the “right things” and what I could actually tolerate/stick with. For example, I try to be super strict with my diet during the day so I can be a bit looser (but still within reason) when I go out on evenings, weekends, holidays, and vacations.

Just like the best exercise or diet is the one you’ll actually do, the same is true for the best money management strategy. Experiment with different ways to manage your money and then make adjustments. (This is why measuring your progress is so important.) Some people keep detailed spreadsheets of their spending, some use apps like Mint, and some give themselves a fixed cash allowance. They’re all different paths to the same place.

Every day is a new day

Whether your resolution for 2018 is to pay off debt, save more or simply be more mindful of spending, I wish you much success. Be kind to yourself and remember that even if you fall away from your intentions, each day is a new day to start again.

Happy New Year!

Want more helpful financial guidance, delivered every day? Sign up to receive the Financial Finesse Tip of the Day, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.