The Skinny On The Latest Tax Reform Package – Should You Worry?

November 03, 2017

You’re likely to see lots of headlines in the coming weeks about the tax reform package that Congress will be hashing out, which many are calling the biggest tax overhaul in 30 years. Time will tell if that’s true and should a new tax law be passed, chances are it will look much different from what has been put forth so far.

I personally tend not to worry too much about this stuff until it’s actually law, but I know not everyone works like that, so here are the highlights of what’s being proposed and whether or not you should worry about it.

Mortgage interest deduction

What’s being proposed: A limit on the amount of interest you can deduct.

Should you worry? The limit applies to interest paid on NEW mortgages bigger than $500,000, so if you currently have a mortgage that’s larger than $500k, you’re good. If you were to take out a mortgage in the future that is higher than $500k, you’ll still be able to deduct interest, the amount would just be capped at the interest on the first $500k.

FYI, the current law caps the deduction at $1 million worth of mortgage debt.

Student loan interest deduction

What’s being proposed: Eliminating the deduction altogether.

Should you worry? If you currently have adjusted gross income over $80k ($160k if you’re married), then you already miss out on this deduction. If you’re just starting out in your career and paying down big loans, yes, this could affect your taxes. Depending on your tax bracket and total interest paid, this could cost you up to $625 in taxes. (keep reading though, this could be made up for with other changes)

Want to figure out more closely what it would cost you? Here’s how:

If you’re single and you make more than roughly $37k per year, then take the amount of student loan interest you actually paid (you can find this by logging into your loan service provider) and multiply it by .25. That’s about the amount you save on taxes with this deduction. Same process if you’re married and make more than about $75k combined.

If you make less than those thresholds, then just multiply your interest by .15 to get your number.

State and local tax deduction

What’s being proposed: A limit on the amount of state and local taxes you can deduct, including property taxes.

Should you worry? If you pay more than $10,000 per year in combined property and state income taxes, you could see your taxable income rise should this provision pass. The good news is that there are some powerful Republicans from states with the highest income tax rates who are likely to fight this on behalf of their over-taxed constituents. The fact that next year is an election year will play to your favor if this is an important deduction to you.

Alimony and moving expense deduction

What’s being proposed: Eliminating the deduction altogether.

Should you worry? If you pay alimony or were counting on a tax deduction to help fund a work-related move, then yes, you should worry. If you receive alimony, this will actually help you because you would no longer have to claim it as income.

Medical expense deduction

What’s being proposed: Eliminating the deduction altogether.

Should you worry? Most working people with decent insurance coverage aren’t able to deduct out of pocket medical expenses anyway, due to the law requiring that expenses must exceed 10% of your adjusted gross income before you can deduct it. Older Americans (who have a lower threshold and likely higher expenses), however, may suffer with this provision.

Is there any good news?

One of the goals of this package is to simplify the tax code, which is why a lot of deductions are going away. To make up for that, there are some positive changes proposed as well.

One thing that could help, especially for people who don’t itemize (and therefore don’t care about the mortgage and other tax deduction loss) is that the standard deduction is slated to practically double to $12,000 for individuals (currently $6,350) and $24,000 for families (currently $12,700). In other words, if you’re worried about losing your student loan interest deduction, the loss could more than be made up for by this larger deduction. The proposal also includes lower tax brackets for most of us, which is also good news.

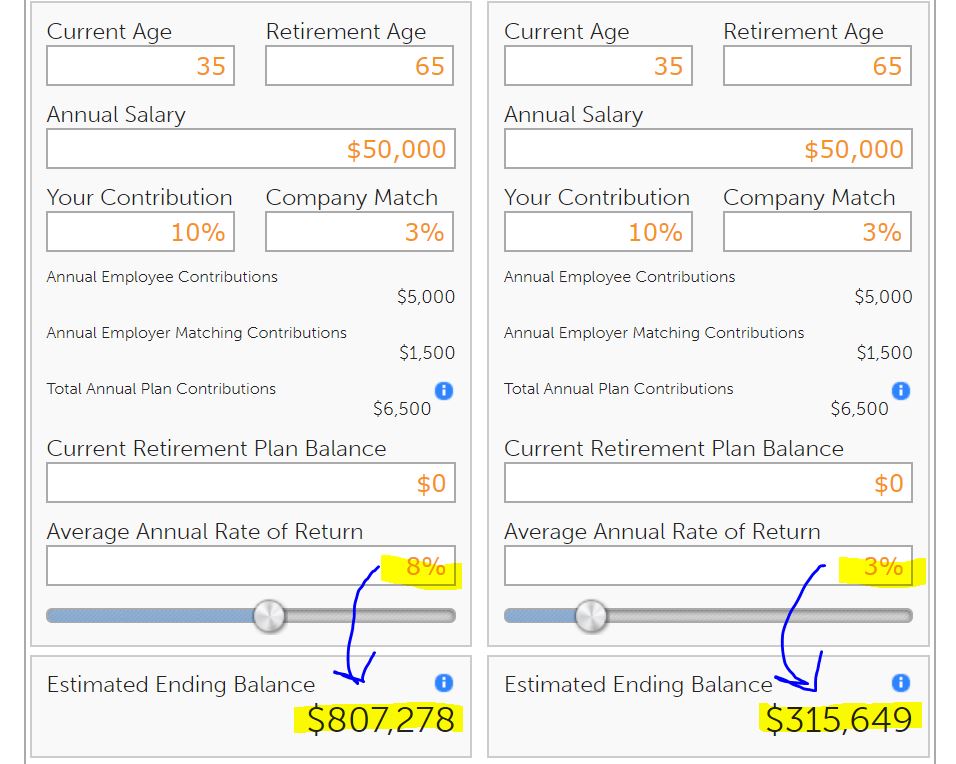

One thing that wasn’t included, that many people thought was on the chopping block, are changes to the treatment of 401k contributions. Unless something gets slipped back into the final package, we can continue to contribute up to $18,000 in pre-tax money plus an additional $6,000 if you’re 50 or older. Even better news, that limit is getting bumped up to $18,500 for 2018.

“Worrying is like paying interest on a debt that never comes due”

The best thing you can do at this point to help your situation would be to let your congressional representatives know how you feel about these proposals. There will likely be organized efforts around some of these issues, so join in if it’s important to you.

There are obviously lots of other changes proposed in the proposed law that our representatives in Congress are working on, but those are the ones most likely to cause confusion and/or directly affect many of us “everyday” working folks. Time will tell what the final result will be. If I had to wager a guess, I’d say we probably won’t know much before Santa starts making his rounds.

Want more helpful financial guidance, delivered every day? Sign up to receive the Financial Finesse Tip of the Day, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.