Would You Go Carless?

June 23, 2016About 4 months I ago, I finally got rid of my 1995 BMW 325ic. I always knew that day would arrive and in many ways, it happened in the best way possible. Instead of breaking down in the middle of the highway or slowly eating away my bank account in small repairs, it simple failed the CA smog test and would have cost me more to repair than the car was worth. Since I couldn’t legally drive it, and it made no financial sense to fix it, my decision was easy. I sold it to a mechanic I met as my Uber driver and decided to go carless.

As with getting rid of cable TV, I’ve never regretted it. (The fact that I’m thinking of moving back to NYC helped too.) But kids, before you try this at home, here are several things you’ll want to ask yourself:

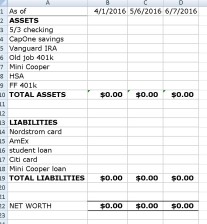

How much does you car really cost you? It’s not just the car payment. Think about the cost of insurance, gas, and maintenance and repairs too. I bought mine in cash so I didn’t have a payment, didn’t drive much, and had a no-frills high-deductible insurance plan. However, I still spent about $85 a month in gas and $35 a month in insurance plus a decent amount in repairs each year.

What’s your life like? What’s your commute to work? Where do you tend to go?

In my case, there are several reasons why I don’t drive much and am able to get along well without a car. When I’m not traveling, I work from home so there’s no need for a commute. I also live in a neighborhood in which I can walk to 3 grocery stores, countless restaurants of every cuisine you can imagine, and even my doctor, dentist, and eye doctor. Your mileage (pun intended) may vary.

How will you get around without a car? We all need to go places that aren’t walkable from time to time. Do you have a spouse with a car? How is public transportation in your area? What other options do you have?

My girlfriend has a car, but I can’t always rely on that. San Diego is also notorious for not having the best public transportation system so I tend to use Car2Go and ride sharing apps like Lyft and Uber. Car2Go allows you to rent little smart cars (gas and insurance included) for short trips and is generally the cheapest option if you park it in a home area (generally urban areas of major cities). If you’re not in a rush, you can also minimize the cost of Lyft and Uber rides by choosing the Lyft Line and Uber Pool options, which give you a lower rate in exchange for possibly having to share your ride with other people going in the same general direction. This is particularly beneficial in longer, more expensive rides as it can cut the cost almost in half (a recent ride went from about $26 to $16) and I’ve only had to share a ride a couple of times.

The best rewards of being carless aren’t financial though. It’s the lack of stress worrying about navigating through traffic (versus playing on my phone as a passenger), looking for parking, and dealing with car problems. Knowing you’re doing your part to literally save the world doesn’t hurt either.