Do You Really Need Long Term Care Insurance?

February 16, 2018Long term care (LTC) insurance can be an important part of retirement planning and one that many of us postpone doing anything about because, well, it is depressing to think about. It is also a complicated insurance product. And there is the added expense, of course. Thinking about it might make you feel a little bit like Goldilocks: Too much or too little? Too early or too late? Too expensive or too cheap? Given so many convenient and seemingly built-in excuses to put off making this decision, no wonder few people are eager to tackle this part of one’s financial plan.

First of all, do you even need it?

Perhaps a good question to start with is: Do you actually need this insurance? If so, when is the best time to buy it? Purchase it too young and you spend years paying into something you very likely won’t use or sacrificing dollars that could have been spent elsewhere. Buy it too late, and it might be incredibly expensive or even unobtainable. Surely, there must be something resembling a Goldilocks type of solution to buying just the right amount of coverage at just the right time?

When to buy LTC

As with life insurance, LTC insurance premiums tend to be lower during our younger, healthier years. However, that means paying those premiums for many years during which we are statistically unlikely to need the type of care we are insuring. Most of the quoted statistics regarding nursing home care (whether provided by family members or in an actual nursing home) focus on age 65. For instance, 68% is the probability that individuals age 65 or older will begin to suffer from cognitive or physical impairment that would lead to using their long-term care insurance.

The best age to buy

Does this suggest we should all wait until our 65th birthdays to buy LTC insurance? Unfortunately, that could be an expensive mistake. Given the odds of needing it go up quite a bit after 65, so does the cost of the insurance. Instead, the sweet spot for buying long term care insurance may lie somewhere between ages 55 and 60 for many people.

Your gender and marital status matter too

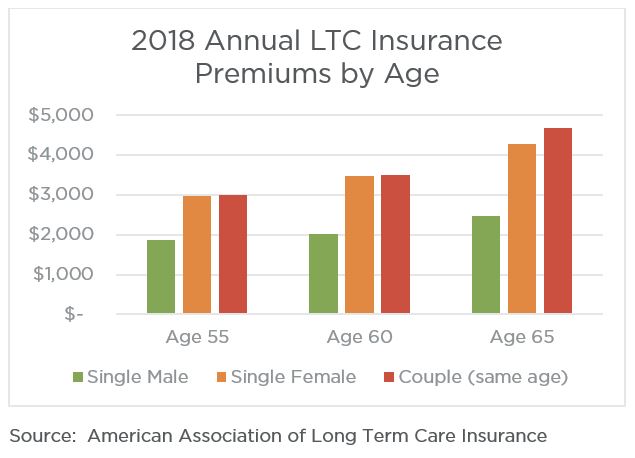

According to a 2018 price analysis, typical insurance costs for singles and marrieds can vary considerably between ages 55 and 65. Among single males, the cost increases only slightly between 55 and 60. However, after age 55, the cost begins to jump considerably for women and married couples.

The other determining factor

In addition to your age and health status, another consideration for purchasing long-term care insurance is your relative level of wealth. Generally speaking, many financial professionals suggest that those with a net worth of less than $200,000 may be better off skipping the LTC insurance altogether. The same can be said for people with a net worth in excess of $2 million or so.

People on the lower end of that spectrum likely would be able to qualify for Medicaid fairly quickly if they enter a nursing home, and those who are wealthier could self-insure (aka just pay out of pocket should the need arise), rather than pay for coverage they may never need.

You still may not need it

What if your net worth lies somewhere in between $200,000 and $2 million or more? That doesn’t suggest you rush right out and buy a LTC insurance policy, either. According to a recent study conducted by the Center for Retirement Research (CRR) at Boston College, previous assumptions about how many people actually need LTC insurance may have been significantly overstated. These new insights are based on a fresh look at how long people actually spend in nursing home care and assumptions about how Medicare (not to be confused with Medicaid) plays a role in LTC health coverage.

Don’t count out Medicare

Although it is widely assumed that Medicare will not cover nursing home costs (a “fact” some insurance sales people seem to enjoy touting), this is not entirely true. Medicare can actually pay for up to 100 days of care in a skilled nursing facility or long term care hospital following a hospital stay of at least three days. Although Medicare does not pay for care related to chronic (permanent) conditions such as dementia, it can cover a limited amount of long term care services related to conditions from which you are expected to recover (e.g., following surgery).

Consider how long your stay might be

While it is true that 44% of men and 58% of women may ever use a nursing facility, the CRR also reports that the average duration for these stays tends to be relatively short. The average stay for men is around 11 months and just under 1.5 years for women. Given the relatively short average stay and the availability of Medicare to cover what could be a significant portion of that stay, the CRR further concluded that purchasing LTC insurance actually made economic sense for only about 25% of consumers (19% of men and 31% of women).

There is more to the LTC insurance decision than the numbers, of course. Your specific financial situation, family dynamics, personal priorities, family health history, etc. all blend together to help shape your individual decision. However, it’s a good idea to consider all of the factors when deciding whether or not and when to purchase coverage.

Want more helpful financial guidance, delivered directly to your inbox? Sign up to receive our posts, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.