Should You Care About a Mutual Fund’s Past Performance?

February 08, 2017The primary reason that investors choose to subject their hard-earned savings to the ups and downs of the stock market is that history has shown that over long periods of time, it’s one of the best ways to grow your savings in order to outpace inflation and maintain purchasing power. One of the biggest investing mistakes I see though is what we call “performance chasing” or making investment choices based solely on the past performance of a particular investment. I’d argue that past performance is actually the last criteria anyone should consider when deciding which funds to buy and is almost completely irrelevant when looking at index funds. Here’s what I mean.

Past performance is often the first thing people look at when presented with a list of mutual funds, like in their 401(k) account. I get it. You want the best and you want your money to grow as much as possible!

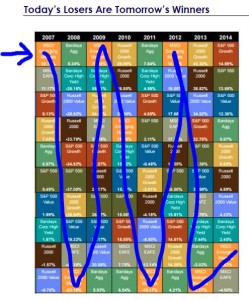

But this is a key mistake that can actually lead to losses rather than gains over time. The problem is that the fund that did the best last year or over the past three to five years is statistically LESS likely to be the best next year, so by buying the “best” based on the past, you may actually be buying high, which is the opposite of everyone’s favorite stock market adage: “Buy low, sell high.” This chart shows that. Just follow the orange square representing “MSCI Emerging Markets” over the 7 years shown:

An investor who chases performance and buys the MCSI Emerging Markets at the end of 2007 because it was the “best” would have lost half their money over 2008. That same investor may be likely to sell at the end of 2008 because they wanted to “stop losing money” and therefore would have completely missed out on the recovery of that sector, when it “won” again in 2009! That’s an extreme example, but follow any of the colored squares over the years and understand a little better why it’s a losing game to only invest in what’s done the best in the recent past. Instead try to spread your investments out over all parts of the market and just “let it ride.”

For investors who like to put their money into actively managed mutual funds, there is a reason past performance matters – so that you can see if the fund is meeting its objective to match or exceed its benchmark. Past performance means nothing without the context of its benchmark. For example, let’s say you’re looking at a mutual fund with the objective of outpacing the S&P 500. Such a fund may include words like “Large Cap” or “US Large Company” or “Capital Appreciation” in its title.

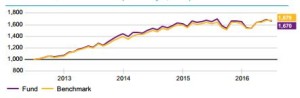

When researching any fund’s performance, look for a chart on the fund fact sheet that shows its performance alongside its benchmark. Here’s one example, showing a fund that is matching its benchmark quite well:

If the lines moves pretty much in tandem together or the fund line is consistently higher than the benchmark line, it means the fund managers are doing their jobs consistently well. If you were to look at a chart and see the fund losing to the benchmark as a pattern, then you may want to reconsider it as an investment, even if the fund is in positive territory. In other words, even if your investment is up 10% this year, if its benchmark is hitting 15%, your fund is failing you.

Likewise, if your fund value is down, it doesn’t necessarily mean you’re in the wrong fund. Markets go up and down. As long as the fund’s benchmark is down as far or further, you’re okay to stick with it.

So what does matter when choosing a mutual fund?

The one guarantee about mutual fund investing is the most important criteria in fund selection: fees. You will pay fees, guaranteed. But you can control how much. That doesn’t mean you want to select funds based solely on the criteria of the lowest fees, but if you’ve taken your risk tolerance quiz to determine a suitable mix of stocks and bonds (see the chart at the very end of the questionnaire for suggestions) and have more than one fund option to fulfill your investing allocation, then fees should be one of the deciding criteria.

What if you’re investing in index funds? Then the only use that past performance really has for you is in helping you to set realistic expectations for how your money will do over the long haul. Look at the performance numbers over the past 10 years or more and that should give you a reasonable idea of the growth you can expect for your own money. Assuming you’re only investing money that you don’t need for 10 years or more, you really shouldn’t care what happens over the next one, three or even five years.

Have you signed up to receive the Tip of the Day via email each business day? If not, head over to the main blog page and sign up!