Have a Pre-Existing Condition? Here’s What to Do Now

May 15, 2017

There’s been a lot of talk in the news this past week about health insurance for people who have pre-existing health conditions. Are you worried about what the American Health Care Act (AHCA) could mean for you or your family’s health insurance should it eventually be signed into law? Here are some ways you can prepare if the current law on pre-existing conditions and health coverage changes.

What We Know

Under the Affordable Care Act (known as “Obamacare”), insurers could not deny coverage for pre-existing health conditions or charge higher premiums for plans beginning in 2014. The AHCA still requires insurers to cover those with pre-existing conditions but allows states to seek a waiver so that insurance plans they regulate could charge higher premiums for those with pre-existing conditions who let their insurance coverage lapse as long as those states meet certain conditions such as setting up a high risk insurance pool. For those with pre-existing health conditions such as diabetes, epilepsy or cancer, this introduces a new level of uncertainty of future, affordable coverage. You couldn’t be denied insurance coverage, but the premiums could be so high you might not be able to afford them. This may put insurance out of reach for those who lose their employer coverage (such as in a layoff or by retiring before Medicare eligibility at age 65).

Note that the AHCA version that recently passed the House of Representatives eliminates the Affordable Care Act penalties for large employers who do not provide affordable health coverage to their employees. For employees of most companies, that is unlikely to have much effect in my opinion. That’s because health insurance is currently considered an expected employee benefit and companies would need to offer it to attract talent.

What We Don’t Know

I don’t pretend to know what’s going to happen with the law. The version passed by the House is not likely to be the version passed by the Senate. Both the House and Senate need to come to agreement on a final version and then the President needs to sign it before it becomes law. If the bill passes as written, we also don’t know if your state would apply for a waiver to allow the insurance companies they regulate to charge premiums that reflect the individual cost of covering pre-existing conditions. If you have strong opinions about it and want to express your views, you can contact your congressperson and senators. You can find their contact information here.

While We Wait For More Information

While we’re waiting to see what finally shakes out, here are a few suggestions for how to put yourself in the best possible financial position in the event you lose your insurance or face significantly higher premiums. Remember that if you are currently covered by your employer’s plan, your risk of that is very low. However, it won’t hurt to be as prepared as you can be in the event you lose your job or plan to retire before age 65.

Max out that HSA if you have one.

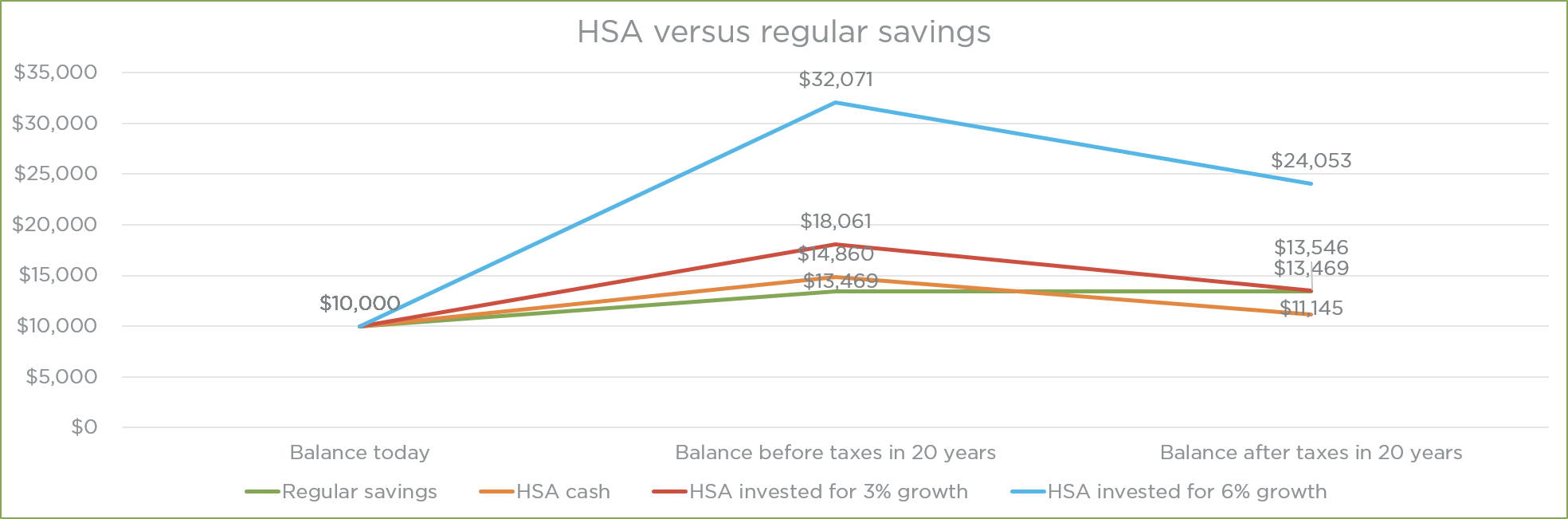

If you are currently covered by a high deductible health plan (HDHP) with a health savings account (HSA), bulk up your balance as much as you can. Contributions are pre-tax and distributions from HSAs for qualified medical expenses are always tax-free. If the House version of the AHCA passes, the additional tax penalty for taking distributions for non-medical expenses will be reduced from 20 percent to 10 percent. A robust health savings account can help you to pay future medical expenses and well as insurance premiums under certain circumstances. (See below.)

How much can you put in? Those workers with individual coverage can contribute a maximum of $3,400 and those with family coverage can contribute a maximum of $6,750 for 2017, which includes any money your employer contributes on your behalf. If you are 55 or older, you may contribute an additional $1,000.

Under the House version of the AHCA, contribution limits would increase to $6,550 for individual coverage and $13,100 for family coverage. I know that seems like a lot, but it’s a better alternative than paying health care expenses after tax. Usually, you only change your target HSA contribution amount deducted from your paycheck during open enrollment, but you can write a check directly to your account for the difference.

Here’s the key. Don’t spend the money if you can use other funds to pay your current deductible and out-of-pocket expenses. After you have built a balance greater than your out-of-pocket maximum for the year, consider investing the remainder. The goal is to build as big of an HSA balance as possible while you have insurance.

Seek coverage under your spouse’s insurance if you lose your job.

Losing health insurance due to a layoff can be considered a qualifying event and would generally allow your spouse to add you to his/her group health insurance plan during a special enrollment period. Under most plans, you’ve only got a 30-60 day window to apply for the updated coverage, so contact your spouse’s HR department as soon as possible. If you are married, this is a natural first place to start, whether or not you have any pre-existing health conditions.

Continue coverage under COBRA.

If you lose your job or retire early, you may continue your group coverage under COBRA for 18 months. You will have to pay the full premium yourself (unless you are fortunate enough to have a retiree health plan). Note that if you have funds in your health savings account (HSA), you can use them tax and penalty free to pay for insurance premiums for health care coverage on your existing group plan through COBRA.

Bearing the full cost of coverage under a group plan can be expensive, so don’t be surprised. However, if the law becomes unfavorable for folks with pre-existing conditions, COBRA is likely to be your best bet to continue coverage. As I wrote in a previous blog post, “If you have a pre-existing condition and are retiring within 18 months of when you’ll be 65, COBRA is likely to be your best option in this age of uncertainty. As long as you pay your premiums, you’ll remain covered up until you’re eligible for Medicare. Even if you don’t have a pre-existing condition, choosing COBRA still gives you a little breathing room to figure out your next steps for insurance once it’s clear what happens to the ACA.”

Do you have a question you’d like answered on the blog? Please email me at [email protected]. You can also follow me on the blog by signing up here and on Twitter @cynthiameyer_FF.