Hiding Purchases From Your Husband is So 1950

March 29, 2017When I was a little girl, I remember my great aunt sending my mom money with a note that simply said, “Please don’t send a thank you note. I don’t want my husband to know.” My great uncle was a bit of a curmudgeon and my aunt would have suffered for her generosity. I also remember my grandmother taking me shopping for back-to-school clothes but telling me to leave everything in the car when we went back to her house so my grandpa wouldn’t know she was spending money. Sound familiar?

A lot of us grew up with this example and continue to exhibit similar behavior in our lives today. Have you ever rushed to put purchases away in the closet before your husband could see or stuffed your Lululemon purchases into your purse before walking into the house to avoid a potential fight about overspending on perceived wants versus needs? How about hiding a Target splurge on stuff for your kids?

While these actions may have been slightly justified back in our grandma’s day, these are all examples of financial infidelity. Just like if you were deleting texts between you and a male coworker to avoid a fight with your husband, hiding purchases from him is the same behavior. It’s a violation of trust. What do you really have to hide?

Back then, women didn’t have as many choices when it came to careers and having their own money or even sometimes in choosing a life partner. I will never forget the day I nervously broke the news that my first marriage was ending to my grandmother. Her response surprised me.

She said, “Good for you. You will do just fine. If I’d had a career and options like you, neither one of my marriages would have lasted.” And while I didn’t relish the thought of anyone I love feeling “stuck” with someone else I love, I understood what she meant and she was right. The big difference between back when my grandmother had to sneak spending behind my grandpa’s back and today is that if you find yourself in a marriage where you truly don’t have economic power, you have the choice to work it out or leave.

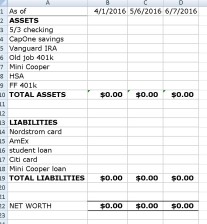

I’m not saying you shouldn’t have the autonomy to make your own purchasing decisions – quite the opposite. You may never get on the same page with your spouse about the value of spending on certain things like clothes or wine or electronics or name the thing that causes money fights in your marriage. But there are ways to solve that without hiding purchases such as having separate spending accounts where you agree that you each can do whatever you want with that money with no judgment and no arguing. The kicker is that you both have to stick to the agreement where you only spend that money and not other money that’s allocated towards your family’s goals.

It may be a challenge to arrive at an amount you both agree on for your spending money. When a spender marries a saver, the saver will always want to spend less, but there are logical ways to arrive at that number. Start with your shared goals like retirement, paying off debt, saving for college, etc. Assign a number to those goals and calculate what it will take to get there and agree together whether that amount is reasonable or if you need to modify the goal. Getting on the same page about this helps you both feel responsible for your part in achieving that goal and should help the saver partner relax a little bit about spending on things they don’t perceive as necessary.

Kelley Long is a resident financial planner with Financial Finesse, the leading provider of unbiased workplace financial wellness programs in the US. For more posts by Kelley or to sign up to have her weekly post delivered to your inbox each Wednesday, please visit the main blog page and sign up today.