Think Tank Bulletin: Student Loan Debt on the Workforce

March 21, 2023Currently, an estimated 43.5 million Americans carry over $1.7 trillion in student loan debt—an average of over $37,500 per…

Currently, an estimated 43.5 million Americans carry over $1.7 trillion in student loan debt—an average of over $37,500 per…

Until they’ve tried it, your employees will never know; and not knowing may be keeping them from engaging with a benefit that could literally change their lives.

Nearly 2 in 3 adults (64%) say that money is a significant source of stress in their life

We know that Americans are dealing with significant levels of financial stress, in many cases exacerbated by COVID-19. According to the American Psychological Association, “Nearly 2 in 3 adults (64%) say that money is a significant source of stress in their life, and around half of adults (52%) say they have experienced negative financial impacts due to the pandemic.”[1]

We also know that talking with a financial coach can improve financial stress levels considerably. For example, the percentage of financially suffering employees (i.e., those with an initial financial wellness score of less than 3.0) with high or overwhelming levels of financial stress fell from 70% to 41% after talking with a financial coach as part of their financial wellness benefit.

So how can we get employees ‘over the hump’ of not knowing and get them comfortable enough to call a coach? I asked our coaching team which myths or misconceptions they believe may be holding employees back. Allow me to bust them.

Myth #1 – A financial coach will try to sell me something.

While many financial professionals are compensated for selling financial products, this is not the case at Financial Finesse. Our company is independent and not affiliated with any other financial institution and our coaches do not sell or manage any financial assets.

Myth #2 – A financial coach will judge me or talk over my head.

Fear of judgment is universal, which is why we seek coaches that have first-hand experience with common financial challenges and screen for empathy and emotional intelligence (EQ).

Fear of judgment is universal

Our coaches are motivated by helping employees make progress, no matter what their starting point. In every conversation, they aim to make financial concepts easier to understand and to build rapport. To get a sense of who is on the other end of the line, employees can “meet” our coaches here.

Myth #3 – A financial coach is not trained to deal with my problems.

Some may think their issues are too simple to merit a call or too complex for us to help. Our coaches address the full range—from fundamentals to complex topics—every day. If an employee needs advice (we provide coaching only), for example on taxes or investing, we can help them find someone through objective screening—we do not have a referral network or any affiliation with any providers.

Myth #4 – A financial coach expects me to have my finances in order before we speak.

Our coaches are happy to help employees get started—no prep work required. We hope the first call is not the last. That’s why we encourage employees to reach out to get the ball rolling.

Myth #5 – A financial coach will share my information with my employer.

This one simply isn’t true. Our coaches adhere to a strict code of confidentiality and never share any information with employers as it relates to their employees’ financial health.

Myth #6 – A financial coach can only discuss benefits offered by my employer.

While our coaches often help employees get the most out of their benefits, they are by no means limited to benefits-related questions. They can help with any financial concern.

We know that the more employees interact with our coaches the more their financial wellbeing improves, but getting first-time users started can be a challenge. By understanding their concerns, you can develop a communication strategy to address them head-on, encouraging engagement and changing lives—a win-win for any organization.

[1] https://www.apa.org/news/press/releases/stress/2020/report-october

Financial Finesse’s 2019 Year in Review Research Study & The Impact of a New Normal Post COVID-19

View the entire COVID-19 best practices abstract “The Impact of a New Normal” here.

1. Question: What were the most significant takeaways from the 2019 Year in Review report?

Answer: For this year’s report we looked at how engagement in online, group, and individual learning sessions influence change in financial wellness as measured by the Financial Finesse Financial Wellness Score. The results were astounding.

Employees that engaged in group learning improved their financial wellness score on average 1.11 points, 40% higher than the 0.79-point average improvement by those that engaged exclusively online. But it was the employees that followed the best practice model and engaged in all three forms of learning that topped them all, improving their financial wellness score on average 1.44 points, outperforming group learners by 31% and online-only learners by 83%.

This improvement in financial wellness also translated into improvement in benefit participation. Employees that engaged in the best practice model had a 43% higher retirement plan deferral rate and an 81% higher annual contribution to a health savings or flexible spending account than employees that only engaged online.

We also found that the greatest net improvement—which is the difference between improvement by those that engaged in the best practice model and those that engaged exclusively online—occurred among employees with the lowest levels of financial health. What is even more remarkable is the speed of improvement. Financially stressed employees exhibited the greatest degree of improvement in the shortest amount of time across all levels of engagement.

2. Question: What can employers leverage from the 2019 Year in Review report to help employees navigate the financial impacts of COVID-19?

Answer: In the wake of the COVID-19 pandemic, we are seeing signs of increasing financial stress associated with the stock market and U.S. economy manifesting itself as a lack of trust in sources of financial guidance and concern for not reaching future financial goals. When considering the relationship between physical health, workplace productivity, and financial stress, this should have employers’ attention. The good news for employers is that the best practice model yields the greatest improvement in financial wellness for the most financially stressed employees in the least amount of time. These results could not have come at a better moment in history.

As the pandemic persists, we expect to see a shift toward lower levels of financial health across the global workforce. Given the strong relationship between financial health and employment cost, we encourage employers to focus their COVID-19 efforts on providing financial resources and support to their most financially stressed populations first. This population can be defined through a workforce financial wellness assessment, a demographic analysis, or by measuring financial stress metrics such as retirement plan leakage, garnishment, or benefit utilization. Once the at-risk population is defined, consider offering ongoing financial coaching delivered through a multi-channel model if possible.

3. Question: What drives the trend of end-users in the lowest tiers of financial health exhibiting the greatest level of improvement in the shortest amount of time?

Answer: The emotional courage it takes to confront serious financial issues is significant. Finances still remain taboo, especially for those who are struggling financially, and there’s often a sense of shame or helplessness they have to overcome. The best practices model is well suited to mitigate that, because it is set up to reduce barriers as a financial wellness benefit that can be accessed however employees feel most comfortable, and then migrate to ongoing financial coaching when they are ready. The message they get is “We are all in this together. Everyone has financial challenges. You are not alone and there is nothing to be ashamed of.” That alone makes a huge difference.

Then when you consider the small wins in finding ways to reduce expenses by getting better deals on essential items, get credit relief or lower interest rates, begin the process of starting an emergency fund, can make a huge difference to financial stability, it makes sense that those who struggle most would improve the most with a model that provides unlimited financial coaching through multiple channels.

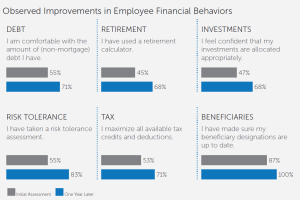

4. Question: On average, which aspects of an employee’s financial wellness improved the most under the best practices model?

Answer: On average, employees that engaged in the best-practice model for five or more years showed a 1.59-point improvement (on a 10-point scale) in financial wellness score. The greatest net difference between improvement among employees who engaged exclusively online and those that engaged in the best practice model occurred in the areas of retirement planning and investing. Employees that engaged in all forms of learning also had a 43% higher retirement plan deferral rate and an 81% higher annual contribution to an HSA or healthcare FSA than employees that engaged exclusively online. They were also more likely to have a handle on cash flow, have an emergency fund, pay bills on time, be comfortable with debt, and pay off credit card balances in full.

5. Question: How do you anticipate COVID-19 may alter the traditional compensation and benefits structure most workplaces have become accustomed to? Do you anticipate a potential or temporary decrease or suspension of benefits like 401(k) matching, PTO, etc., as employers explore potential cost-savings strategies to avoid having to layoff or furlough employees?

Answer: Many employers are considering any practical cost-saving measures to stay afloat during this crisis. However, rather than decreasing or suspending benefits that impact some, I believe we will see a strategic refocus of attention and funds, where available, towards benefits thought to be more flexible and impactful across the board, like HSA’s for example.

That said, I believe COVID-19 will cause a major mind shift in how we think about employee benefits, in line with human-centered design principles, where the focus shifts from the benefits themselves to the employee’s individual financial needs, integrating benefits in a way that best meets their financial security. This includes:

6. Question: According to PayScale, the gender pay gap has improved 7% since 2015. Why do you think the gender gap in financial wellness continued to widen for women in 2019 despite a narrowing of the gender pay gap over the last several years?

Answer: Historically, the gender gap tends to widen in periods of economic expansion and narrow in periods of economic contraction. This has held true throughout the duration of our research. Based on the data, men tend to be more confident and aggressive in their investment strategies during bull markets, which puts them in a better position financially at the time, but also creates more risk in the event of a market downturn. Women, on the other hand, tend to be more conservative, but also more resilient and take a more active role in managing their finances in a down market. Since 2019 was a strong year for the market and economy overall, the gender gap widened. We fully expect it to narrow post-COVID-19. Please note, the narrowing is not necessary a good thing as it represents the “gap” not “absolute” financial wellness. In tough economic times, both men and women tend to regress financially, women just regress at a slower pace.

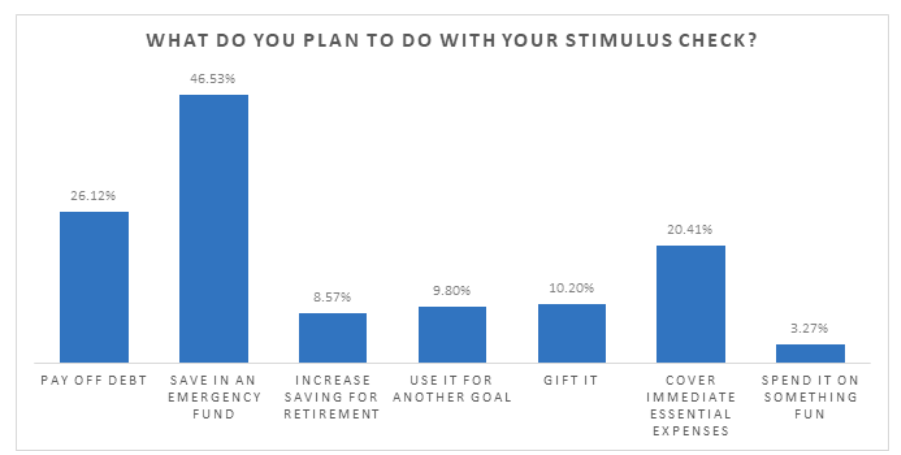

7. Question: How are employees planning to utilize their COVID-19 economic stimulus checks?

Answer: As part of our ongoing COVID-19 relief efforts, Financial Finesse hosts weekly webcasts aimed at helping employees navigate the day-to-day financial changes and decisions we’re all facing. In order to make these webcasts as relevant as possible, we created a follow-up survey and shared it with the thousands of employees who attended. One of the questions we asked was “What do you plan to do with your stimulus check?” Surprisingly, the majority of respondents that received a payment (47%) plan to put it toward an emergency fund. Only one in five (20%) indicated using it to cover immediate essential expenses. While there is no such thing as good news when it comes to COVID-19, we were excited to see most employees proactively saving their stimulus check versus reactively relying on it to cover immediate essential expenses.

How can employees determine if what’s being marketed as a ‘financial wellness program” is a real benefit which offers unbiased guidance and coaching, or a sales pitch of financial products or services?

These are the first three questions every employer considering financial wellness should ask prospective vendors in order to fully protect their employees and set their programs up for success.

Employers that offer financial coaching and mentorship to their early career employees are more likely to help them achieve their life goals and enjoy financially healthier lives.

Liz Davidson, founder and CEO of Financial Finesse, answers some of the most common questions about workplace financial wellness programs, such as how to have an impact on every employee generation present in the workforce; where fintech tools fit into your program; how to decipher between financial wellness programs and financial education programs; and more.

Our best practices guide for workplace financial wellness programs defines what it means to be financially well, and what constitutes a workplace financial wellness program to help employers avoid ‘bait and switch’ providers who are marketing themselves as financial wellness providers when in reality, they are aiming to sell employees a financial product or service. This guide aims to set industry standards around financial wellness programs in the workplace.

Employees Say Benefits Drive Their Engagement with Their Employer, But The Vast Majority Don’t Maximize The Benefits They Have

Employees who understand, maximize and appreciate the value of their employee benefits are happier at work and more productive and engaged. This isn’t just a guess — the research agrees. Per SHRM’s 2016 Employee Job Satisfaction and Engagement Survey, 84 percent of employees indicated that their benefits were critical to their financial wellbeing, and 60 percent said that benefit were a key factor in their decision to join or stay at a company. Yet, most admit not fully understanding the benefits they have and virtually all are not fully maximizing them— accidentally leaving money on the table each year, not even realizing it. Based on our own research working with hundreds of thousands of employees over the years, many are leaving upwards of a million dollars on the table by not maximizing the benefits they have — and instead using that money for “nice to have” purchases that decline in value or going outside their employer to invest in more expensive financial products and services which often don’t have the same tax advantages. In some cases, employees are actually paying out of pocket for benefits the company would otherwise fully or partially subsidize, such as gym memberships, daycare, commuter benefits, legal support, tuition or continuing education reimbursement or relocation expenses. The list goes on.

Even Benefits Managers Don’t Understand Their Entire Benefit Offering

When we work with benefits managers to integrate all employee benefits into their financial wellness program, the most common refrain we hear is, “I didn’t know we had that benefit!” If that’s sometimes the sentiment of those who manage benefits for a living, imagine how employees in the field must feel. Imagine how differently they might feel if they knew all the company was providing them and could take full advantage of every benefit that truly provided a benefit to them personally.

Because of this disconnect, it is absolutely critical your workforce financial wellness program should integrate all benefits so that employees recognize their benefits are a critical part of their financial wellness and have guidance as to how to maximize them as part of their overall financial plan. This helps employees understand where to go to find resources and the role each benefit plays in their financial lives.

It also should be used as the key vehicle to help employees manage benefits changes, so they minimize the impact to their finances and even manage to find ways to make the change work to their advantage.

The Most Successful Employers Offer Employees Unlimited Personalized Guidance On Their Benefits

The most successful benefits planning programs — which help employees maximize their benefits based on their own personal financial situation — employ a “concierge” strategy where the employee has access, both online, through a mobile app, over the phone, and in person, to their own personal financial coach who can help them make the right decisions for their life situation and goals. As a best practice to reach a large number of employees in a deeply personalized the coaching should meet the following criteria:

Managing Benefits Changes

Benefits changes are a fact of life today, whether they are for cost-savings reasons, to add more value, flexibility or support to employees, or simply to simplify or streamline a benefits offering to make it easier for employees to manage. Unfortunately, even good changes can add yet another thing for an employee to understand and act upon, and most major changes transition more costs to employees, adding to their financial stress.

If you handle benefits planning through the process described above, benefits changes become much easier to manage, because employees automatically have a coach to turn to in order to make the right decisions for their situation.

However, in virtually all cases, best in class employers do more than simply leverage their existing coaching. Without broad-based communications and education around the changes, and multiple touch points to ensure that all employees affected are aware of the change, it’s easy for important decisions to “fall through the cracks.” Your financial wellness provider should help you proactively communicate and educate employees around all changes —consulting around all aspects of the change management process, producing materials, videos, and tools as needed to help employees navigate the change, and delivering webcasts and workshops to all those affected by the change. They should also provide you with full reporting of employee engagement in these different communications and education campaigns, both for legal documentation but also so you understand what type of communication resonated the most for the purpose of designing future campaigns.

Among the most common changes that require this level of communication and education–

One last note

Benefits and personal finances are complicated and highly personal. Beware of any vendor who presents a one size fits all solution that is “turnkey” and “highly scalable”. While their solution may fit into part of a larger strategy, they are typically not set up to provide the level of customization you need to address either employee benefits planning or communication of benefits changes. Your employees care much more about their financial security than any singular benefit you provide. Your ability to bridge the gap between the myriad of benefits and the strategy they need to employ to become financially secure by maximizing these benefits is what matters most. The days of siloed benefits offerings and floods of email announcements on different benefits options are over. It’s now about what it always should have been — the employee who you want to benefit in the first place.

What motivates employees to take action to improve their financial health? The single most important part of providing a financial wellness program is motivating lasting changes to the way employees manage their finances. Without doing this, you won’t be able to meet the objectives for the program, including cost savings from an increase in benefits participation and retirement preparedness, reduction in plan leakage, absenteeism, wage garnishments, health care and workers’ compensation costs.

The key? Deliver a workplace financial wellness program that is rooted in the fundamentals of behavioral finance.

Understanding Behavioral Finance

Behavioral finance is the study of why people make irrational financial decisions. Why do we do things with our money that we do? Here’s what we’ve found that has the most impact on employee financial wellbeing:

Willpower is naturally limited According to the American Psychological Association, willpower can be depleted. Your financial wellness program should make it more likely that employees will actually act on the decisions they make. This includes making decisions easy to implement, like a 1-click enrollment in auto escalation of retirement plan contributions. Create a single sign-on so other benefits providers are accessible from your online financial learning center.

Decision fatigue We also get tired of making decisions. Social psychologist Sheela Iyengar estimates that we make at least 70 decisions per day. Providing your education earlier in the day when employees have not yet made many difficult decisions will make it easier for them to act on what they learn.

People are More Emotional than Rational Biases in financial behavior are common. At one point or another, we are all likely to do things like be overconfident, get attached to a reference point that is no longer valid, have clearer views in hindsight, look for confirmation of our opinions, follow the herd and overreact to recent events. Financial education and coaching from an unbiased planner – someone with no ulterior motive to sell financial products or services – helps employees recognize and deal with behavioral biases.

The Financial Behavior Change Model

Financial behavior change can’t be forced, but it can be facilitated. Studies show that if a financial coach knows when an employee is ready to change a certain financial behavior, they can customize their coaching or education to facilitate that change (see one academic study here). The principles of financial behavior change are that it must:

Financial Coaching Is What Helps Get Employees “Unstuck”

Per the Society for Human Resource Management (SHRM), younger employees in particular expect to access information about wellness programs on their computers and smartphones. It’s the interaction with a financial coach, however, that changes employee financial behavior. According to Financial Finesse’s 2015 Year in Review research, while technology was helpful in increasing employee awareness of their financial vulnerabilities, online interactions alone did not improve employee financial wellness. The more an employee interacts with a financial coach, the more progress they are likely to make. Online only users nationally in 2015 had an average Financial Wellness Score of 4.8 (on a ten scale), while repeat users of workplace financial wellness programs had an average score of 5.7. An incremental increase in financial wellness could save a large company millions from reduced costs of absenteeism and wage garnishments, tax savings from increased HSA and FSA participation and health care savings.

What’s the best way to design a workplace financial wellness program? At their core, effective programs meet the strategic needs of your business. Key areas that drive the creation of workplace financial wellness programs are:

According to a Consumer Financial Protection Bureau report, “a financially capable workforce is more satisfied, more engaged, and more productive for their employers.” That’s why 93 percent of companies surveyed in a 2015 Aon Hewitt report are likely to create or broaden their efforts on financial wellness.

Determine the Right Approach for Your Workforce

Workplace financial wellness offerings can range from highly effective, comprehensive solutions fully integrated with company benefits to online-only tools or programs that address specific employee populations. There are three broad approaches:

Benefits-Based Approach A workplace financial wellness benefit can be the one benefit that pulls all the other benefits together, increasing employee understanding, use and appreciation of their value. In particular, when your strategic goals are to engage employees, reduce financial stress, encourage benefits appreciation and realize measurable cost savings by reducing financial stress or benefits appreciation, the best solution is making financial wellness an ongoing employee benefit available to all employees. The foundation of a benefits-based approach to financial wellness is ongoing guidance and coaching that promotes behavior change. Depending on workforce needs, this includes some combination of workshops, webcasts, one to one coaching (telephone, in-person, or both) and online learning.

The benefits-based approach embeds financial wellness into your company culture and establishes your company as a partner in employees’ financial security. This is a powerful contribution to your recruiting brand. Over time, research shows a benefits-based approach can provide significant ROI for a large company.

Program-Based Approach The program-based approach can be a good fit for companies who may not have a strategic need for workplace financial wellness as a benefit offered to all employees, but have a need for support for specific employee populations. Typical employee populations to address with a targeted financial wellness program include pre-retirees, employees offered early retirement, recent college graduates and employees who have requested a retirement plan loan or received a wage garnishment. Companies may also choose to target executives by offering them an unbiased review of their financial plan by an experienced financial planner.

Tool-Based Approach Financial wellness websites and apps are generally used as tools in a more comprehensive program. There are some circumstances where a tool-based approach on its own may be a fit: when you are looking for a lower cost solution to check the box, when you have a very specific issue you want to address— such as helping parents navigate the college planning process, refinancing student loans for employees, offering employees in plan advice to help them better manage their 401(k) investments, or decision making tools that help them select the right health care plan during open enrollment. The right tools can make an impact here, provided you are working with a best in class provider and your population truly needs the service. However, they don’t generally make an enduring impact on overall employee financial wellness, retirement preparedness, or even benefits satisfaction. To do that, a holistic approach is needed. This is why employers are increasingly folding these tools into fully integrated financial wellness programs that utilize a “concierge” service approach where employees are directed to the right tools and benefits based on their needs, while working with a counselor that can help them continually improve their finances over time.

Understand What Your Employees Really Need

Everything starts with data. Once you have decided on whether to implement a benefits-based, program-based or tool-based program based on your strategic needs, you still need to validate the needs of the employees you are trying to reach with the program. There’s nothing worse than spending a large amount of time and money to launch a new program, only to discover that you could have spent half that amount and gotten much more appreciation and utilization from employees who actually needed a completely different service.

For example, you may think student loan debt is a major issue looking at your population— but what if the bigger issue is not knowing how to effectively budget to pay off the debts? You can help provide loan consolidation support for employees in this scenario but the effect will be marginal, as their foundational habits around how they manage their money won’t change. Similarly, in plan advice can be great— but it’s more expensive than target date funds and if employees who rely on their retirement plan as their sole investment vehicle choose in-plan advice thinking it will provide them with a bullet proof investment strategy when a cheaper target date fund would serve essentially the same purpose, you may have actually exposed yourself to legal liability down the road when they realize the extra fees were not justified for their situation.

Why A Workforce Financial Wellness Assessment™ is a “Must Have” Before Making Any Decisions on What To Offer Employees

The only way to truly understand what employees need, whether you are looking to add tools, programs, or a holistic benefit is to better understand their finances, in a confidential, non-invasive way. The best way to do this is to provide them with access to an online financial wellness assessment which they can use to get a snapshot of their personal financial wellness and key next steps to take to improve their finances, including a Financial Wellness Score™ they can use as a gauge to track their progress. Employees take five minutes, answer non-invasive questions about their financial habits, behaviors, and decisions they’ve made — without any account information collected — and you get an aggregated Workforce Financial Wellness Assessment™ detailing the following:

The American workplace is constantly changing. At one time, people generally stayed with one employer throughout their entire career and then retired with a gold watch and a big pension until they passed away. Then over the last 25 years, employers increasingly shifted from those traditional defined benefit plans to defined contribution plans which left the control, and the risk, in the hands of employees who were often ill-equipped and unprepared for that responsibility. From 1980 to 2008, the percentage of private employees with a defined benefit pension fell almost in half from 38 percent to 20 percent, while the percentage with only a defined contribution plan rose from 8 percent to 31 percent.

This trend isn’t limited to retirement benefits. More recently, we’ve seen a shift toward consumer-driven health care plans that place more risk and responsibility for healthcare spending on employees as well. According to a Willis Towers Watson/NBGH survey last year, 86 percent of employers were considering offering a consumer-driven health care plan this year, and over a third were planning to make it the only available option.

The workplace is beginning to go through another evolution in which employers become more than just a source of pay and benefits. As employees bear more of the responsibility for their financial wellbeing, employers are increasingly finding it to be in their best interest to help their employees advance their total financial wellbeing. For example, 93 percent of companies surveyed in a 2015 Aon Hewitt report are likely to create or broaden their efforts on financial wellness in a manner that extends beyond retirement decisions. Employees appreciate it too, as 81 percent in a TIAA survey reported that they trust financial information offered by their employer. There are several reasons that help explain this trend:

It’s a lot easier to understand the value of a pension or a comprehensive medical plan that the employer pays for than a 401(k) or an HSA that the employees may be solely responsible for funding, or at least share responsibility. A financial wellness program can help employees understand, utilize, and more fully appreciate these benefits. In turn, this can help employers recruit and retain talent.

A 2016 survey by Bank of America Merrill Lynch revealed an increase in the percentage of Americans reporting financial stress to 60 percent, up from 50 percent in 2013. In fact, our 2016 Financial Stress Research found that one in four employees reported financial stress that was “high,” or “overwhelming” – levels that could be considered unmanageable. According to an AP/AOL health poll, high levels of financial stress are correlated with higher occurrences of headaches, insomnia, high blood pressure, stomach ulcers, muscle tension, and severe anxiety and depression. Those experiencing high levels of stress also experience more relationship and substance abuse issues. There’s a rising awareness among employers that this stress can have a negative impact on a company’s bottom line due to factors like higher health care costs, absenteeism, lost productivity, and on-the-job accidents. For example, our most recent study of one Fortune 100 healthcare company calculated that employer healthcare costs associated with employees who used the company’s financial wellness program actually decreased by 4.5 percent, while the costs associated with employees who never used the program increased by 19.4 percent

In addition to suffering greater financial stress, Americans are increasingly delaying their retirement. A 2014 Gallup poll found that the average retirement age rose from 60 to 62. Many employees continue to work because they are underprepared or they don’t know if they are prepared to retire. 69 percent of Boomer employees do not believe or do not know if they have enough money to live comfortably to age 85, according to a Bankers Life Center for a Secure Retirement® study. This delayed retirement trend may only accelerate with the potential of future cuts in Medicare and Social Security and lower investment returns due to relatively low interest rates and high stock valuations. Employees who would like to retire but delay could cost their employer $10,000 to $50,000 for each year they work past normal retirement age due to higher health care costs and salaries versus younger employees who would have otherwise taken their place. This doesn’t include the cost of lower employee morale/productivity and higher turnover of high performing employees who aren’t advancing.

One of the biggest contributors to delayed retirement is not saving enough. However, financial wellness programs can make a difference by not only educating employees on the need to save more, but also helping them learn the basic money management skills to come up with the money to save. Our 2015 Year in Review Research showed a direct correlation between average 401(k) deferral rates and the number of interactions employees had with their financial wellness program. Those with only one interaction averaged less than a 6 percent deferral rate, while those with 5 or more interactions had an average 11 percent deferral rate, almost twice as much. Our research also shows that repeat users had an 88 percent improvement in the percentage on track for retirement.

Another factor is how well the employees invest the retirement money they save. However, our research found that only 46 percent of male employees and 36 percent of female employees felt confident in their investments. A workplace financial wellness program can help employees understand their investment options and make the right choices for themselves.

Our recently released ROI Special Report also found a direct relationship between an employee’s financial wellness and their average annual cost to the employer from other factors like absenteeism, garnishments, and payroll taxes. The study found that those with the lowest Financial Wellness Score™ of 0 to 2 cost an average of $198 per employee while those with the highest scores of 9 to 10 actually saved $143 per employee per year. Increasing the median financial wellness score of a 100,000 employee company from a 4-5 would save over $433,000 in decreased garnishment costs, over $682,000 in payroll tax savings from increased usage of flex spending/HSAs, and over $4 million in reduced absenteeism. Increasing the median from a 4 to a 6 would save over $886,000 in garnishments, $1.7 million in flex spending/HSAs, and over $8.5 million in absenteeism.

Employers used to bear the risk and burden of providing for the health and retirement security of their employees. As that burden has shifted onto employees, employers are finding themselves in a new role. The American workplace has become more than just a place to earn money — it’s now a place to learn how to make the best use of that money.

While some employers do take a tool-based or program-based approach to financial wellness in order to address niche needs of specific employee demographics, the marketing of those programs is by nature, much more narrow and limited in scope. There’s typically a launch to the target population, and periodic reminders at benefits fairs and the like. With everything employers have to communicate to employees, large scale marketing campaigns around a single tool, perk, or program distract from larger more important goals and can leave employees with information overload and decision-fatigue. You need the important information to stand out, and each time you send any additional communication to an employee, you take their attention away from the core messages you want to send.

With that in mind, this post is intended for those employers who specifically are focused on offering financial wellness as an employee benefit.

Let me clarify what I mean by offering financial wellness as an employee benefit. A financial wellness benefit is not a tool, app, niche service, program for a specific population group, a perk, or bullet 178 on the list of things you do to make your company a great place to work. On the contrary, it is an additional employee benefit, subsidized by you, the employer, to provide every single employee with access to employee unlimited personalized financial coaching to help them maximize their pay and benefits— free of any conflicts of interests or sales pitches. When you offer employees a true financial wellness benefit, you are making a commitment to their financial security by providing a resource they can turn to at any time, for any financial need, and know that the guidance they get is solely in their best interest, designed around their specific financial priorities, goals, and circumstances.

Accordingly, you need to market your financial wellness benefit the way you would any core benefit.

This starts by always calling it a benefit— not a program, service, platform, tool, resource, app— but an additional employee benefit that you are offering to all employees as part of their overall benefits package.

It also means leveraging all the traditional methods you use to communicate important benefits, including:

This strategy accomplishes several important objectives:

Interest in financial wellness is exploding, and many companies have questions about what a financial wellness program is and how to implement one. Corporate benefit managers seeking financial wellness solutions are asking themselves, “Is this a wellness initiative? A benefits initiative? Both? How do I find the solution that best fits our company?”

I’m sure you’ve heard the phrase “start off on the right foot.” It’s a guideline that can be applied to everything in life, from starting a new career to getting married. But a lot of times, we make initial mistakes that lead to others – we’re not only on the wrong foot; we’re wearing the wrong shoes.

You probably see this with employees in their benefits plans: They are using their benefits wrong from the get go. Instead of helping them reach financial milestones, like retirement or to pay for costly health care expenses, benefits end up costing employees more or become lost opportunities.

As workplace financial educators, we often see the mistakes employees make with their benefits after it’s too late. Mistakes are common because employees are either unaware of or misunderstand their benefits. Here are the five most common mistakes we see.

Benefits, in the scheme of everyday life, can help employees not only meet milestones and pay expenses but also build wealth. If you’ve seen mistakes that cost employees, share them with us. As plan providers, you can educate them on common mistakes, so they can maximize their benefits. If you would like a worksheet you can share with your clients and their employees, e-mail us at [email protected].

We’ve all heard that we learn more from our failures than our successes.

But is that really true? Recent research demonstrates the opposite to be true—that there is actually a tremendous amount we can learn from our success. And, further, that leveraging our successes can create major, systemic change and transform cultures within organizations, often in relatively short amounts of time. In their best-selling book, Switch, Chip and Dan Health call these successes “bright spots” and draw upon large scale research studies to show the impact of studying and replicating success.

We’ve seen the same thing from a benefits communication and education perspective: Most employers have experienced major successes in their benefits communication. Maybe not consistently, but if they go back over the last few years they can identify campaigns that really engaged employees, significantly increased participation in benefit programs, and really helped employees better manage their benefits. In some cases, the campaigns may have been so successful they took on a life of their own—becoming viral and even institutionalizing themselves into a culture as an annual event or contest.

When we work with employers, we recommend they examine their best campaigns and initiatives—starting with benefits communication and planning but expanding into overall HR initiatives to determine what the successful programs have in common. In every case where our clients have gone through this exercise, they’ve been able to identify common themes. In some environments, a sense of community is extremely important. Therefore, creating a forum where employees actively participate in the dialogue and interact with each other is vitally important. For others, it’s about target marketing—getting the right groups the right information in the right way at the right time so the communication has a highly personal feel. In other cases, it’s about repetition and making it part of day to day communications and ultimately the culture of an employer group—or even making it part of employee identity. Of course there are always those environments that are all about fun—where employees work incredibly hard and can become burned out and immune to communications because they simply don’t have the energy or enthusiasm to look at one more thing. In these environments, it’s about creating special occasions and events that are fun and allow employees to get their minds completely off work and focused for a moment on themselves and what they need to do to maximize the benefits they have in order to achieve their most important life goals.

At the end of the day, every company is different, but you can almost always find a pattern in your success, and then use these patterns as your roadmap in developing new campaigns that will resonate with your employees. Over time, you’ll end up developing a brand and culture associated with your benefits communications that differentiates your company as an employer of choice and creates a more cohesive (and ideally a more fun) working environment.

What exactly is an unbiased workplace financial wellness program? Companies interested in providing one need to understand the essential components of this new workplace benefit. Behavioral finance expert Dr. Scott Spann explains how using the right success metrics, services, and customization can result in both financially healthier employees and an increase to the companies’ bottom line.

Can you guess which employees are the most financially stressed? Research shows that 55% of lower to middle income mothers have “high” or “overwhelming” levels of financial stress. Thankfully, many of them are turning to their workplace financial wellness programs to help reduce their level of financial stress. Learn more about how these valuable initiatives are helping female employees thrive.