The ROI of Workplace Financial Wellness

October 19, 2016

How much money can a highly effective financial wellness program save your organization? The answer, for most large companies, is well into the millions — and that’s focusing on the costs that are easiest to measure: wage garnishments, absenteeism and utilization of FSAs and HSAs. With additional analysis, companies can also measure the savings from reductions in healthcare costs and delayed retirement. Modeling and survey research can benchmark and measure improvements in employee engagement, productivity, retention and morale. While the most toxic effects of unchecked financial stress, like embezzlement, workplace violence and a culture of negativity, are nearly impossible to calculate, it’s intuitive that reducing financial stress would also reduce those problems.

The Starting Point for Calculating ROI: Financial Finesse’s Predictive Model

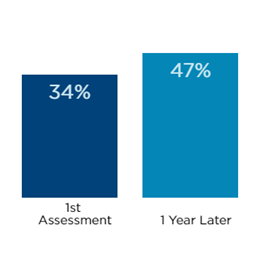

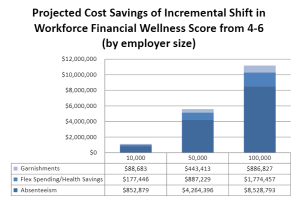

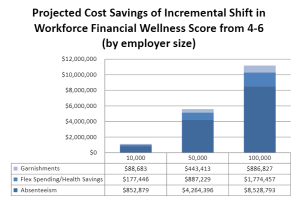

The national average financial wellness score is 5, based on Financial Finesse’s 0-10 financial wellness scale which benchmarks each employee’s financial wellness based on an online assessment. A Workforce Financial Wellness Assessment™ aggregates and analyzes this data on the company level. The chart to the left shows the projected costs savings of an incremental shift in the median workforce financial wellness score from 4-6, which has the potential to save a large employer of 50,000 employees approximately $5.6 million a year.

The national average financial wellness score is 5, based on Financial Finesse’s 0-10 financial wellness scale which benchmarks each employee’s financial wellness based on an online assessment. A Workforce Financial Wellness Assessment™ aggregates and analyzes this data on the company level. The chart to the left shows the projected costs savings of an incremental shift in the median workforce financial wellness score from 4-6, which has the potential to save a large employer of 50,000 employees approximately $5.6 million a year.

The cost savings illustrated in the above chart are simply a starting point of what is easy to measure — the tip of the iceberg of a much more in-depth analysis that needs to be done to more accurately calculate the true financial impact.

A strong behavioral-based financial wellness program drives results in areas that are much more strategically important to the success of your organization, such as:

- Reducing health care costs;

- Reducing delayed retirement costs, with the greatest gains here among employees working in highly physically or mentally tasking jobs where a small decline in their desire or capabilities to do the work can put their own well-being or the well-being of others at risk; and

- Recruiting, retaining and engaging employees

Healthcare Cost Savings

A 2014 study from the American Psychological Association reports that 64 percent of those surveyed cited money as a significant source of stress, and that Americans are paying for this stress with their health. Financial stress has been attributed to decreased employee productivity, increased absenteeism and increased employer healthcare costs.

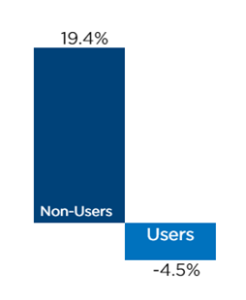

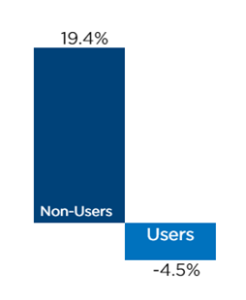

Financial wellness programs are correlated with lower healthcare costs. Our own study of a Fortune 100 healthcare company found that employer healthcare costs associated with employees who used the company’s financial wellness program actually decreased by 4.5 percent, while the costs associated with employees who never used the program increased by 19.4 percent. This equated to a cost savings of $271.50 per employee. If a 50,000-life employer experienced the same cost savings by offering a comprehensive workplace financial wellness program, it could save the employer over $13.5 million a year.

POTENTIAL ANNUAL HEALTHCARE COST SAVINGS

$271.50 (net healthcare savings per employee)

$271.50 (net healthcare savings per employee)

X 50,000 (average number of employees)

= $13,575,000

Reducing Costs of Delayed Retirement

Employees today are woefully underprepared for retirement, with only 21 percent indicating they are on track to achieve their income goals in retirement according to recent research from Financial Finesse. As employees progress through the late career cycle, those who are underprepared may have to delay their retirement for financial reasons. This has repercussions throughout the company in terms of increased health and disability costs as well as the velocity of talent development. According to the Transamerica Center for Retirement Studies®, 65 percent of Baby Boomers either plan to work past age 65 or do not plan to retire at all. For every year an employee who would like to retire delays retirement for financial reasons, the employer faces estimated additional costs between $10,000 and $50,000.

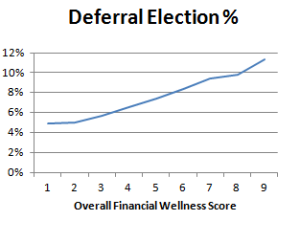

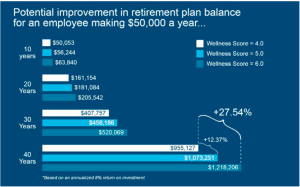

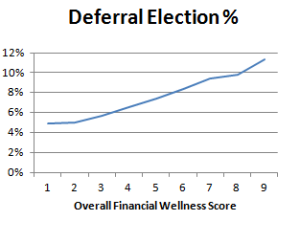

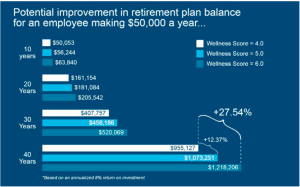

Our research shows that as employee’s overall financial wellness levels increase, so do contributions to retirement plans. Higher contribution rates reduce the likelihood of delayed retirement, since employees are more financially prepared. For younger employees, our research suggests that increases in contribution rates due to improved financial wellness could increase lifetime retirement savings by as much as 12 percent to 28 percent.

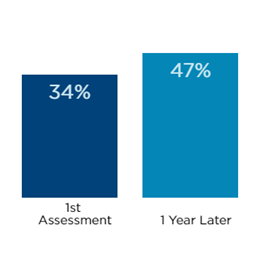

Our research also found that employees that engage repeatedly in their employer’s financial wellness program increase their likelihood of being on track for retirement—from 34 percent to 47 percent according to our findings*. For a 50,000-life employer, this 13-point improvement could equate to a $6.5 million annual cost reduction related to delayed retirement.

Our research also found that employees that engage repeatedly in their employer’s financial wellness program increase their likelihood of being on track for retirement—from 34 percent to 47 percent according to our findings*. For a 50,000-life employer, this 13-point improvement could equate to a $6.5 million annual cost reduction related to delayed retirement.

POTENTIAL COST SAVINGS FOR HELPING EMPLOYEES RETIRE ON TIME

13% (improvement in employees on track to retire)

X 10% (estimated % of workforce nearing retirement)

X $10,000 (estimated annual cost per employee for delayed retirement)

X 50,000 (average number of employees)

= $6,500,000

*Data based on study conducted for Fortune 100 employer using Financial Finesse’s services. Individual company results may vary.

Recruit, Retain, and Engage Top Talent

According to the 2016 Deloitte Millennial Survey, two-thirds of younger employees plan to leave their current job by 2020, with 25 percent saying they plan to leave in less than a year. Turnover costs companies money. Citing the research of W. F. Cascio, the SHRM Foundation’s report, Retaining Talent, indicates that “…direct replacement costs can reach as high as 50 percent to 60 percent of an employee’s annual salary, with total costs associated with turnover ranging from 90 percent to 200 percent of annual salary.” That puts costs anywhere between $45,000 and $100,000 when replacing an employee making $50,000 a year. A 2016 Paychex survey found that approximately 70 percent of employees cited low pay as a reason they have left or would leave a job, and 45 percent said they have or would leave due to a lack of benefits.

In our experience, most employees are dissatisfied with their pay and benefits because they haven’t fully maximized the value of what their company offers. They leave thousands (in some cases tens of thousands) of dollars on the table annually by not taking advantage of free or low-cost benefits such as company matching programs, discounted voluntary benefits, health and wellness benefits, and the small benefits that add up over time like commuter benefits, free parking, tuition reimbursement and others. The money they are foregoing could be the difference between sinking deeper into debt and proactively saving towards key financial goals.

Consider a scenario where a 50,000-life company with a 10 percent turnover rate institutes a comprehensive workforce financial wellness program. If that program resulted in 50 fewer employees leaving the company (i.e., a 1 percent reduction in the turnover rate), it could equate to over $2.2 million in annual savings:

POTENTIAL COST SAVINGS BY REDUCING TURNOVER

1% (projected reduction in employee turnover)

X 10% (turnover rate of employees)

X $45,000 (estimated net cost to replace employee)

X 50,000 (average number of employees)

= $2,250,000

Measuring Your Organization’s ROI

Using Financial Finesse’s predictive model, companies can set research-based benchmarks for their financial wellness program, customized to their employee demographics and financial wellness levels. This starts with a Workforce Financial Wellness Assessment™ to determine the median levels of employee financial wellness and financial stress, followed by implementing optimal outreach based on your workforce demographics. Improving median financial wellness is a process that takes time – there aren’t instant fixes that happen in one quarter. Companies can integrate data based on key measurement variables and benchmark results on a year-over-year basis. For the hypothetical 50,000-employee company discussed here who implements a comprehensive workplace financial wellness program according to industry best practices, pulling all those results together could result in total cost savings of nearly $28 million.

| Garnishments |

$ 443,413 |

| FSA/HSA contributions payroll taxes |

$ 887,229 |

| Absenteeism |

$ 4,264,396 |

| Health care |

$ 13,575,000 |

| Delayed retirement |

$ 6,500,000 |

| Turnover |

$ 2,250,000 |

| Estimated Total |

$ 27,920,038 |

The national average financial wellness score is 5, based on Financial Finesse’s 0-10 financial wellness scale which benchmarks each employee’s financial wellness based on an online assessment. A Workforce Financial Wellness Assessment™ aggregates and analyzes this data on the company level. The chart to the left shows the projected costs savings of an incremental shift in the median workforce financial wellness score from 4-6, which has the potential to save a large employer of 50,000 employees approximately $5.6 million a year.

The national average financial wellness score is 5, based on Financial Finesse’s 0-10 financial wellness scale which benchmarks each employee’s financial wellness based on an online assessment. A Workforce Financial Wellness Assessment™ aggregates and analyzes this data on the company level. The chart to the left shows the projected costs savings of an incremental shift in the median workforce financial wellness score from 4-6, which has the potential to save a large employer of 50,000 employees approximately $5.6 million a year. $271.50 (net healthcare savings per employee)

$271.50 (net healthcare savings per employee)

Our research also found that employees that engage repeatedly in their employer’s financial wellness program increase their likelihood of being on track for retirement—from 34 percent to 47 percent according to our findings*. For a 50,000-life employer, this 13-point improvement could equate to a $6.5 million annual cost reduction related to delayed retirement.

Our research also found that employees that engage repeatedly in their employer’s financial wellness program increase their likelihood of being on track for retirement—from 34 percent to 47 percent according to our findings*. For a 50,000-life employer, this 13-point improvement could equate to a $6.5 million annual cost reduction related to delayed retirement.