Should You Pay Your Mortgage Off Early Or Keep The Tax Deduction?

March 27, 2018I recently received a question after one of my workshops from a woman who was wondering if she made a mistake paying her mortgage off early because she no longer has the mortgage interest deduction. I can’t tell you how many times I’ve gotten different versions of that same question (including after a later workshop session that same day). Here are several reasons why this is a classic case of letting the tax tail wag the dog:

1. The interest decreases as a percentage of your mortgage payment. When you first take out a mortgage, most of your payments are interest, so most of what you pay is deductible. However, the interest portion steadily declines so that by the time your mortgage is almost paid off, your payments are mostly non-deductible principal anyway.

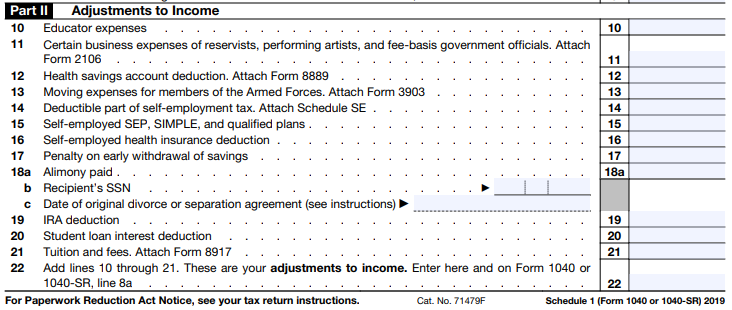

2. The mortgage interest deduction may not benefit you as much as you think. In fact, it may not benefit you at all. As an itemized deduction, it only helps you to the degree that your itemized deductions exceed your standard deduction since you only get whichever one is higher. Considering that the standard deduction is now $12,000 per person (or $24,000 for a married couple), AND the income and property tax deduction is limited to $10k per year, many people will fail to qualify for itemized deductions going forward, even if you have many years to go on your mortgage.

Even if you do itemize, your taxable income is only reduced by the difference between the two. If your itemized deductions are $100 more than the standard deduction, that mortgage interest is only reducing your taxable income by $100.

3. The cost of the interest is always more than the tax savings. Let’s assume that you have $15,000 in mortgage interest (not just payments) and all of that exceeds your standard deduction. Even if you’re in the top 37% tax bracket, you’d still be saving only $5,550 in federal income taxes. Does it really make sense to pay $15,000 to save $5,550?

That all being said, there are some good reasons NOT to pay down your mortgage early. They just (mostly) have nothing to do with taxes. All of the following should be considered higher priorities:

Reasons NOT to pay down your mortgage early

1. You don’t have adequate emergency savings. An emergency fund can help you make those mortgage payments even when you’re in between jobs. Don’t rely on a home equity line of credit for that. Your line of credit might get canceled, especially when the economy is weak or you’re unemployed, which is exactly when you most need it.

2. You’re not contributing enough to get the full match in your employer’s retirement plan. It’s hard to beat a guaranteed 50% or even 100% return on your money.

3. You have higher interest debt. It makes a lot more sense to pay down a 10% credit card than a 4% mortgage. If the rates are close, don’t forget to factor in the tax deduction to reflect the true cost of the mortgage. (Student loan interest is also deductible up to $2,500 per year.)

4. You’re eligible for HSA contributions and haven’t maxed it out. Contributing to an HSA is the most tax-advantageous thing you can do since the money goes in pre-tax and then can be used tax-free for health care expenses. If you’re in the 24% tax bracket, you can save 24% on your HSA contributions and earnings that you use for health care expenses. The only catch is that you must have an HSA-eligible health insurance plan to contribute (although you can still spend the funds if you switch to a lower deductible plan in the future).

5. You can earn more by investing your extra money instead. To be on the safe side, I like to assume you’ll average about a 3% return if you’re very conservative (20-40% in stocks), 4% if you’re moderately conservative (40-60% in stocks), 5% if you’re moderately aggressive (60-80% in stocks), and 6% if you’re very aggressive (80-100% in stocks). If your mortgage interest rate is less than that, you’re probably better off investing your extra savings. If you’re investing in a tax-sheltered account like a 401(K) or IRA, the tax benefits cancel out the mortgage interest deduction.

Depending on your situation, paying off your mortgage early may not be a good idea. (At retirement is a different story.) But it’s seldom because of the tax deduction.