The 8 Things That Saved Our Sanity When My Husband Went Back To School

November 08, 2017When my husband and I first made the decision that he would stop working and go back to school full-time to take accelerated classes towards a nursing career, we were both pretty excited.

Sure, there were sacrifices involved. He’d sacrifice his desire to work and have a steady income for a short time as well as give up most of his free time to studying. I’d give up some luxuries so that we could cut expenses, and I’d need to hold down the fort when he needed to study, especially around exam time.

The thing we didn’t anticipate

What we did not really think about was some of the stress that came with our decision. Now, if you are superman or superwoman and you can do all things, that is awesome! I admire you! I have friends like that, but sometimes, I can’t find my cape. So, if you find yourself in a similar situation as us and you aren’t feeling superman-ISH and superwoman-ISH, I’m here to help you.

Here are some things that have helped us keep our sanity along the journey.

1. Control the emotional rollercoaster. Talk about your concerns and remember that you are both making sacrifices, so you’re in this together, fighting on the same team. It makes the journey so much better if you don’t spend your time arguing.

2. Be prepared to experience hiccups along the road. The spouse going to school is human and may not get an A+ on everything and may need to repeat a class. If you’re the one in school, don’t give yourself a hard time about that. If your spouse is in that situation, give him/her some grace.

3. Stick to a realistic budget. All work and no play is just boring and it’s not sustainable over a long period of time. Create a monthly spending plan, so that adjusting to your new level of income won’t leave you with more bills than money at the end of the month. It also will keep you from being disappointed when you aren’t able to conquer the world like you used to.

For instance, you may not be able to ramp up your savings of your own or for your kids’ college education during this time. This may not be the best time to accelerate your student loan payments either. Just remember that this is a temporary situation.

4. Get a head start and at least create a plan you can tackle once you are back to two incomes. That really helps us when we get to feeling stressed.

- You can organize your debt and figure what to pay off first

- Calculate how long it will take you to pay off your debt

- Find out how much you need to save towards your kids’ education

- Figure where you on on saving for retirement

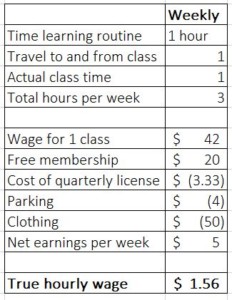

5. Have an outlet for you both. Remember, neither of you are robots. You need an outlet. I cut back on getting my hair and nails done as frequently and signed up for a personal trainer at the gym. (Best shape I’ve ever been in, by the way, and it’s a stress reliever.) Find budget friendly gyms in your area. Facilities like YouFit and Planet Fitness have great deals for gym memberships on a budget. Or sometimes you can get corporate discounts for gym memberships simply because of where you work. Check with your employer to see which gyms might offer additional perks.

My husband is an avid car lover and found his outlet by working part-time at a friend of the family’s mechanic shop. DOUBLE WIN! He had an outlet and we had additional cash to go enjoy ourselves!

6. Don’t overthink dating, JUST DATE! Everything you do does not have to be over the top or complicated. Walking around the lake or park, holding hands and talking doesn’t cost a penny…Well, except for the gas you use on the way if you have to drive, but you get the point. Groupon is your friend. Try a new experience together.

The point is that consistent dates are important. Most of what I read says you should go on a date once a week. Wow! We have a 2-year-old and are still working on the consistency part. Like I said, I’m not superwoman.

7. Give yourself some grace about household chores. If it’s been a long day with work, school and the kids, consider leaving the dishes in the sink until tomorrow, or letting the dishwasher do the job.

If the thought of that makes you stress out, and you can find room in your budget, consider hiring a maid. You can have the maid service twice a month, once a month, whatever you can afford. Added bonus: You can still take credit for the clean house. Hey! You did the leg work to hire some help.

A lot of people have had a maid at some point, so you may be able to get a referral from a friend, family member, or co-worker. You can even check out Angie’s List. Don’t forget you might find a deal on Groupon, too.

8. Get help before things get out of hand. If you find it challenging to talk and your marriage is on a very rocky road, consider marriage counseling with the pastor at your church or seeking marriage counseling outside of church. Be sure that you and your spouse can both relate to, and feel comfortable opening up to the counselor.

Another option is to check with your employer. Many companies offer free/discounted counseling services to their employees through an Employee Assistance Program (EAP).

Keep the end-game in mind

The most important thing to remember is that your decision is going to better position your family to live the way you really want to in the long run. For us that means a number of things like more family time, and an overall better quality of life. Stick together, keep the end in mind and remember all your sacrificing will soon pay off.

And for those of you who listen to TD Jakes: Just remember these are light afflictions during a short time in our lives.

Want more helpful financial guidance, delivered every day? Sign up to receive the Financial Finesse Tip of the Day, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.