4 Different Ways To Rebalance Your 401(k)

July 05, 2018

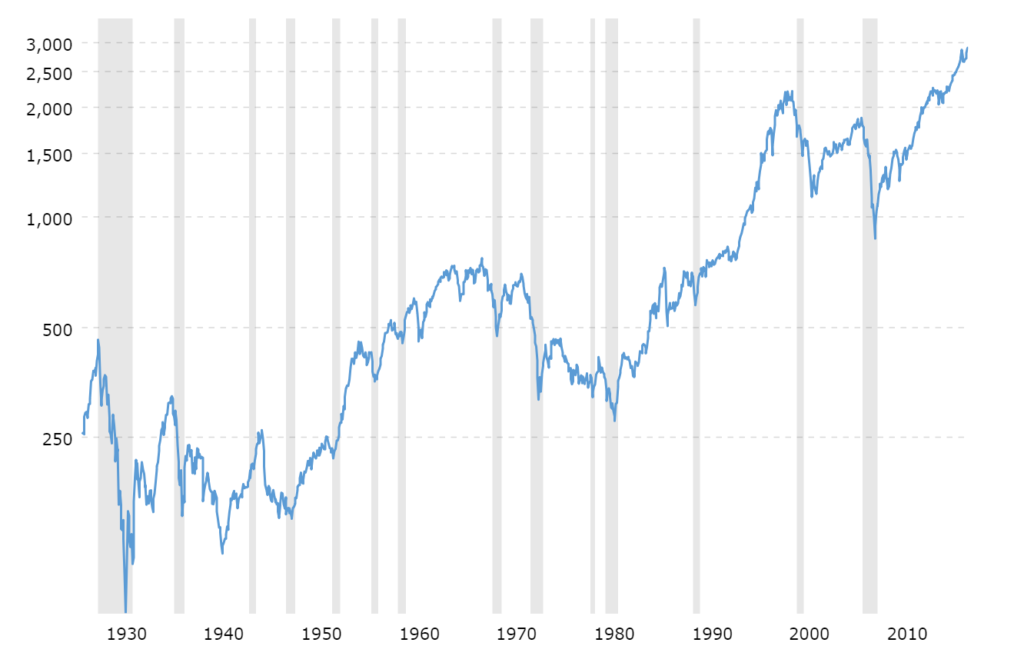

When the stock market starts going wild, it can cause you to second guess your investment choices in your 401(k). Perhaps all those aggressive funds that made you so happy these past few years are letting you down. You could ignore this roller coaster and focus on your financial life goals and maybe you should…or maybe you shouldn’t because that sick feeling in your stomach every time you look at your statement is trying to give you a message: you may need a portfolio rebalancing strategy.

What is rebalancing?

Everyone loves a mutual fund winner and dislikes a losing investment. It’s natural to want to keep funds that have increased in value and to sell out of funds that have fallen in value, but that can be a losing strategy. Rebalancing turns that natural tendency on its head. It means periodically selling a portion of the funds which have gone up, then buy more shares of your funds which have gone down to maintain your target mix of investments over time.

Rebalancing helps you buy low and sell high

Rebalancing back to a target mix of investments helps you keep the level of risk in your portfolio stable by taking some profits from those funds that are now taking up more space in your portfolio than originally intended – usually because they grew in value – and buying more of the funds that are now taking up less space than you intended, possibly because they fell in value.

Since stocks, bonds and other investments tend to move up and down at different times, implementing a regular rebalancing strategy with a diversified portfolio mix helps you “buy low and sell high” over the long haul. (In a tax-sheltered account like a 401(k), selling profitable shares to rebalance doesn’t have any tax consequences. However, keep in mind that rebalancing in a taxable investment account could generate short-term and long-term capital gains.)

Start by defining your target investment mix

Let’s say you were going to take a vacation in Europe. You’d plan your itinerary in advance, choosing which countries you’d like to visit, what sites you’d like to see, how you’ll get there, how much you plan to spend, etc. When you actually go on your trip, you may find that things change along the way that cause you to adjust your plans – a delayed flight, lost luggage, bad weather, etc. Then you have to adjust.

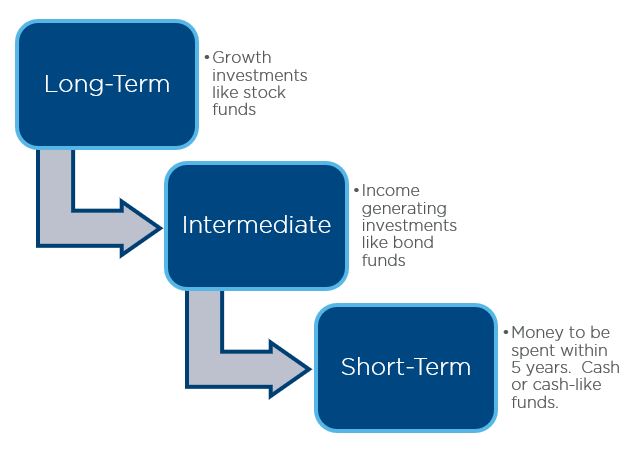

Investing is the same. First, you put together your itinerary, called your “asset allocation” strategy in investment jargon. Asset allocation is how you split up your savings between different types of investments such as stocks, bonds, real estate and commodities.

By diversifying your investments, you minimize the risk that they will all fall in value at the same time. For example, a 35-year-old who’s got 30 years to go until retirement and a moderate risk tolerance might target a mix of 60% to 70% in stocks and 30% to 40% in bonds.

How to create an asset allocation strategy

Don’t have an asset allocation strategy? Start by completing this risk tolerance assessment and following the guidelines for your risk profile. You can also use this calculator to develop a basic strategy and this worksheet to put together something more detailed.

Four ways to rebalance

Once you’ve begun your investing trip, you may find that there are unexpected detours along the way like a stock market downturn or interest rate cuts that cause a bond rally. Don’t let them throw you off your plan. Here are four ways to rebalance your investment mix to get back on track:

1. Rebalance according to the calendar

How it works: With calendar rebalancing, you pick a regular date where you will rebalance your investments to their target weights. Sell enough of what’s gone up to get back to the target weight and buy more of what’s gone down. You could do this monthly, quarterly, semi-annually or annually, but don’t forget to do it at regular intervals over a long period of time.

Many 401(k) plans have begun to offer automatic calendar rebalancing features at no additional cost, so research if your plan has one. You may also have access to “hands off” investment strategies like target date funds or asset allocation funds, where rebalancing is handled by the fund manager and you don’t have to worry about it.

An example: John is trying to maintain a constant mix of 65% stocks, 25 bonds and 10% real estate. He begins the year with a $10,000 balance, so he puts $6,500 in a stock fund, $2,500 in a bond fund and $1,000 in a real estate fund. He plans to rebalance his investment mix on the last business day of each quarter.

At the end of the first quarter, his balance is higher at $10,300 but the percentages have changed:

Stock fund $6,386 (62%)

Bond fund $2,678 (26%)

Real estate fund $1,236 (12%)

To rebalance his portfolio, John will sell $103 of his bond fund and $206 of his real estate fund and buy $309 of his stock fund. If he has enrolled in the automatic rebalancing feature in his 401(k) plan, it would happen automatically on the scheduled date.

2. Percentage of portfolio rebalancing

How it works: Not sure you want to rebalance that strictly? Percentage-of-portfolio rebalancing involves setting a tolerance band stated as a percentage of the portfolio’s value. When an investment falls below or rises above the tolerance band, it triggers rebalancing back to your target asset allocation for the entire portfolio.

An example: A 40% weighting in bonds with a +/- 5% tolerance band means that bonds could make up between 35% and 45% of the portfolio without rebalancing. If they rise to become 46% or fall to 34% of the portfolio, that triggers rebalancing of all the investments back to their target percentages.

It’s best to do some research when setting the tolerance band. Too narrow means normal market volatility will lead to excessive rebalancing and too wide makes it easy to take on extra risk. You’ll also need to check the percentage weights at regular periods to see if the need to rebalance is triggered. Percentage of portfolio rebalancing is a strategy that requires more frequent market monitoring, so it’s best for a more “hands on” investor.

3. Constant proportion portfolio insurance (CPPI)

How it works: Do you have an amount below which your portfolio must not fall? Consider a constant proportion portfolio insurance (CPPI) rebalancing strategy. Stock holdings are held to a constant proportion of the predetermined cushion – the difference between the total portfolio value and the floor value:

Target investment in stocks = target proportion × (current portfolio value – floor value).

CPPI rebalancing is expected to do well in bull markets, when the increasing cushion leads to purchasing more stocks. It could also be helpful in bear markets because when the cushion is zero, there are no holdings in stocks. In a volatile market with frequent reversals of short term trends, however, CPPI tends to underperform.

An example: Let’s say Susan has already saved $500,000 towards her goal of retiring in 5 years. Based on her conservative risk tolerance, it’s important to her to maintain at least a $450,000 value in her 401(k). She is comfortable putting 60 percent of her surplus over her floor value in stocks.

Target investment in stocks = 60% x ($500,000 – $450,000) = $30,000

At the end of year one, the total portfolio value is $510,000.

Year 2 Target investment in stocks = 60% x (510,000 – 450,000) = $36,000

Year 2 turns out to be a recession and horrible year for investors. Susan’s stock index fund has a 40% negative return and her bond funds lose 10 percent. Her total portfolio value is now $448,200.

Year 3 Target investment in stocks = 60% x ($448,200 – $450,000) = $0

4. Rebalance with future contributions

How it works: As an alternative to selling some investments which have increased in value and buying more of what has decreased, you could add more cash to your portfolio to buy more underweighted shares. For taxable accounts, this is a more tax-efficient strategy since you won’t incur capital gains by selling any shares.

In a tax-sheltered 401(k) plan, this would mean changing the investment mix of your future contributions so that you’re buying enough of the underweighted fund to get you back to your target percentage.

An example: Taylor began the year with a $100,000 portfolio and a target investment mix of 70% in stocks and 30% in bonds. At the end of the year, Taylor’s portfolio is worth $120,000: 78 percent in stocks and 22% in bonds. She plans to contribute $10,000 this year. In order to move towards her target 70/30 asset allocation, she would need to allocate all of her $10,000 contribution towards buying the bond fund.

The downside of trying to rebalance with new money in a 401(k) plan is that it may not be a perfect recalibration. Depending on the size of your balance, the amount you’re contributing may not be sufficient to fully rebalance. There’s also the risk that the markets could continue in the same direction.

Which rebalancing strategy is right for you?

What’s the best rebalancing strategy for your retirement journey? It depends on your risk tolerance, how “hands-on” or “hands off” you are with your investments, and whether you have perseverance to stick to it consistently over a long time period. Finally, don’t forget to check with your 401(k) provider as many have automatic rebalancing options available or offer fixed asset allocation funds where the rebalancing is done for you.

Learn more about rebalancing

Interested in learning more? New investors can try this free online course from Morningstar. More experienced investors may enjoy this Vanguard brief on best practices in rebalancing. The quantitatively-inclined can check out this article from the CFA Digest.