Why It Irks Me So Much When People Joke About The Lottery As Their Retirement Plan

September 04, 2018You don’t have to work as a financial planner long before someone jokes to you that their retirement plan is to win the lottery. I have a reputation of being an irreverent smart aleck, so this shouldn’t bother me – but it does. Here’s why.

Reason #1: The math

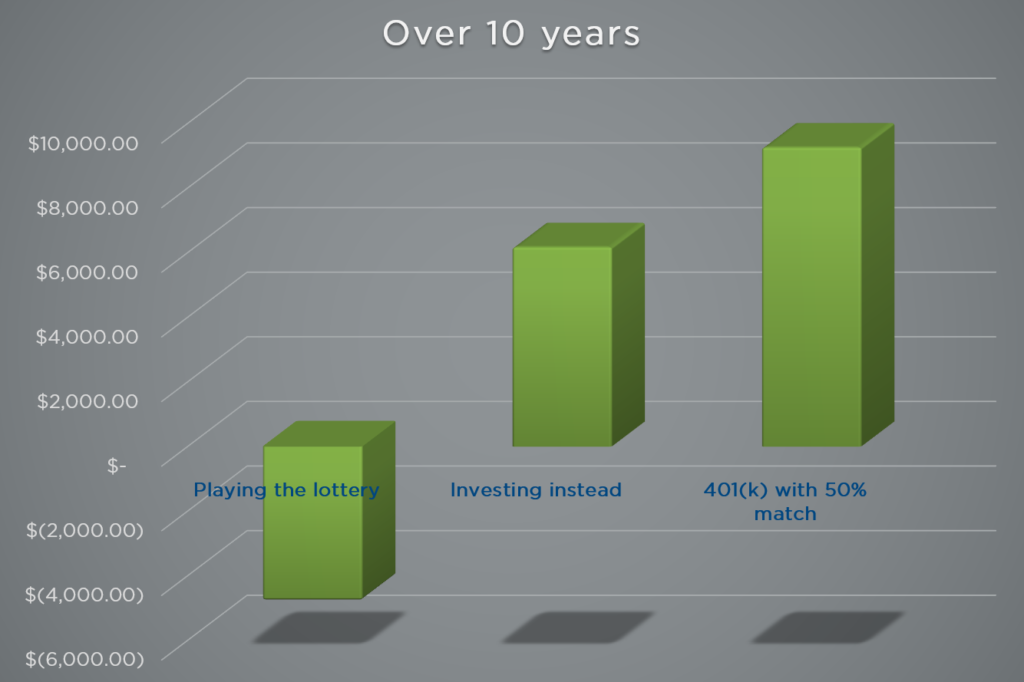

The first reason is just the simple math. If you spend $10 a week on lottery tickets (which is 260 chances to win if you’re buying five $2 tickets per week), that adds up to $520 a year. Granted, some of those tickets will win so let’s assume you win $4 nine times and $7 once for a total of $43 throughout that year. Adding it up, your lottery tickets cost $520 – $43 = $477. If you do this for 10 years, you would have spent $4,770.

If instead you put that $477 per year into a mutual fund that earned an average 5% per year over those same 10 years, you would have $6,000. Taking it up a notch, let’s imagine you put that $477 into your 401(k) and got a 50% match. In that scenario, after 10 years you would have $9,000. Playing leads to a loss of $4,770 and investing leads to an account worth $6,000 to $9,000.

Reason #2: The dangerous money mindset

The second thing that bugs me even more is the mindset that often goes along with playing the lottery. To me it is a dangerous one — it’s the mindset that says: I’m never going to get ahead anyway, so in order for me to retire, I need to “get lucky.”

This takes the responsibility and accountability toward an individual’s own future and pins it on some unseen force that is out of their control. What irks me is that preparing for a comfortable retirement is, for the most part, 100% in the control of the everyday worker.

Sure, life throws curveballs and it’s tough to juggle the competing priorities of today versus the future, but at the end of the day, everyone is in control of their own money habits and if you have $10 per week to buy lottery tickets, then you definitely have $10 per week to save for your future.

What it really takes to retire comfortably

I’m really close to my 30-year anniversary in the financial planning industry, which means that I have talked with literally tens of thousands of people. With very few exceptions, the people who were in a position to retire did the following:

- Spent less than they made

- Invested their savings in things like their 401(k), income producing real estate, a business, etc.

- When they did take on debt, they paid it off as fast as they could

- They monitored their spending and investments at least once a quarter

While some of these people may have “gotten lucky” and bought Apple or Alphabet 20 years ago, or bought an investment property that really did well, they still followed these same 4 steps. And that’s what really matters.

Take control of your financial future today by working toward the steps that are proven to work, no luck required.