Financial Rules of Thumb: The 50-30-20 Rule

February 05, 2025One way to measure whether or not a particular expense or goal fits into your spending plan is to measure it against your existing financial goals and commitments. A popular way to look at this is called “The 50-30-20 Rule.”

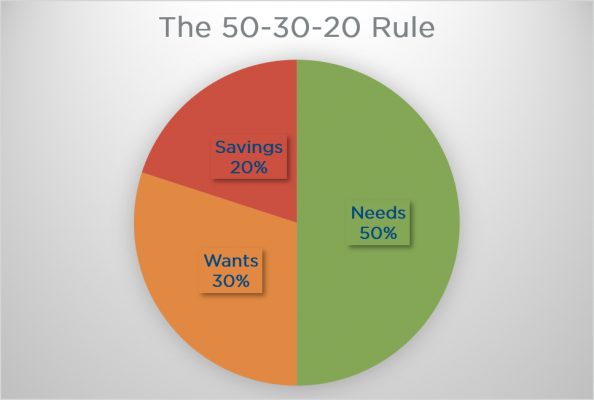

The 50-30-20 Rule

The rule basically says that one way to achieve financial security is to limit your fixed expenses (or needs) to 50% of your after-tax income, your discretionary expenses to 30%, and setting aside 20% toward your goals. Let’s break that down by type so you can see what we mean.

50% to “needs.”

Examples of things that fit in this category include:

- Housing

- Transportation

- Food

- Clothing

- Utilities

- Healthcare

One part of this rule that’s often debated is how much of these categories are true needs versus wants (or discretionary spending). Let’s take the purchase of a vehicle as an example. How much you spend on a vehicle can vary widely. For many people, having a vehicle is a need. They need it to get to work and earn money to pay bills. On the other hand, plenty of people live in big cities who get by just fine without this “need!” Likewise, we all need food to live and clothing to avoid being arrested in public. However, spending on these two categories very easily bleeds over to wants.

Making trade-offs

So you have to be honest with yourself about whether the things you’re putting in this category are absolutely vital to your life or if part of the expense could be classified as a want. Maybe another way to think of it is as a trade-off — it’s fine to spend more on housing if having a more expensive place is important to you; it just means you’ll need to spend less on a car to make it balance.

30% to “wants.”

Examples here include:

- Entertainment, including cable

- Dining out

- Gym membership

- Hobbies

- Personal care beyond the basics

- Cell phone beyond the basic plan

As you can see, the rules can be tricky, so you have to be honest with yourself. Most of us need regular haircuts to maintain a decent appearance. However, spending on a pricey salon cut goes above and beyond, so it belongs in this category.

20% to goals

This category obviously includes savings (including what you put into your retirement account at work) and includes debt payments. So if you’re paying $250 per month on a student loan, that counts toward your 20%.

Tying it all together

Remember, this rule is meant to be a guideline, particularly when you’re just getting started and have no idea what you should be spending on things like rent or a car payment. But it can also offer insights into areas where you may need to cut back. For example, if you run your own numbers and find that your needs far exceed 50%, it may be time to think bigger picture about making some changes – do you need to sell your car for a cheaper payment? Think about moving to lower housing or transportation expenses?

This rule can help show you whether or not you can afford to add a new want into your life. If your wants are way beyond 30%, that definitely means that you can’t afford to add a payment for something like a boutique fitness membership, cleaning service, or upgraded cable package to your life at this point.