Waited Too Long To Start Saving For College? Here’s An Alternate Idea

December 04, 2018I often speak to parents who feel guilty because they don’t feel they’ve done an adequate job of saving for their child’s education. Like a lot of folks we work with, they graduated with their own student loans, maybe got married, took out a mortgage, had children, paid daycare expenses, had unexpected setbacks, helped their aging parents, and so on, and so on. Saving for education never rose to the top of the priority list.

Time to get serious is often too late

Now that their child is in high school, they know they need to get serious about saving for college expenses, and they’re disappointed when they learn there is no magic investment out there which guarantees a 20% rate-of-return with zero risk to catch up and close the savings gap. One recent caller I spoke to would need to save $1,200 per month to meet the goal. She was so worried about the heavy burden of student loan debt on her child’s shoulders that she was willing to cannibalize her own retirement account to make it happen.

Rather than feeling guilty and jeopardizing your own future, I ask that you consider a mind shift….

An impactful alternative to paying for college

If you can’t offset the tuition and costs of their education today without a major change to your current situation, why not help them get a jump start on their retirement instead, and have your child take out loans for college? Bear with me here: what if instead you could contribute $1M or more to their retirement nest egg at a much lower annual cost than college?

It’s totally possible. Consider the following hypothetical…

If your 16-year-old teenager works just 15 hours per week at the federal minimum wage, he/she will earn about $5,655 in gross wages in a year. Now what if you and your teenager agree to invest $5,500 in a Roth IRA in their name, the maximum allowed for 2018? Then, make the commitment to invest a total of $5,500 each year (about $459 per month) until your child graduates college as incentive (assuming he/she continues to work and earn at least $5,500 per year).

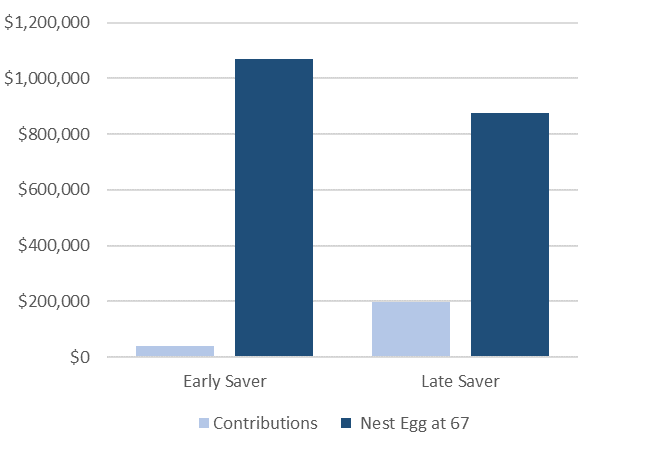

Assuming graduation at age 22, the total deposits to your child’s Roth IRA after 7 years would be $38,500. Assuming a 7% average return, it would be worth about $47,500 by the time they graduate college. (That might be the equivalent of 2-3 years of college education!)

Now let’s assume no additional deposits or withdrawals. Assuming a 7% average return over the years, the Roth IRA could grow to about $1,026,000 by age 67. Even better, the withdrawals would be tax-free since the funds are in a Roth IRA.

That’s the power of time and compounding.

Now assume your child waits until age 32 (maybe after all of their student loans are paid off) to start getting serious about their own retirement savings. They start saving $5,500 per year every year until retirement at 67. That makes total deposits of $198,000 for 36 years and, at 7%, it would only grow to about $876,356.

That’s the impact of procrastination.

While I’m not suggesting that your child’s retirement should take precedence over education funding, these examples give insight into an alternative way to help your child build a solid financial foundation early on by leveraging the power of time and compounding.

Another benefit to this strategy is that a Roth IRA is not counted as a spendable asset on the FAFSA.

Other ideas if you can’t afford to max out a Roth IRA

If you can’t invest the maximum contribution to a Roth IRA, consider a lesser amount to get them started. Another option is to introduce them to the concept of a “match” by matching any contribution they make with your own contribution dollar-for-dollar. You could even encourage relatives to gift dollars for Roth IRA deposits as well, as long as you don’t exceed the current limit of $5,500 and as long as your child has earned income to match the deposits.

The point is to get them on the track towards a secure financial future without derailing yours in the process.