How To Find A Lost Retirement Account

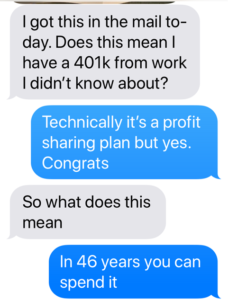

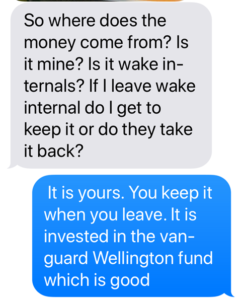

August 14, 2018This is a recent texting exchange I had with my 24-year old daughter who works in the medical field:

It got me thinking that if she hadn’t opened her statement or thought it was junk mail, would she ever know she had this plan at work? Since she’s not contributing, there’s a chance she may have never known about it, moved on to another job in the future, and missed out on potential thousands of retirement dollars in the future.

Many of us have changed companies over our careers, and I talk to people on a regular basis who think they might have an old retirement account somewhere, but have no idea how to go about tracking it down. Are you certain that you know where all of your old retirement plans are?

Here’s how to find an orphaned retirement account

First the easy steps:

- If you remember the name of your 401(k) provider (Vanguard, Fidelity, TIAA, Voya, etc.), first contact them to see if your money is still there.

- You can also contact the old employer. Look for the company online, and if it still exists, contact the HR department either by phone or email and ask them for your balance and account information.

Now the harder steps:

If the above two steps don’t yield any results, you’ll have to do a little more detective work.

- You account may have been reported as “abandoned.” To search that, visit the US Department of Labor abandoned retirement plan database. It is searchable, so if you don’t know the Plan Name or exact Company Name, you can search by City and State to narrow the results.

- Each state has an unclaimed property web site that is searchable as well – to find it, you can either search the name of your state and the term ‘unclaimed property’ or try starting here with a national database. If you have lived in multiple states, make sure you search each state’s site (and include your maiden name if appropriate).

Eureka! You’ve found something

If you are able to uncover old retirement accounts, you’ll have to take some steps to take back control. If it’s been reported as unclaimed property, go through the steps as directed to re-claim it as yours. If the money is still sitting at your old company or old plan, then getting started on re-claiming it may be as simple as updating the address on the account.

Once you’ve regained control of your account, you may want to transfer it to a place where you can keep better track going forward. Options include:

- Transferring it to a rollover IRA (or existing IRA)

- Roll it over to your existing retirement plan (if they allow rollovers)

Unless you’re over the age 59 1/2, resist the urge to just take the money and run — there are most likely tax consequences and penalties involved there, and since you didn’t know the money was out there, why not continue to “let it ride” for your future retirement? Happy searching!