The Real Income Number That Matters When It Comes To Taxes

March 19, 2018One of the things that is toughest to grasp about taxes for non-tax professionals is the difference between income (a.k.a. gross income), adjusted gross income (a.k.a. AGI), modified adjusted gross income (or MAGI) and taxable income (the amount that actually determines your marginal tax rate).

Gross income is actually (kind of) irrelevant

We all know that our gross income is really only just a number on paper. No one actually takes home the total amount of income they earn (at least no one complying with the tax laws in the U.S.), but understanding how that number translates into the amount of taxes they pay each year is a mystery that most leave to the tax geeks of the world like me and my fellow CPAs.

Unless figuring out the tax code intrigues you, there is no need to become an expert on how it all fits together, but I do think it’s important to have a general understanding of the different terms. Why? Because you’ll be able to make better financial decisions that ideally may lead to tax savings. Here are a few key concepts to better understand:

Adjusted Gross Income or “AGI”

Why it’s important:

Your AGI is the basis for several tax thresholds, including:

- Determining whether you qualify for certain tax credits

- Determining whether you can deduct medical expenses, all your itemized deductions and/or miscellaneous itemized expenses (at least for tax years 2017 and prior)

Your AGI is also the starting point for most states in figuring out your state income taxes.

How it’s calculated:

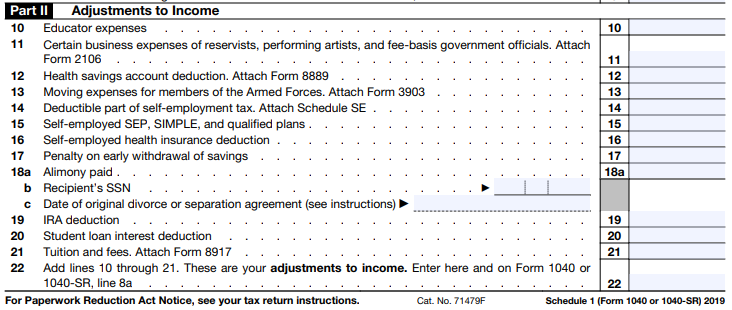

To put it simply, it’s all your income from working, investments, retirement accounts, rental property, etc. minus all the expenses considered “above the line” such as IRA contributions, student loan interest and HSA deposits. Here’s the full list from the 2021 Schedule 1, which is part of the Form 1040:

Modified Adjusted Gross Income (“MAGI”)

Why it’s important:

Your MAGI adds back some of the “above the line” deductions mentioned earlier, and determines things like your eligibility to: contribute to a Roth IRA, take a tuition and fees deduction (which was resurrected for tax years 2018 – 2020), and deduct contributions to a traditional IRA (when you have an employer-sponsored retirement savings plan, like a 401(k), available to you).

Why you should care

Here are just a few examples of reasons you should have a rough idea of what your AGI and MAGI is:

- You rule out making Roth IRA contributions because your salary exceeds the income limits, not understanding that the limit is based on your MAGI for IRAs. If you make contributions to your 401(k) at work, deposit funds to your HSA or even pay alimony, your MAGI may fall below the limits and allow you to contribute.

- You sold a stock holding that was gifted to you many years ago from a relative and the gain from the sale pushes you over the MAGI limit resulting in additional net investment income tax. If you’d known before, you could have taken steps to minimize that additional tax.

- You are retired and decide to make a last-minute withdrawal from your IRA right before the end of the year, not realizing that the withdrawal increases your AGI, subjecting more of your Social Security income to taxation.

Avoiding these situations requires careful tax planning and the assistance of an expert. But these are just examples of why we should all try to be a little more knowledgeable about how the income tax system works so that we will know when to look further into certain financial moves before we make them.

After all, who wants to pay more taxes than they have to?

Disclaimer: The author of this post is not a practicing tax professional; the content of this post is for informational purposes only and should not be construed as tax advice. Taxpayers should always consult a tax professional for tax planning services and/or tax-related questions.