Your Obsession With Being Perfect Could Cost You Six Figures

December 06, 2017As a recovering perfectionist, I feel slightly hypocritical even writing about this — perhaps I should title the post “How I’d Be Wealthier If I’d Gotten Over Perfectionism Sooner,” but either way, I need to call out something I’ve noticed more and more in my conversations with peers and colleagues who are 40 and younger. There’s an obsession with perfect that is getting in the way of a lot of things (read Brene Brown’s Gifts of Imperfection if you really want to get into it), but when it comes to money, it’s costing real dollars.

Perfect as a goal

There’s nothing wrong with striving for greatness in life, and that desire to get things “right” serves us well throughout our school years in terms of getting good grades and therefore better college and eventual career opportunities. But once we get into the “real world,” there are benchmarks we use to measure certain areas of personal finance that can mislead people who put “doing it right” ahead of all other criteria.

When it comes to your financial outlook, getting it perfect in the short term could actually lead to missed opportunities in the long-term. The worst part is that you probably won’t even know if you got it “wrong” until it’s too late. Here’s what I mean.

What is “right?”

The biggest issue here is that “right” is a moving target when it comes to things like investing, your credit score and even building a cash nest egg (also known as the emergency fund).

Investing

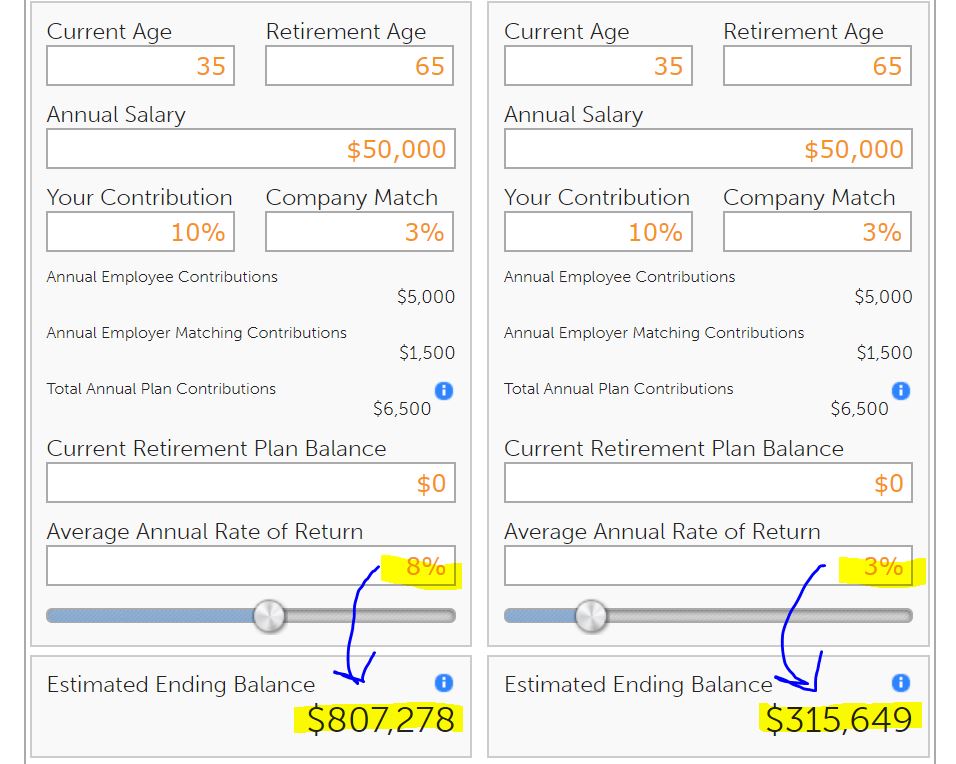

When it comes to investing, getting it “right” doesn’t actually mean you never experience a loss of value in your portfolio. If you make it through your entire career without once seeing your 401(k) balance drop, you actually got it wrong because it means you invested too conservatively and missed out on the greater growth that comes with greater risk.

It may feel better because you never had that pain of “loss,” but you’ll never actually know what you lost out on in missed opportunity. In fact, investing too conservatively over a 30 year career could literally cost you a half million or more.

When it comes to investing, there is no perfect, but generally speaking, the longer your time horizon, the more chance that taking risk will pay off. When the market drops, think of it as a buying opportunity — the cheaper you buy into your 401(k) and other investments, the better the long-term outcome. Even investing on the worst day in the market (aka going all-in the day the market peaks before an extended down period) leads to a better outcome than not investing at all — don’t wait.

Credit score

I like that people want to have a great credit score and it’s kind of cute how some of my more competitive colleagues compare scores all the time, but trying to get it perfect may actually hurt you in the long run. For example, I’ve talked with people who are hesitant to explore refinancing their debt or even apply for a mortgage because they were afraid of the “ding” from applying. What’s the point of having a great credit score if you’re not going to use it? Anything over 750 is enough, heck even 720 will be good enough to offer you great credit options. Obsess less about your score and more about these things.

Nest egg

When you’re first starting out, getting some cash in place to handle the things that come up in life like job losses, cat surgeries and car engines needing replacing (all true stories in my life) is super important. A great guideline to shoot for is 3 — 6 months of expenses, but as life goes on and hopefully cash flow becomes a little more … flow-y, it’s important to reassess that balance.

We can get to a point where we’re so used to putting cash in a savings account that we may be missing out on other opportunities for that money, whether it’s using it to increase HSA contributions, invest in something else or even pay down your mortgage faster. There is no perfect number that applies to everyone, actually. The amount you need in your nest egg depends on several things:

- job security (the more secure your job or in-demand your skills are, the less likely you’ll face prolonged unemployment)

- family situation (the more mouths you have the feed, the more you need)

- housing situation (the person who could get out of a month-to-month lease and move in with mom and dad in an instant needs less than someone who owns an historic old home in a transitional neighborhood that might take several months to sell)

- other sources of cash available (not that you want to use these things, but they can be a part of your emergency plan as time goes by)

If you find yourself the sole breadwinner with a spouse and 4 kids at home, you probably need up to a year’s worth of salary set aside, while a DINK couple (dual income, no kids) could get by with 3 months as long as they would be able to trim back on spending quite easily upon a job loss or accident.

Getting this one wrong on either side could cost you — have too little saved (perhaps because you were focused on spending money on making your house look perfect first?) and you could find yourself in serious debt or losing your home should something come up. Having too much in cash could cost you investing opportunities (see above). It’s best to re-evaluate how much you need at least every 5 years or so, and definitely when you have a big life event such as the birth of a child, significant increase in income, new home purchase or change in marital status.

Where you should try to get it perfect:

Avoiding high interest debt (or debt at all) — Interest, whether it’s tax deductible or not, is money wasted. The less you can spend on it, the easier it will be to achieve financial independence, which I view as having choices in life.

Minimizing taxes — I don’t mean spending money on mortgage interest to get a deduction, but making sure you’re taking full advantage of all tax savings opportunities. Some examples:

- Maxing out your HSA before contributing to your 401k beyond the match

- Making full use of a flexible spending account if you aren’t HSA eligible

- Properly documenting and deducting charitable contributions

- Running eligible education expenses paid out of pocket through your state’s 529 plan, if applicable

- Tracking business deductions if you have a side gig

Choosing your life partner — You won’t find a perfect human and you can’t be perfect (sorry!), but you can find someone who’s perfect for you and that makes a huge difference in your long-term finances. My CEO Liz wrote about this in her book What Your Financial Advisor Isn’t Telling You and it’s true — who you marry could be your best or worst financial decision ever.