Every Person Under Age 30 Needs To Read This RIGHT NOW

July 07, 2017Over the past few weeks I have had the opportunity to watch my oldest child graduate from college and listen to a lot of conversations among her friend group about the terror they are experiencing regarding finding their first “real job.” Not a lot has changed since my friends and I graduated, at least in the terror department! Although, things are much different in the starting salary arena.

The first thing I noticed in their conversations about what they expect is that starting salaries today are what the next-level-up-in-the-organization’s salaries were when I was starting my career. And, as my kids would tell you, back when I graduated from college I still had to walk to work eating raw food until people invented the wheel and fire. But I digress.

As I listen to these young people debate the next couple years of their lives, I can’t help but wish for some magic power that would get them to listen to me about saving money. As they ruminate over how much they’ll make and what kind of apartment they can afford, all I can think about is the tremendous opportunity they have that will slowly buy surely whittle away that they’ll never get back if they don’t take advantage: time.

The mind-blowing power of compound interest

As a number crunching financial geek, I totally understand that compound interest works exceptionally well the longer the time period. And I vaguely recall seeing examples about how much it pays to save early, so during the course of a meeting with a 23 year-old new-hire this week, I went online and found this blog from Darwin’s Finance.

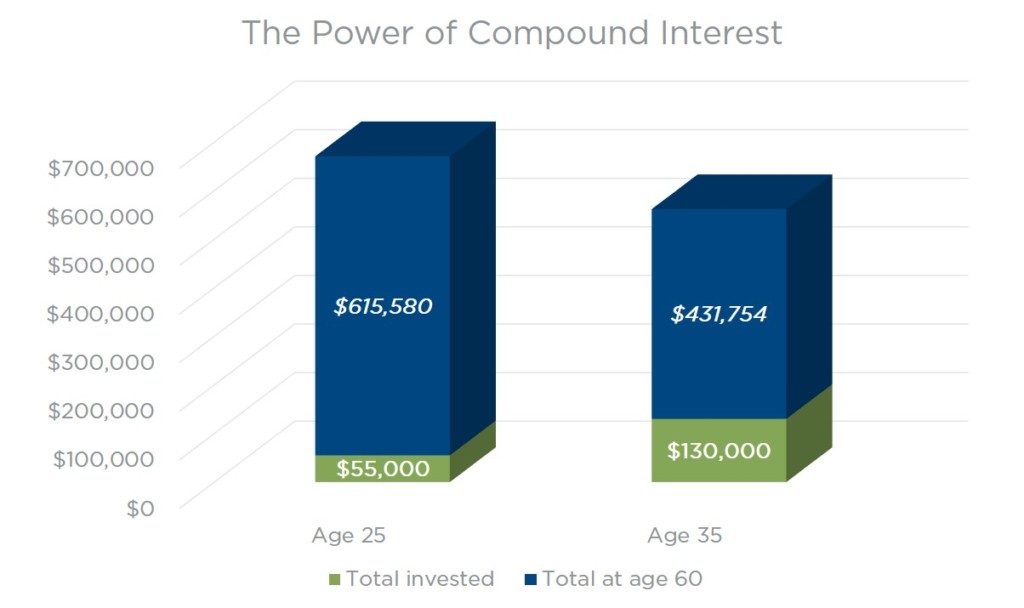

It shows what happens when a 25 year-old invests $5,000 per year (which is just about $200 per paycheck, which is easier to find than you might think) until age 35 and then stops (11 years, $55,000 total invested) vs. a 35 year old who invests $5,000 per year until age 60 ($130,000 total invested). The net result still surprises me almost every time I look at it, and I’ve seen the results A LOT.

Assuming a constant 8% rate of return, the person who starts at age 25 reaches age 60 with a balance of ~$615,000 and the 35 year old who invests more than twice as much ends up at age 60 with ~$432,000. That’s a HUGE difference, nearly $200,000. I shouldn’t be surprised by this result, yet I am every time I re-run the numbers. Starting earlier means you can save less (a LOT less!) and still have more! Mind: blown.

Take advantage of this!

For people who are early in their careers, I will make it a point to share this (and make sure that my daughter sends this to her friends on social media) and do everything I can to encourage them to participate in their 401(k) plans, open a Roth IRA, or simply save every dollar possible starting with their first paycheck.

The only negative I can find in these numbers is this: I showed this to a friend who is 40+ and has recently gone through a divorce and is starting all over again and he said the numbers depressed him. The good news is that even for the 40+ crowd (of which I’m a long-standing member), there is still time to save a substantial amount of money for retirement. I’ll address some “late starter” thoughts in a future post.

Want more helpful financial guidance, delivered every day? Sign up to receive the Financial Finesse Tip of the Day, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.