How To Deduct Your Home Office On Your Tax Return

February 15, 2017Updated in 2018 for the Tax Cuts and Jobs Act of 2017

If you have any self-employment income AND you have a home office that serves as a primary place you do “office work,” then the home office deduction is most likely available to you provided you meet the IRS qualifications. In order to qualify as a home office for tax purposes, your space must meet two requirements:

- Regular and exclusive use: The space you are claiming as your home office must only be used for that so if you work at your kitchen table, that wouldn’t qualify. I sectioned off a corner of our family room for my office. That qualifies because no one else uses that specific space for anything but my work.

- Principal place of business: You have to show that your home is your primary place of business, although there are some situations where you may still qualify even if you have a separate place where you also do business. Check the IRS regulations to see if you qualify.

If you’ve determined that you indeed do have a home office for tax purposes, then it’s important to understand how to calculate what you can deduct. There are two methods for calculating your deduction, and you can use a different method from year to year.

The Actual Expense Method

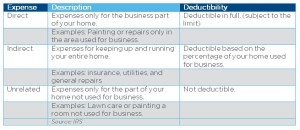

This is best for taxpayers who have a large amount of space and keep meticulous records of expenses. (The home office deduction is reputed to be a red flag for audit, although the IRS does not corroborate this.) The actual expense method is pretty self-explanatory. You deduct the actual amount of the expenses related to your home office.

Figuring the percentage

To determine the percentage of your home that qualifies for business use, you need to measure the space compared to the total size of your home. The IRS offers these two examples:

Example 1

- Your office is 240 square feet (12 feet x 20 feet).

- Your home is 1,200 square feet.

- Your office would be 20% (240/1,200), so that is also your business percentage.

Example 2

- You use one entire room in your home for business.

- Your home has 10 rooms, all equal in size.

- Your office would be 10% (1/10), so that is also your business percentage.

The Safe Harbor Method

This is best for people whose office space is 300 square feet or less and don’t want to hassle with tracking records. Here’s how the safe harbor method works:

You calculate your deduction by multiplying the square footage of your home office (but not to exceed 300 square feet) by $5. That’s it! In other words, the maximum amount you could claim each year would be $1,500.

A few final things to consider

- Your home office deduction cannot exceed your gross business income for the year, but if you use the actual expense method, you can carry over any amounts that you are unable to deduct to future years where you also use the actual expense method.

- IRS Publication 587 has more information, including several easy-to-use worksheets that can help you figure your deduction.

This post is not meant to replace the advice of a paid tax professional who can give you specific guidance on your own unique situation. Please consult your CPA or tax preparer if you are not certain whether you qualify to take this deduction.