How to Actually Change Employee Financial Behaviors

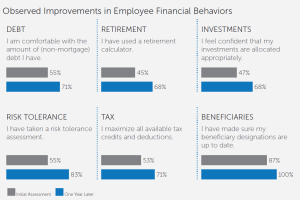

October 19, 2016What motivates employees to take action to improve their financial health? The single most important part of providing a financial wellness program is motivating lasting changes to the way employees manage their finances. Without doing this, you won’t be able to meet the objectives for the program, including cost savings from an increase in benefits participation and retirement preparedness, reduction in plan leakage, absenteeism, wage garnishments, health care and workers’ compensation costs.

The key? Deliver a workplace financial wellness program that is rooted in the fundamentals of behavioral finance.

Understanding Behavioral Finance

Behavioral finance is the study of why people make irrational financial decisions. Why do we do things with our money that we do? Here’s what we’ve found that has the most impact on employee financial wellbeing:

Willpower is naturally limited According to the American Psychological Association, willpower can be depleted. Your financial wellness program should make it more likely that employees will actually act on the decisions they make. This includes making decisions easy to implement, like a 1-click enrollment in auto escalation of retirement plan contributions. Create a single sign-on so other benefits providers are accessible from your online financial learning center.

Decision fatigue We also get tired of making decisions. Social psychologist Sheela Iyengar estimates that we make at least 70 decisions per day. Providing your education earlier in the day when employees have not yet made many difficult decisions will make it easier for them to act on what they learn.

People are More Emotional than Rational Biases in financial behavior are common. At one point or another, we are all likely to do things like be overconfident, get attached to a reference point that is no longer valid, have clearer views in hindsight, look for confirmation of our opinions, follow the herd and overreact to recent events. Financial education and coaching from an unbiased planner – someone with no ulterior motive to sell financial products or services – helps employees recognize and deal with behavioral biases.

The Financial Behavior Change Model

Financial behavior change can’t be forced, but it can be facilitated. Studies show that if a financial coach knows when an employee is ready to change a certain financial behavior, they can customize their coaching or education to facilitate that change (see one academic study here). The principles of financial behavior change are that it must:

- Be employee driven:

- Create small wins;

- Motivate and encourage;

- Stay free of judgment;

- Offer accountability;

- Measure accomplishments; and

- Build a pattern of success.

Financial Coaching Is What Helps Get Employees “Unstuck”

Per the Society for Human Resource Management (SHRM), younger employees in particular expect to access information about wellness programs on their computers and smartphones. It’s the interaction with a financial coach, however, that changes employee financial behavior. According to Financial Finesse’s 2015 Year in Review research, while technology was helpful in increasing employee awareness of their financial vulnerabilities, online interactions alone did not improve employee financial wellness. The more an employee interacts with a financial coach, the more progress they are likely to make. Online only users nationally in 2015 had an average Financial Wellness Score of 4.8 (on a ten scale), while repeat users of workplace financial wellness programs had an average score of 5.7. An incremental increase in financial wellness could save a large company millions from reduced costs of absenteeism and wage garnishments, tax savings from increased HSA and FSA participation and health care savings.