Should You Be Making Catch-Up Contributions?

February 01, 2017Turning age 50 is definitely a milestone – one that some people celebrate and some mourn while others remain ambivalent. No matter how you may feel about it, there’s at least one minor thing to celebrate from a financial planning perspective: 50 is the age when the annual contribution limits to retirement savings accounts is increased for savers via what’s called “catch-up contributions.” Here’s how they work.

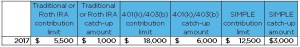

Each type of retirement savings account has an annual limit that savers can contribute to each year. Catch-up contributions are intended to allow people who perhaps got a late start to “catch up” by giving them the ability to save above and beyond those annual limits:

So someone with a workplace retirement plan and a Roth IRA over the age of 50 could conceivably tuck $30,500 away after age 50 versus the lower $23,500 that younger workers are limited to. Even if you’re right on track with your retirement goal, the catch-up contributions can help to lower your taxable income and accelerate that financial independence day.

A strategy for 401(k) and 403(b) savers

For workers who are contributing to 401(k) or 403(b) accounts via payroll deductions at work, the catch-up contribution is typically a separate election that must be made in dollar amounts versus the regular contributions where you must elect a percentage of income. For workers whose pay varies due to hourly wages or commissions, it can be challenging to budget for these contributions or ensure that a certain amount is going in each pay period. The good news is that you don’t have to be maxing out your regular contributions in order to elect catch-up contributions.

So if you’re looking to bump your contributions up by a certain dollar amount and don’t feel like doing the math to figure out what percentage that is, you can just enter it as a catch-up amount. A small consolation for hitting that half-century mark? I think so.

Of course, I would always recommend trying to get the maximum amount into your retirement account each year, but that’s not always realistic for lower income workers or people with competing priorities like family needs or high interest debt. If you’re over 50 and thinking about making catch-up contributions, run a retirement estimate to see how they can help you get to your retirement goal sooner. Then start catching up today!

Receive the Tip of the Day in your inbox every week day! Just enter your email address on the Financial Finesse blog main page and select which categories you’d like to receive.